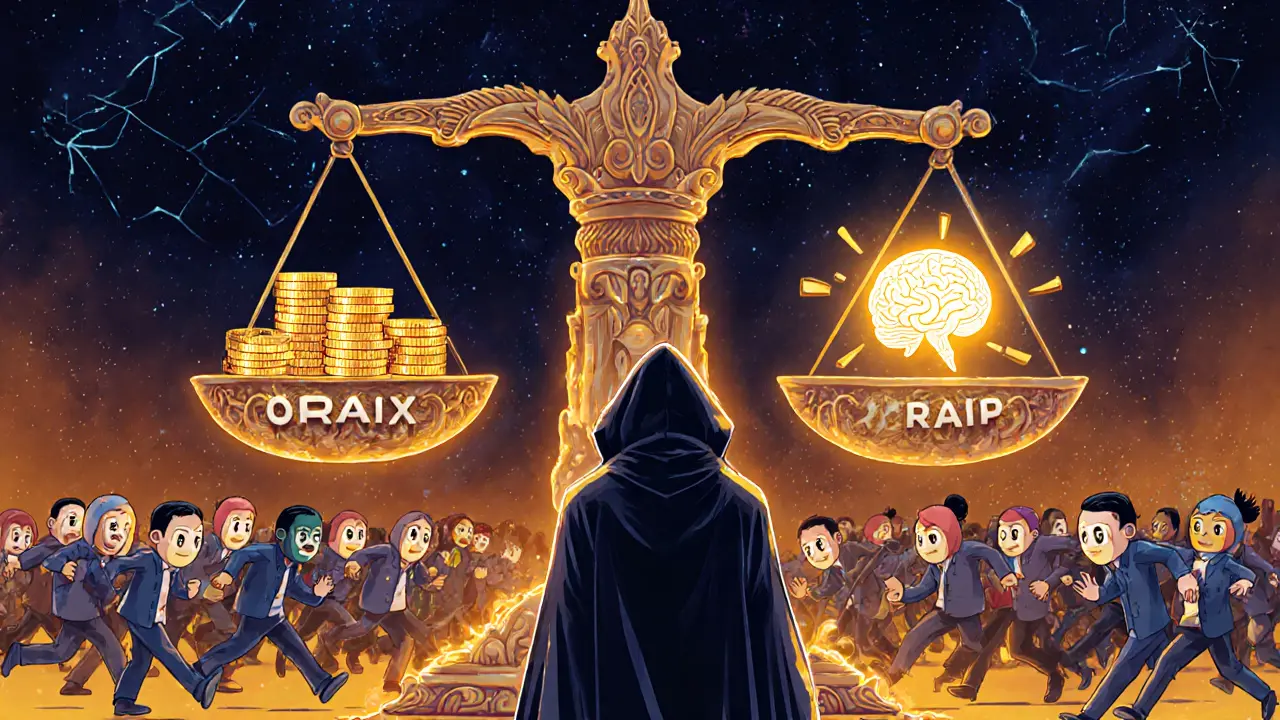

Most crypto exchanges are built to move tokens fast and cheap. OraiDEX tries to do something different: it wants to make you smarter while you trade. That’s not just marketing fluff - it’s built into the code. But is it actually useful, or just a fancy experiment with little real-world traction?

What Is OraiDEX?

OraiDEX is a decentralized exchange built on the Oraichain blockchain, which itself runs on the Cosmos SDK and uses CosmWasm smart contracts. Unlike Uniswap or PancakeSwap, which are pure token-swap platforms, OraiDEX layers in artificial intelligence. This isn’t a chatbot that gives trading tips. It’s a system where AI models act as oracles - verifying data, running test cases, and helping traders make decisions based on real-time, validated information.

The platform’s native token is ORAIX. As of October 2025, there are 90.93 million ORAIX in circulation out of a total supply of nearly 750 million. The token price hovers around $0.0045, with a daily trading volume under $220,000. That’s tiny compared to the biggest DEXs, where daily volume often hits billions.

How OraiDEX Works: More Than Just Swaps

OraiDEX isn’t just a swap tool. It’s a four-part system:

- Bridge: Lets you move tokens between Ethereum, BNB Chain, and Oraichain without relying on centralized intermediaries.

- Swap: Standard decentralized trading with liquidity pools and yield farming - but with AI-powered analytics attached.

- IBC Integration: Connects to other Cosmos chains like ATOM, LUNA, OSMO, and JUNO. This means you can trade across multiple blockchains without wrapping or bridging through third parties.

- NFT Bridge: Moves NFTs between chains, which is rare on DEXs and useful if you’re collecting or trading Cosmos-based NFTs.

The real differentiator? Every time someone uses an AI service through OraiDEX, they attach test cases. The AI provider has to pass those tests to get paid. Validators check if the AI model actually works - not just if it’s fast or cheap. This is unique. No other DEX does this.

Why OraiDEX Stands Out (And Why It Doesn’t)

Let’s be honest: OraiDEX isn’t competing with Uniswap for volume. Uniswap handles $1.5 billion a day. OraiDEX handles less than a quarter million. That’s not a bug - it’s a design choice. It’s targeting a niche: traders who care about AI-verified data, not just the lowest slippage.

If you’re someone who trusts AI to spot trends, verify market data, or filter out fake on-chain signals, OraiDEX could be valuable. For example, imagine an AI oracle that checks whether a token’s liquidity pool is truly locked or if it’s a rug pull. That’s the kind of thing OraiDEX is built for.

But here’s the catch: you need to already be comfortable with Cosmos wallets like Keplr or Leap. You need to understand IBC, staking, and how AI oracles work. Most retail traders don’t. They just want to swap ETH for USDC and go. OraiDEX doesn’t make that easier - it makes it more complex.

How It Compares to Other DEXs

Here’s how OraiDEX stacks up against the big names:

| Feature | OraiDEX | Uniswap | PancakeSwap | SushiSwap |

|---|---|---|---|---|

| Blockchain | Oraichain (Cosmos SDK) | Ethereum | BNB Chain | Ethereum |

| AI Integration | Yes | No | No | No |

| Multi-Chain (IBC) | Yes | No (requires bridges) | No | No |

| 24h Volume (Oct 2025) | $213,451 | $1.5B | $850M | $320M |

| TVL (Total Value Locked) | Not publicly reported | $5.2B | $3.1B | $1.4B |

| Learning Curve | High (Cosmos + AI) | Low | Low | Low-Medium |

| NFT Support | Yes (cross-chain) | No | Yes (on BNB) | No |

OraiDEX wins on innovation. It loses on scale. If you want the biggest liquidity and easiest interface, go with Uniswap or PancakeSwap. If you want to experiment with AI-driven trading tools and cross-chain flexibility, OraiDEX is one of the few places you can do that.

Who Should Use OraiDEX?

Not everyone. Here’s who it’s actually for:

- AI-focused DeFi users: If you’re already using Chainlink or Band Protocol for data feeds, and you’re curious about AI-specific oracles, this is a live testbed.

- Cosmos ecosystem traders: If you’re active on ATOM, OSMO, or JUNO, OraiDEX gives you a native DEX with AI tools built in.

- Early adopters of AI+blockchain: You believe AI will become standard in DeFi. You’re not waiting for others to adopt - you’re helping build it.

If you’re a casual trader, a beginner, or someone who just wants to swap tokens quickly - skip it. The interface is functional but clunky. There are no video tutorials. The documentation is sparse. You’ll need to figure things out on your own.

The Risks and Unknowns

There are red flags, even if they’re quiet ones.

First, there’s confusion around the ORAIX token. CoinMarketCap says 90.93 million are circulating. SwapSpace says zero. That’s a problem. Either the data is wrong, or the token contract is broken. Either way, it makes you wonder how solid the infrastructure really is.

Second, no major DeFi research firms have reviewed OraiDEX. Messari, Delphi Digital, and others haven’t published analyses. That’s unusual for any project claiming to be innovative. It suggests the community and institutional interest are still minimal.

Third, there’s no user feedback. No Reddit threads. No Twitter discussions. No Trustpilot reviews. That’s not normal. Even obscure DEXs have at least a few vocal users. OraiDEX feels like a project stuck in development mode, with no real user base to push it forward.

Finally, regulatory risk is rising. The EU AI Act is fully in effect as of August 2025. If OraiDEX’s AI models are used to make trading decisions, they could fall under new AI governance rules. No one knows how that will play out - but it’s a blind spot.

The Bottom Line: A Glimpse of the Future, Not the Present

OraiDEX isn’t the next Uniswap. It won’t make you rich overnight. It won’t even make your swaps cheaper.

But it might be one of the first real attempts to merge AI with decentralized trading in a meaningful way. The test-case verification system is clever. The IBC integration is solid. The NFT bridge is useful for Cosmos users.

If you’re a developer, a DeFi researcher, or someone who believes AI will transform how we trade crypto - OraiDEX is worth exploring. Play with it. Test the AI oracles. See if the data actually improves your trades.

But if you’re looking for a reliable, high-volume exchange to use daily - stick with the big ones. OraiDEX is a lab, not a marketplace. And right now, the lab is still quiet.

Is OraiDEX safe to use?

OraiDEX runs on the Oraichain blockchain, which uses Tendermint BFT consensus and CosmWasm smart contracts - both well-tested technologies. However, the platform is still relatively new, and there’s no public audit report from a major blockchain security firm. Use it with caution, especially if you’re moving large amounts. Stick to small test trades first.

Can I use OraiDEX without a Cosmos wallet?

No. OraiDEX requires a Cosmos-compatible wallet like Keplr or Leap. You can’t connect MetaMask or Trust Wallet directly. If you’re not already using a Cosmos wallet, you’ll need to set one up and learn how to manage multiple chains - which adds complexity.

What’s the difference between ORAIX and ORAI?

ORAIX is the native token of OraiDEX, used for governance and platform fees. ORAI is the token of the Oraichain blockchain, used for staking and securing the network. They’re related but not the same. ORAI powers the underlying chain; ORAIX powers the exchange layer.

Why is OraiDEX’s trading volume so low?

OraiDEX is a niche platform targeting AI-savvy traders in the Cosmos ecosystem. It doesn’t have the liquidity or brand recognition of Uniswap or PancakeSwap. Most users still trade on larger chains because they’re easier and have more options. OraiDEX’s volume reflects its experimental, early-stage status.

Does OraiDEX have mobile apps?

No. There are no official mobile apps. You can access OraiDEX through a browser using a Cosmos wallet extension like Keplr on your phone, but the interface isn’t optimized for mobile. It’s designed for desktop use.

Can I earn yield on OraiDEX?

Yes. OraiDEX offers liquidity pools and yield farming similar to other DEXs. You can provide liquidity in token pairs and earn trading fees. However, the APYs are modest compared to high-risk farms on other platforms, and there’s no indication of token emissions or incentive programs beyond basic pool rewards.

What’s Next for OraiDEX?

OraiDEX’s future depends entirely on Oraichain’s success. If AI oracles become a standard part of DeFi - like oracles for price feeds - then OraiDEX could be the first mover. But if AI in crypto remains a buzzword with no real adoption, OraiDEX will fade into obscurity.

Right now, it’s a proof of concept. Not a product. Not a platform. A quiet experiment. And sometimes, that’s where the next big thing starts.

15 Comments

Okay but why does this even exist? I can swap tokens on Uniswap in 10 seconds. This thing feels like someone built a spaceship to drive to the corner store.

AI oracles verifying test cases? That’s actually kind of genius if it works. Most DeFi oracles just pull price feeds from centralized APIs. If OraiDEX is really forcing AI models to prove their logic before getting paid, that’s a step toward real trustless intelligence. Not many are trying this.

Oh great. Another project that thinks ‘AI’ is a magic word that makes people throw money at it. You know what’s more dangerous than a rug pull? An AI that thinks it knows better than you and gets paid to make your trades worse. This isn’t innovation-it’s a confidence trick wrapped in blockchain jargon.

Let’s not pretend this is about trading. This is about epistemology. OraiDEX is asking: How do we know what’s real in a world where every price feed can be manipulated, every liquidity pool can vanish, and every token’s story is written by someone with a Discord admin role? The AI doesn’t just predict-it validates. It demands evidence. It refuses to accept the illusion of liquidity. That’s not a feature. That’s a philosophical stance against the entire crypto status quo. And yes, it’s clunky. Most revolutions start in the mud.

Uniswap is the supermarket. OraiDEX is the lab where someone’s trying to invent a new kind of food. You won’t find it on your grocery list. But if you’re hungry for truth, not just convenience, you’ll show up anyway.

The low volume? Of course. The people who need this don’t have mass appeal. They’re the ones who stayed up at 3 a.m. reading the whitepaper because they believed the blockchain could be more than a casino. They’re the quiet ones. The ones who don’t tweet. The ones who don’t need hype. They just want to know if the AI actually works.

And yes, the token data is messy. That’s the point. The project isn’t trying to be polished. It’s trying to be honest. If you’re looking for a clean interface and a shiny APY, go somewhere else. But if you’re tired of being lied to by oracles that never answer back-then maybe, just maybe, this quiet corner of the blockchain is where you belong.

Y’all are overthinking this. Just try it. It’s free to test. What’s the worst that happens? You lose a few cents on gas? That’s cheaper than a coffee. And if the AI actually helps you avoid a rug pull? You just saved your whole portfolio. Stop waiting for someone to hand you a tutorial. Go play. You’ll learn more in 10 minutes than reading 10 Reddit threads.

im not a dev but i tried it last week and the ai oracle flagged a token i was about to swap as fake liquidity. i didnt listen at first but then checked the contract myself and yep-100% rug. i lost like 20 bucks on gas but saved 3k. worth it. also the nft bridge worked when nothing else did. its clunky but its real.

One must acknowledge the structural elegance of this architecture. The integration of IBC with AI-driven validation layers represents a non-trivial advancement in decentralized infrastructure. While liquidity remains nascent, the ontological framework-where truth is algorithmically verified rather than socially aggregated-is profoundly significant. One cannot dismiss this as mere vaporware when the underlying mechanisms exhibit such conceptual rigor.

Oh wow, an AI that tells you not to trade? Groundbreaking. Next they’ll invent a toaster that warns you not to burn your toast. This isn’t innovation-it’s a tax on complexity. If you need an AI to tell you not to invest in a token with zero liquidity, you shouldn’t be investing at all. This is just crypto’s way of charging you extra to feel safe.

90 million ORAIX circulating? Yeah right. CoinMarketCap says one thing, SwapSpace says zero. That’s not a bug, that’s a feature. They’re not trying to be transparent-they’re trying to create the illusion of activity so they can pump and dump. This isn’t DeFi. It’s a ghost town with a fancy UI.

the eu ai act is in effect and no one is talking about it. this platform could get shut down next month. theyre using ai to make trading decisions. that’s illegal in europe. theyre all just waiting for the regulators to come knock. the devs probably already fled to serbia. you think this is a project? its a time bomb with a wallet extension.

You think this is niche? Honey, this is the future. The rest of DeFi is still using 2017-era oracles that get hacked every other week. OraiDEX is building the AI layer that will replace Chainlink. You’re not seeing the potential because you’re still stuck in the ‘swap and go’ mentality. This isn’t a DEX-it’s the first AI-native financial network. And you? You’re the person who still thinks Bitcoin is just ‘digital gold.’

It’s not about volume. It’s about intent. Most platforms want you to trade faster. This one wants you to think deeper. That’s rare. That’s uncomfortable. That’s why it’s quiet. The people who get it don’t need to shout. They’re already testing it.

And yes, the token data is messy. So is the early internet. So was email. So was Bitcoin. The tools aren’t perfect. The vision is.

Y’all are being so harsh 😔 I tried OraiDEX last week and honestly? It felt like the future. The AI didn’t give me tips-it gave me questions. Like ‘why do you trust this pool?’ and ‘is this liquidity locked?’ That made me check the contract myself. And guess what? I found a rug I would’ve missed. I’m not rich but I’m alive. And that’s worth more than APY. 🌱💙

if you’re new to cosmos wallets just use keplr on mobile. it’s not that bad. the ui is kinda clunky but once you get past the first few clicks it’s fine. i used it to swap osmo to juno and the ai flagged a fake pool. saved me like 50 bucks. no big deal but still cool. try it with a small amount. you’ll be surprised.

I’ve been using OraiDEX for 6 months. I don’t trade big. I just use the AI oracles to validate tokens before I move into them on other chains. It’s not a replacement for Uniswap. It’s a filter. And honestly? It’s the only thing keeping me from getting rekt in this space. I don’t care about volume. I care about not losing everything. This works.