Crypto Exchanges in Iran: How to Trade Bitcoin and USDT When Banks Block You

When crypto exchanges in Iran, platforms that let users buy, sell, and trade digital assets despite government banking bans. Also known as P2P crypto platforms, they’ve become the backbone of personal finance for millions of Iranians facing inflation and frozen bank accounts. Traditional banks in Iran are legally barred from handling crypto transactions, but that hasn’t stopped people from trading. Instead, they’ve turned to peer-to-peer networks, stablecoins, and offshore platforms that don’t require local bank links. This isn’t theory—it’s daily life for people protecting savings from hyperinflation and accessing global markets.

What makes P2P crypto Iran, a decentralized trading model where individuals directly exchange Bitcoin or USDT for Iranian rials without intermediaries so critical? Because it bypasses the entire banking system. Users find buyers and sellers through apps like LocalBitcoins, Paxful, or Telegram groups, paying via mobile wallets, gold, or even cash drops. The USDT Iran, Tether’s stablecoin used as a digital proxy for the U.S. dollar in countries with unstable currencies dominates these trades—not because it’s perfect, but because it holds value when the rial doesn’t. You won’t find Binance or Coinbase officially operating here, but you’ll find Iranians using them through VPNs and anonymous accounts. The real challenge isn’t finding a platform—it’s avoiding scams, managing payment risks, and staying under the radar of authorities who can jail people for crypto trading.

Iranians don’t just trade—they adapt. Some use gold-backed digital tokens. Others trade USDT for Persian rugs or electronics in offline meetups. The most active users rely on Telegram bots to match buyers and sellers, with escrow services built into group chats. The risks are real: payment reversals, fake escrow agents, and sudden government crackdowns. But the alternative—watching your savings vanish—is worse. This isn’t about speculation. It’s about survival.

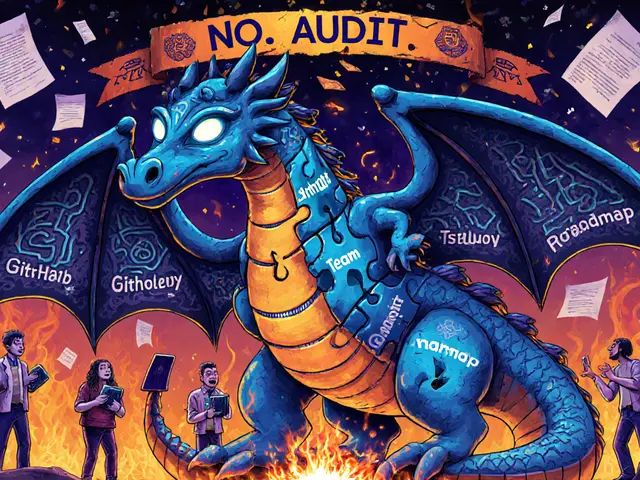

Below, you’ll find real stories and reviews from people who’ve navigated this system. Some posts expose failed platforms that vanished overnight. Others show how traders use obscure exchanges to move funds without triggering sanctions flags. You’ll see which methods still work in 2025, which ones got people arrested, and what tools actually help you stay safe. There’s no sugarcoating here—just what works, what doesn’t, and how to protect yourself when the system is stacked against you.