When you’re looking for a new crypto exchange, you don’t just want another platform with a flashy logo and big trading volume numbers. You want to know if your money is safe, if the interface actually works for real traders, and whether the platform can handle your trades without crashing during market swings. That’s what matters.

What Is CoinUp.io?

CoinUp.io is a cryptocurrency derivatives trading platform launched in September 2021. It’s registered in the Cayman Islands, with teams based in Singapore, Canada, and Hong Kong. Unlike exchanges that focus mostly on spot trading-buying and selling Bitcoin or Ethereum directly-CoinUp.io leans hard into derivatives: futures, options, and leveraged trades. That means it’s built for users who want to go long or short on crypto without owning the actual asset.

The platform supports over 300 digital assets, including major coins like Bitcoin (BTC), Ethereum (ETH), Solana (SOL), Cardano (ADA), Dogecoin (DOGE), and stablecoins like USDT. It also lists newer tokens like WorldCoin (WLD) and PEPE, keeping up with market trends. Its 24-hour trading volume hits around $6.5 billion, which sounds massive. But here’s the catch: it doesn’t show up in most top exchange rankings from 2025. Binance, Coinbase, Kraken, KuCoin-they’re all there. CoinUp.io isn’t. That doesn’t mean it’s fake. It just means it’s not yet recognized as a top-tier player by industry standards.

Trading Experience: For Beginners and Pros

The trading interface on CoinUp.io is clean. It’s not cluttered like some older platforms, and the charting tools are responsive. You can switch between spot trading and derivatives mode with one click. If you’ve used TradingView before, you’ll feel right at home. The order types include market, limit, stop-limit, and trailing stop-all the essentials.

For beginners, there’s a simplified mode that hides complex leverage options and shows only basic buy/sell buttons. But if you’re an active trader, the advanced dashboard gives you real-time liquidation alerts, position history, and funding rate tracking. One user mentioned it’s the “best crypto exchange app” for trading stocks, crypto, and futures in one place. That’s rare. Most exchanges split these functions across different platforms.

The mobile app is available on both iOS and Android. It mirrors the web experience well. You can check your portfolio, set alerts, and place trades on the go. There’s no lag, and the push notifications for price breaks and liquidation risks are timely. But here’s something missing: there’s no public data on app store ratings. No 4.7 stars. No 10,000 reviews. Just an empty space where trust should be.

Fees and Liquidity

CoinUp.io advertises low fees, but it doesn’t publish a clear fee schedule. From user reports, the standard taker fee is around 0.06%, and maker fees are close to 0.02%. That’s competitive-better than Coinbase’s 0.60% and on par with Binance and KuCoin. But without official documentation, you’re relying on word of mouth.

Liquidity is strong on major pairs like BTC/USDT and ETH/USDT. Spreads are tight, and orders fill quickly even during high volatility. That’s good news if you’re scalping or swing trading. But on smaller altcoins, liquidity drops fast. You might get slippage on orders over $5,000. That’s not unique to CoinUp.io-it’s true for most mid-tier exchanges. But if you’re trading niche tokens daily, you’ll want to check depth charts before placing large orders.

Security: Claims vs. Reality

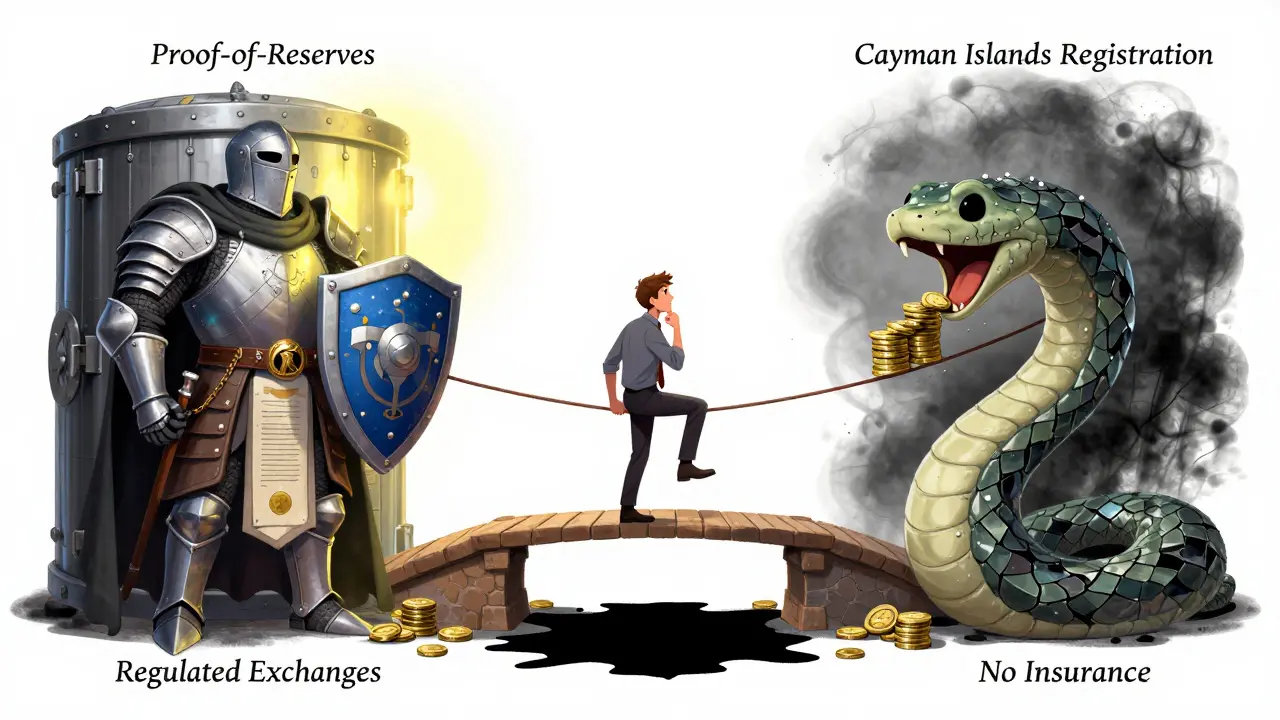

CoinUp.io says it’s “one of the safest cryptocurrency exchanges globally.” That’s a bold claim. But where’s the proof?

Most reputable exchanges publish details about their security: cold storage percentages, multi-sig wallets, insurance funds, and third-party audits. CoinUp.io doesn’t. You won’t find a single blog post explaining how user funds are protected. No mention of Fireblocks, Ledger Vault, or any cold wallet provider. No audit reports from CertiK or SlowMist.

They claim to have 24/7 customer support and encryption for logins and withdrawals. Fine. But every exchange says that. What sets Coinbase apart? They hold $2.7 billion in insurance through Coincover. Kraken publishes quarterly proof-of-reserves. Binance has its SAFU fund. CoinUp.io? Nothing.

And here’s another red flag: their Bitcoin holdings are listed as 4,511.62 BTC-worth over $513 million at $113,808 per BTC. That’s a huge amount. But CoinMarketCap only tracks wallets with more than $500,000. So we don’t know if that’s real-time data, or if it’s outdated. No blockchain explorer link. No transparency.

If you’re putting in $10,000, you might be fine. If you’re trading $100,000+ regularly, you’re taking a risk without knowing the safety net.

Regulatory Status: The Big Unknown

This is the most critical part. CoinUp.io is registered in the Cayman Islands-a jurisdiction known for light regulation. It’s not licensed in the U.S., EU, UK, or Australia. That means if you’re in those regions, you’re using it at your own risk.

Compare that to Coinbase, which is fully regulated by the SEC and state regulators. Or Kraken, which holds licenses in the U.S. and EU. Even Binance, despite its troubles, operates under licenses in places like Dubai and Japan.

CoinUp.io doesn’t say whether it complies with KYC or AML rules. You can sign up with just an email. No ID upload. No proof of address. That’s a problem. Regulators are cracking down hard on unlicensed exchanges. In 2024, the U.S. Treasury sanctioned several offshore platforms for operating without licenses. CoinUp.io could be next.

Using an unregulated exchange means no legal recourse if things go wrong. No FDIC-style protection. No government watchdog watching over your funds.

Customer Support and Community

CoinUp.io offers 24/7 support via email ([email protected]), Telegram, and Discord. Responses are usually within 2-4 hours, which is decent. But there’s no live chat on the website. No phone number. No ticket system.

On Reddit and Twitter, users have mixed feelings. Some say the platform is fast and reliable. Others report withdrawal delays of 3-5 days during high-volume periods. No one’s posting screenshots of failed withdrawals, so it’s hard to verify. The Telegram group has over 50,000 members, but it’s mostly promotional posts and memes. Real troubleshooting? Rare.

And watch out for confusion: there’s another app on Google Play called “CoinUp: Liquidation Chart, etc.” by Softable Co. It’s a market analysis tool-not an exchange. It has 5-star ratings and 10,000 downloads. But it’s not CoinUp.io. People mix them up all the time. Don’t download the wrong one.

Who Is CoinUp.io For?

Here’s the truth: CoinUp.io isn’t for everyone.

If you’re new to crypto and just want to buy Bitcoin and hold it? Go to Coinbase or Kraken. They’re regulated, insured, and simple.

If you’re a serious derivatives trader who wants low fees, deep liquidity, and advanced tools? CoinUp.io might work-for now. But only if you’re willing to accept the risks: no regulatory oversight, no public audits, no clear insurance policy.

It’s like driving a high-performance car with no airbags. It’s fast. It’s sleek. But if something goes wrong, you’re on your own.

Final Verdict

CoinUp.io has the look and feel of a serious player. The trading volume is real. The interface is polished. The asset list is wide. But the lack of transparency on security, regulation, and user protection is a dealbreaker for many.

It’s not a scam. But it’s not a safe haven either. If you’re willing to take the risk-and you understand that your funds aren’t protected by law or insurance-then you can use it for short-term trading. But don’t store large amounts there. Don’t treat it like a bank.

For now, CoinUp.io is a tool for experienced traders who know how to manage risk. Not a place to park your life savings.

Is CoinUp.io regulated?

No, CoinUp.io is not regulated by any major financial authority like the SEC, FCA, or ASIC. It’s registered in the Cayman Islands, which has minimal oversight. This means users outside the Cayman Islands have no legal protection if the platform fails or freezes withdrawals.

Can I trust CoinUp.io with my crypto?

You can use it for small, short-term trades if you understand the risks. But don’t store large amounts of crypto on CoinUp.io. Unlike exchanges like Coinbase or Kraken, it doesn’t publish proof-of-reserves, insurance coverage, or third-party security audits. There’s no safety net if something goes wrong.

Does CoinUp.io have a mobile app?

Yes, CoinUp.io has official apps on both the iOS App Store and Google Play Store. The apps support real-time trading, portfolio tracking, and access to promotions. But there’s no public data on ratings or download numbers, making it hard to judge reliability based on user feedback.

What’s the difference between CoinUp.io and CoinUp: Liquidation Chart?

They’re completely different. CoinUp.io is a cryptocurrency exchange where you trade BTC, ETH, and derivatives. CoinUp: Liquidation Chart is a free market analysis tool by Softable Co. that shows liquidation levels and technical indicators. It does not allow trading or holding crypto. Many users confuse the two because of the similar names.

How does CoinUp.io compare to Binance or Coinbase?

CoinUp.io has similar trading volume to smaller exchanges but lacks the regulatory status, security transparency, and user base of Binance or Coinbase. Binance offers 350+ tokens, full global licensing in some regions, and a $1 billion SAFU fund. Coinbase is fully regulated in the U.S. and insured. CoinUp.io offers fewer compliance safeguards and no public audits, making it riskier for long-term use.

Does CoinUp.io offer spot trading?

Yes, CoinUp.io supports both spot trading and derivatives trading. You can buy and sell Bitcoin, Ethereum, and other coins directly. But its main focus is on leveraged futures and options trading, which is where most of its volume comes from.

Are there hidden fees on CoinUp.io?

CoinUp.io doesn’t publish a full fee schedule. Based on user reports, taker fees are around 0.06% and maker fees are near 0.02%. There are no deposit fees, but withdrawal fees vary by coin and network. Always check the current fee before withdrawing-rates can change without notice.

14 Comments

CoinUp.io is like a sports car with no seatbelts - fast, sleek, and terrifying if you’re not careful.

I’ve traded on it for 6 months now. Liquidity on BTC/USDT is insane, and the app doesn’t crash during pump events. But yeah, I keep 90% of my funds off-platform. No trust, just use.

For beginners, I’d say avoid this entirely. But if you’re already comfortable with leverage and understand the risks - and you’re only risking what you can afford to lose - then it’s a decent tool. Just don’t confuse it with a bank. I’ve seen too many people lose everything because they thought ‘it looks professional’ meant ‘it’s safe.’

Also, the mobile app is actually really smooth. I wish more exchanges had this level of polish. But the lack of app store reviews? That’s a red flag. No one’s leaving feedback because they’re either too happy to care or too broke to complain.

Let’s be real - this platform is a ticking time bomb. No audits. No insurance. No regulatory oversight. And they’re not even trying to hide it. They’re banking on FOMO and hype. If you’re trading $500 here, fine. If you’re trading $50K, you’re not a trader - you’re a martyr waiting for a headline.

And don’t get me started on that ‘4,511 BTC’ claim. That number could be pulled from a dream. No blockchain explorer link. No transparency. Just vibes and a fancy website.

CoinUp.io is a psyop. They’re not even trying to be legit. The Cayman Islands registration? Classic. They know regulators won’t touch them. They’re running a honeypot for retail traders who think ‘low fees’ means ‘safe.’ Meanwhile, the whales are long gone, cashing out on Binance while we’re here debating if the UI is ‘clean.’

And that ‘50,000 member Telegram’? It’s all bots and paid shills. I’ve seen the same memes posted 12 times an hour. Real users? Gone. Or buried under spam.

They’re not a crypto exchange. They’re a crypto casino with a trading interface.

why is no one talking about how the withdrawal times go from 5 min to 5 days? i had 2.3 eth stuck for 72 hours last month. they said ‘system upgrade.’ no proof. no timeline. just crickets. i’m not even mad, just disappointed. this place feels like a ghost town with a fancy logo.

I’ve used this for swing trading altcoins and honestly? It’s been fine. I don’t store anything long-term. I move funds in, trade, move out. The interface is buttery smooth and the charts are better than Kraken’s. I just treat it like a rental car - you don’t leave your laptop in it.

Also, the funding rate tracker is legit. Saved me from getting liquidated twice. Small win.

Been using CoinUp since early 2022. No issues. No drama. Just good trades. I don’t need a 5-star app store rating to know my trades execute. If you’re overthinking security, maybe crypto isn’t for you. It’s wild west out here. Get a wallet, use a small amount, and move on.

Also, the ‘CoinUp: Liquidation Chart’ app? Yeah, I downloaded that by accident too. Got a nice little analytics tool. Not a bad freebie.

While the platform demonstrates technical competence in execution and liquidity management, the absence of verifiable security disclosures and regulatory compliance constitutes a material risk that cannot be mitigated through user experience alone. Institutional-grade custody protocols, third-party audits, and jurisdictional licensing are not optional features - they are foundational requirements for any entity handling user assets at scale. Until such disclosures are published, this platform remains unsuitable for any user requiring fiduciary assurance.

As someone from Nigeria, I’ve seen countless crypto platforms rise and vanish overnight. CoinUp.io feels like one of those - polished, persuasive, and perilously opaque. I admire the sleek interface, but I cannot in good conscience recommend it to my community. We’ve lost too much to ‘promising’ platforms with no paper trail. Trust isn’t built on charts - it’s built on transparency. And here? There’s silence.

It’s not a scam, but it’s not safe either. The trading experience is excellent, the fee structure is competitive, and the asset selection is broad. However, the lack of published proof-of-reserves, insurance coverage, or audit reports renders any claims of security meaningless. Until CoinUp.io publishes a detailed security whitepaper - not a marketing page - it remains a high-risk tool for advanced traders only.

For the record: I’ve used it for over a year. I keep under $5,000 on it. I never store long-term. I withdraw immediately after trades. That’s the only responsible way to use it.

Everyone’s acting like this is some dangerous underground exchange. Newsflash: Binance was once ‘unregulated’ too. Kraken started with no insurance. This is just the next phase of crypto evolution. The regulators are scared because they can’t control it. That’s why they’re pushing FUD. CoinUp.io is ahead of the curve. The ‘lack of transparency’? That’s innovation. You’re not ready for the future if you need a government stamp to feel safe.

Also, the ‘no app reviews’ thing? They’re probably avoiding Apple’s 30% tax. Smart. Don’t hate the player, hate the system.

look i don't care if they're regulated or not. i just want to trade. if i lose money, i lose money. it's crypto. that's the game. i've made more than i've lost here. the app works. the support replies. the fees are low. i'm happy. why are you all so nervous? just use it and move on.

There’s a reason the top exchanges publish their audits, insurance policies, and regulatory licenses. It’s not because they’re boring. It’s because they understand that trust isn’t built on aesthetics - it’s built on accountability. CoinUp.io’s silence speaks louder than any trading volume number. You can’t trade with your heart. You have to trade with your head. And your head should be screaming right now.