Blockchain Project Red Flag Checker

Project Assessment Tool

Check the indicators below to evaluate potential red flags in unaudited blockchain projects. Based on data from 127 failed crypto initiatives.

No assessment yet. Select indicators to check the project's risk level.

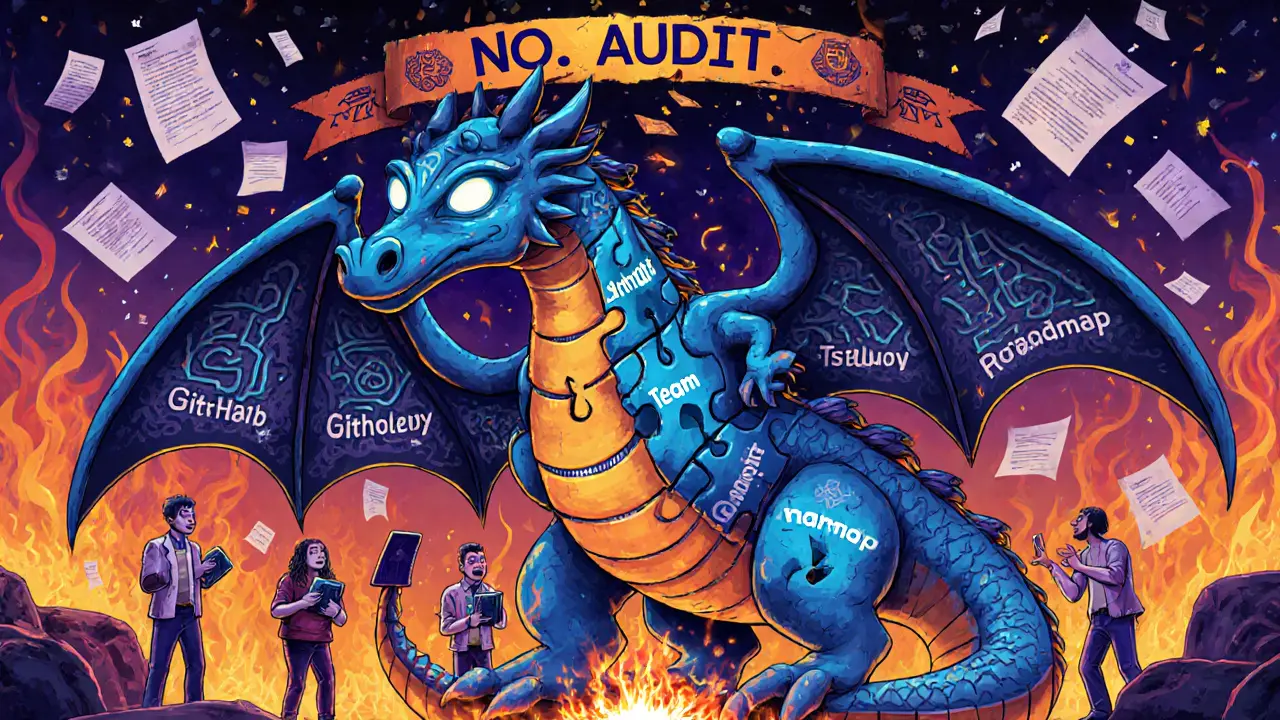

Most blockchain projects never get audited. That’s not a bug-it’s the norm. From DeFi protocols to NFT collections to Web3 startups, the vast majority launch without a single independent review of their code, finances, or operations. And yet, people invest millions. Why? Because they assume the tech speaks for itself. It doesn’t. Without an audit, you’re flying blind. The real question isn’t whether a project is built on Ethereum or Solana-it’s whether you can trust what’s underneath. Here are the red flags that show up again and again in failed, scammy, or collapsing unaudited blockchain projects.

Ghost Ownership: No One Knows Who’s in Charge

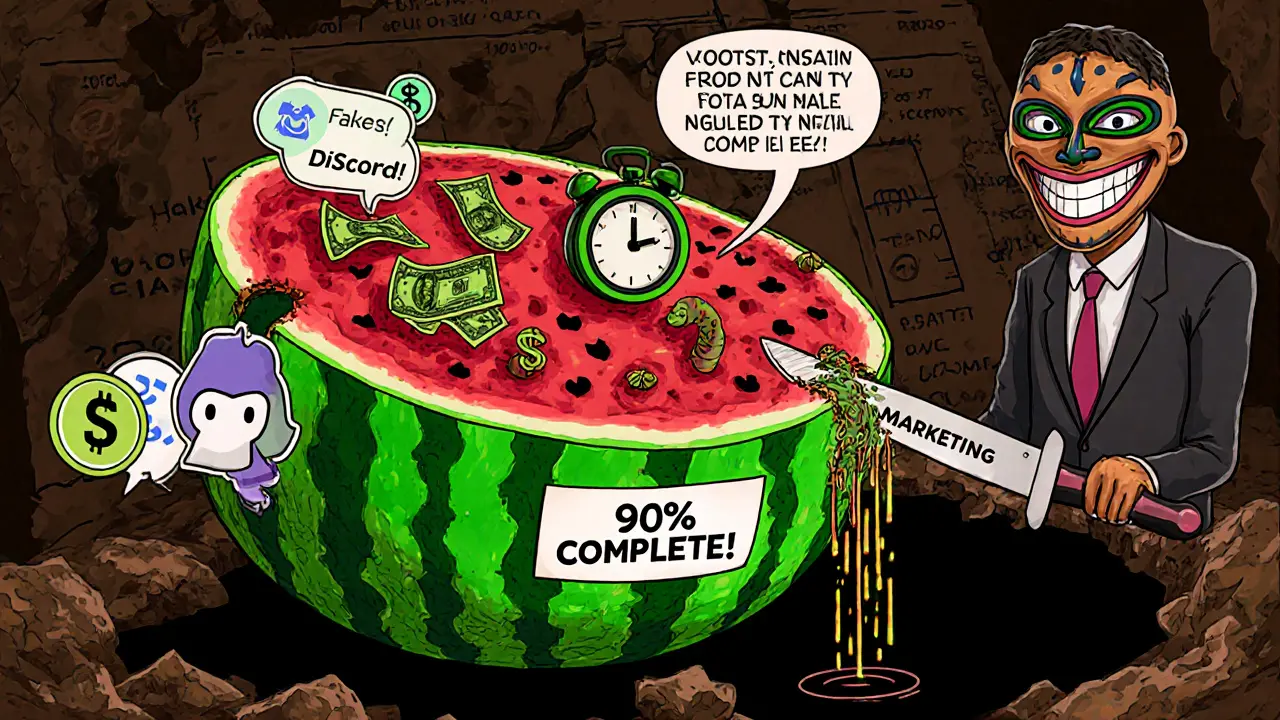

If you can’t find a clear team lead, a verified GitHub profile, or even a LinkedIn account linked to the project, run. In unaudited blockchain projects, role confusion isn’t just messy-it’s dangerous. A 2023 analysis of 127 failed crypto initiatives found that 63% had multiple people claiming responsibility for the same critical function, or worse-no one claiming anything at all. This isn’t just poor organization. It’s a setup for fraud. When no one is accountable, funds disappear, updates stall, and the team vanishes. Real teams publish their identities. Scammers hide behind pseudonyms and burner wallets. If the project’s whitepaper says “a team of experts” but lists zero names, that’s not vague-it’s a warning siren.Watermelon Reports: Green on the Outside, Red Inside

You’ve seen it: the project’s Twitter feed shows “90% complete!” “Major milestone reached!” “Partnership announced!” But dig into their Discord or GitHub, and commits have dried up. Progress reports haven’t changed in three months. That’s a watermelon report-green on the outside, rotten inside. A 2024 study of 200 crypto projects found that 41% used identical progress updates across multiple reporting cycles. One project claimed “smart contract deployment complete” for six straight weeks while their GitHub showed zero new commits. That’s not optimism. That’s deception. In audited projects, progress is tied to verifiable outputs. In unaudited ones, it’s often just marketing fluff. Check the code. Check the dates. If the numbers don’t match reality, the project is already failing.Money Moves That Don’t Add Up

Crypto projects move money fast. But unaudited ones move it *mysteriously*. Look at treasury spending. Are 30% of expenses labeled “consulting” or “strategic services” with no names attached? That’s a classic red flag. TrueProject’s 2023 data showed that in unaudited crypto projects, professional services were miscategorized 3.2 times more often than operational costs. One DeFi protocol paid $450,000 to a “blockchain advisor” with no public profile, no deliverables, and no contract. Months later, the wallet was drained. Another project listed “marketing” as a $200,000 expense-yet their social media following barely grew. When financials lack transparency, money isn’t being spent-it’s being stolen. Always ask: Can you trace every dollar? If not, you’re funding a black box.Milestones That Never Happen

Roadmaps are great. Until they’re just wishful thinking. A 2022 forensic analysis of failed blockchain projects found that 34% missed three or more consecutive milestones without any formal explanation or approval. One NFT project promised “mainnet launch Q3 2023.” Q3 came. Q4 came. No update. No delay notice. No apology. Just silence. That’s not a delay-it’s abandonment. Real teams communicate setbacks. They adjust timelines. They admit mistakes. Unaudited teams? They disappear. If a project has missed two major deadlines and still hasn’t issued a public update, treat it like a sinking ship. The longer they stay silent, the more likely they’ve run out of funds-or worse, they never had any intention of delivering.

Stakeholders Who Vanish When You Ask Questions

Ever tried to get a straight answer from a project’s lead dev? You send a DM. You post in Discord. You tag them in a thread. Days pass. No reply. Then, suddenly, they respond to someone else’s question about the token price. That’s not bad communication. That’s selective unreachability. The AIHC Association’s 2023 fraud report found this pattern in 19% of crypto scams. It’s not about being busy-it’s about control. If the team only responds to praise and avoids hard questions, they’re hiding something. In audited projects, transparency is mandatory. In unaudited ones, silence is the shield. If key people avoid accountability, they’re not protecting the project-they’re protecting themselves.Scope Creep Without Limits

The original whitepaper said “a simple token swap.” Now the project wants to build a full DeFi ecosystem, a mobile app, a DAO governance system, and a metaverse land parcel. That’s scope creep. And in unaudited projects, it’s rarely documented. The Black Women in Project Management Organization’s 2024 survey found that 47% of failed crypto projects had scope creep exceeding 15% without formal change control. That means new features get added without budget adjustments, without timelines, without consensus. The result? The team burns through funds trying to do everything, ends up delivering nothing, and blames “market conditions.” Real projects prioritize. They say no. Unaudited ones say yes to everything-until they run out of money.Rubber-Stamp Approvals: No One Actually Reviewed Anything

You’ve seen the “Approved” stamps on proposals, budgets, and vendor contracts. But where’s the proof? Who signed off? When? Why? SAFEbooks.ai’s April 2024 audit of 80 unaudited blockchain projects found that 22% had approvals with no review records-just digital stamps with no names, no dates, no comments. One project had a $1.2 million smart contract upgrade approved by a “committee” of three anonymous wallet addresses. No one knew who they were. No one could verify their credentials. That’s not governance. That’s a loophole for theft. In audited environments, approvals are traceable. In unaudited ones, they’re theater.

AI-Generated Updates: When the Team Isn’t Even Human

This one’s new-and growing fast. Since early 2024, the Defense Department Inspector General’s Fraud Red Flags database has flagged “AI-generated progress reports” as a serious risk. In blockchain, this means bot-driven Twitter posts, templated Discord messages, and AI-written blog updates that sound professional but are completely detached from reality. One project’s “CTO” posted daily updates in perfect English, but their GitHub showed no activity for 11 months. When a user dug deeper, they found the posts were generated by a script. The team? Gone. AI isn’t the enemy-but using it to fake human involvement is. If every update sounds like it was written by ChatGPT and no one ever replies to criticism, you’re not investing in a project. You’re investing in a chatbot.What to Do Instead

You don’t need a full audit to protect yourself. You need a minimum viable audit trail. That means three things:- Check the team’s real identities-LinkedIn, GitHub, past projects.

- Verify code commits and wallet movements-use Etherscan or Solana Explorer.

- Ask for proof of progress-not promises.

Why This Matters Now

The EU’s 2024 Project Transparency Directive requires all EU-funded blockchain projects over €500,000 to implement basic red flag monitoring. The U.S. SEC is watching. Regulators aren’t coming for Bitcoin. They’re coming for the unaudited scams. And if you’re investing without checking for these signs, you’re not being brave-you’re being predictable. The market is learning. The smart money is moving to projects with transparency, not hype. Your next investment shouldn’t be based on a whitepaper. It should be based on evidence.Are all unaudited blockchain projects scams?

No, not all unaudited projects are scams-but most failures are. Many early-stage teams skip audits due to cost or lack of access to qualified auditors. The issue isn’t the lack of an audit-it’s the lack of transparency. If a team openly admits they haven’t been audited yet, shares their roadmap, and shows progress, they’re more trustworthy than a project with a fake audit report. Always look for effort, not just labels.

Can I trust a project that says it’s ‘in the process of getting audited’?

Not yet. Saying you’re “in the process” is a common tactic to delay scrutiny. Ask for the auditor’s name, the scope of the audit, and a timeline. If they can’t give you that, it’s likely a stall tactic. Real audits take 4-12 weeks. If a project has been “in process” for six months, they’re not waiting-they’re avoiding.

How do I check if a blockchain project’s code has been audited?

Look for the audit report on their official website or GitHub. Reputable auditors like CertiK, Trail of Bits, and OpenZeppelin publish their reports publicly. If the report is buried in a PDF with no summary, or if it’s just a screenshot with no link, it’s likely fake. Always verify the report’s hash against the auditor’s official site. If you can’t find it, assume it doesn’t exist.

Is it safe to invest in a project with no team members listed?

No. An anonymous team is a massive red flag. Even Bitcoin had Satoshi Nakamoto-even if that name was a pseudonym, it was tied to public communication. Projects with zero identifiable people behind them are almost always exit scams. Real innovation doesn’t hide. It shows up in code, commits, and conversations.

What’s the cheapest way to spot red flags without hiring an auditor?

Use free tools: check GitHub commit history, track treasury wallet movements on Etherscan or Solana Explorer, read community forums for recurring complaints, and look for duplicate progress reports. If the team avoids hard questions and the code hasn’t changed in months, walk away. You don’t need to pay for an audit-you just need to ask the right questions.

20 Comments

Okay but have y’all seen the latest NFT project that’s been posting ‘Q3 roadmap complete!’ for 8 months straight? 🤡 Their GitHub hasn’t updated since last June and their Discord mods delete any question that starts with ‘where’s the audit?’ I’m not even mad-I’m impressed at how brazen they are. It’s like they’re running a performance art piece called ‘How to Scam 10,000 People Without Getting Caught.’

It's imperative to note that the absence of formal auditing procedures in blockchain initiatives constitutes a systemic failure of risk mitigation protocols. The lack of verifiable accountability mechanisms renders investor capital inherently vulnerable to irreversible loss. One must exercise due diligence commensurate with the magnitude of potential exposure.

I just... I can't believe people still fall for this. It's like watching someone walk into a glass door over and over again. The silence from the team? The ghost ownership? It's not just red flags-it's a whole damn fireworks show of betrayal. And we wonder why crypto feels so emotionally draining.

Brooooooo... I swear to god, if I see ONE MORE ‘We’re in the process of getting audited’ tweet with a glittery GIF, I’m gonna scream into the void. 😭💀 These people are not building-they’re *performing*. And the worst part? They think we’re too dumb to notice the AI-generated ‘CTO’ posts and the same 3 screenshots recycled every week. It’s not innovation-it’s a Netflix docuseries about greed.

The epistemological rupture between performative transparency and ontological veracity in Web3 ecosystems is profound. The audit is not merely a technical artifact-it is a hermeneutic contract between trust and materiality. When this contract is suspended, the entire semiotic architecture of value collapses into speculative noise. We are not investing in code-we are investing in narratives, and when the narrative lacks grounding, the entire symbolic economy implodes.

So basically every crypto project is just a TikTok trend with a whitepaper and a Discord server? I mean… I get it. The hype cycle is real. But when the ‘team’ is just three burner wallets and a ChatGPT account, why are we still giving them our money? I’m not even mad. I’m just… tired.

Can we talk about how every single unaudited project has a ‘team of experts’ but not one expert has a LinkedIn with more than 3 connections? And the ‘advisor’ who got $450k? That’s not a consultant-that’s a money launderer with a fancy title. It’s not even subtle anymore. They’re not trying to hide. They’re just counting on us being too lazy to check.

Thank you for writing this. I’ve been trying to explain this to my cousin who just invested $20k in a project with a Discord bot as their ‘CTO.’ I told her: if the person who’s supposed to be leading the tech doesn’t reply to DMs but replies to ‘when’s the next pump?’ then they’re not a leader-they’re a ghost. She didn’t believe me until I showed her the GitHub. Now she’s furious. And honestly? Good.

This is all part of the globalist financial reset. The central banks are funding these fake blockchain projects to distract people from the real inflation. The audits? Fake. The wallets? Tracked by the IMF. They want you to think it’s about code-but it’s about control. And if you’re still investing in unaudited tokens, you’re not just dumb-you’re complicit.

Wow. A 2024 study says 41% of projects reuse progress reports. Shocking. Next you’ll tell me the sun rises in the east and water is wet. I’m literally crying. Where’s my Nobel Prize for this groundbreaking revelation?

You're all overreacting. Most of these projects are fine. You just hate crypto because you don't understand it. If you can't handle risk then go back to your savings account and cry about 0.5% interest

Thank you for this. I’ve been sharing this with my DAO group and we’ve started making a checklist: GitHub commits, wallet transparency, team IDs, and actual replies to questions. No more just trusting a Twitter thread. Small steps, but they matter. We’re not trying to be investors-we’re trying to be smart.

Good stuff. I’ve walked away from 3 projects this year because I couldn’t find a single real commit. Just saved myself $15k. Seriously-check the code before you check the price chart. It’s that simple.

I read this at 2am after losing a bet on a ‘soon-to-be-audited’ project. I didn’t cry. I just closed the tab. Sometimes the best investment is walking away.

Oh my god I just realized my favorite project’s ‘CTO’ is the same guy who ran that rug pull last year. He changed his avatar and his Discord handle but kept the same fucking grammar mistakes. I’m reporting this to every crypto subreddit I’m in. This is not an accident. This is a pattern. And we’re letting it happen.

AI-generated updates? That’s the new norm. I saw one project post a 2000-word blog about ‘decentralized governance’ that was clearly written by an LLM. Then they pinned it and called it ‘community-driven.’ I’m not even mad. I’m just… done.

I used to think ‘in the process of audit’ was just a delay. Now I think it’s a trap. I asked a project for the auditor’s name, timeline, and scope. They replied with a GIF of a rocket. I unsubscribed. No drama. No yelling. Just… done.

Red flags? Nah. The real red flag is that people still think audits = safety. Audits are just expensive opinions. The real question is: who’s holding the keys? And if the answer is ‘a team of anonymous devs’-then you’re not investing in tech. You’re betting on luck.

Very clear points. I am from India and many young people here invest without checking anything. They believe in influencers. This guide should be shared more.

It is not merely a matter of auditing; it is a question of epistemic integrity within distributed systems. The absence of verifiable provenance in governance structures and financial flows constitutes a fundamental violation of the ontological commitments upon which blockchain technology was predicated. When opacity supersedes transparency, the technological substrate becomes a vessel for performative capitalism. The remedy lies not in regulation alone, but in the reclamation of epistemic accountability by the community-through open verification, persistent scrutiny, and the refusal to accept rhetoric as evidence.