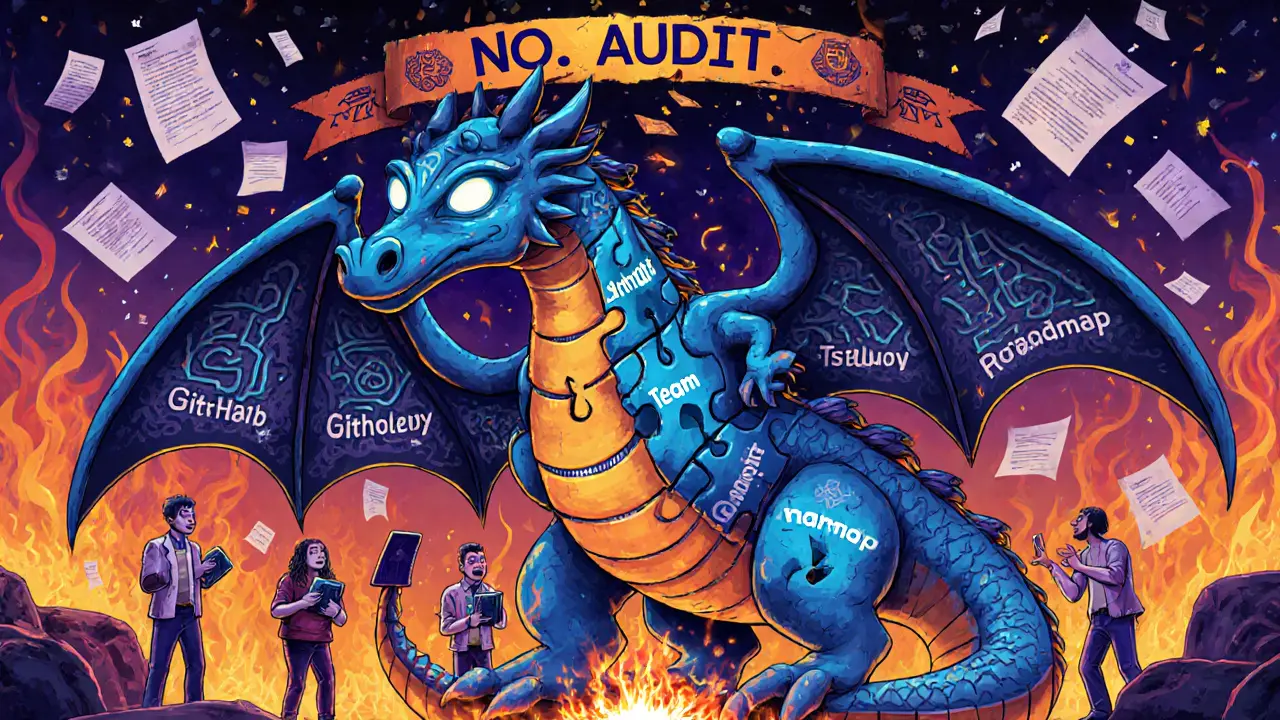

Unaudited Blockchain Projects: What They Are and Why You Should Care

When you see a new crypto token promising 100x returns, it’s easy to get excited—until you realize no one has checked if the code even works. An unaudited blockchain project, a cryptocurrency or smart contract launched without independent security review. Also known as unverified token, it’s like buying a car with no inspection—looks shiny, but the engine could fall out. Most of these projects never get audited because the team doesn’t want to pay for it, or worse—they know it’s broken.

These projects often hide behind buzzwords like "DeFi," "Web3," or "next-gen blockchain," but their real tell is silence. No public audit report. No team names. No GitHub activity. Look at veDAO (WEVE), a token that doesn’t exist on any blockchain. Also known as fake crypto project, it was just a website with a whitepaper and zero code. Or Wannaswap, a DEX that vanished after launching with no liquidity or updates. Also known as dead crypto exchange, its token now trades only as a ghost asset with no buyers or sellers. These aren’t rare cases—they’re the norm in the unregulated corners of crypto.

Unaudited projects don’t just fail—they steal. North Korea’s Lazarus Group targets them because they’re easy to exploit. Tokens like Franklin (FLY), a micro-cap ERC-20 with zero trading volume and no development. Also known as dormant crypto token, it’s not even a scam—it’s just abandoned, but still listed on shady exchanges. Meanwhile, platforms like GroveX, a no-KYC exchange with ultra-low fees but zero transparency. Also known as unregulated crypto exchange, it lets anyone list anything, including tokens with no supply or utility. You can trade on these platforms, but you’re trading with ghosts.

There’s a reason why serious investors only touch projects with public audits from firms like CertiK, Hacken, or PeckShield. Audits don’t guarantee success—but they do prove someone cared enough to check for bugs, backdoors, or hidden mint functions. Without that, you’re gambling with code you can’t read, owned by people you can’t find.

This collection shows you exactly what happens when audits are skipped. You’ll see tokens that vanished, exchanges that died, and airdrops that never existed. You’ll learn how to spot the red flags before you send your funds. And you’ll see real examples—not theories—of what happens when no one’s watching.