Crypto Carbon Footprint: How Blockchain Energy Use Really Adds Up

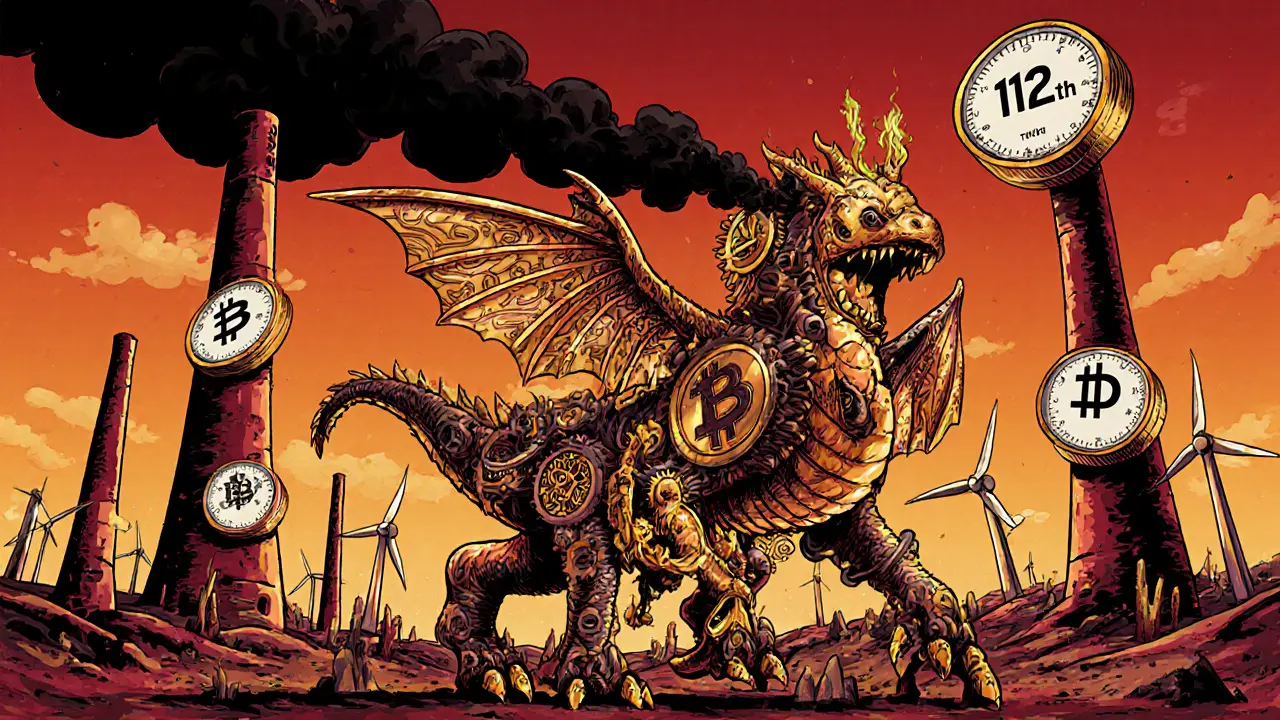

When people talk about the crypto carbon footprint, the total amount of greenhouse gases emitted by cryptocurrency mining and transaction processing. It’s not just a buzzword—it’s a real number tied to how each blockchain gets its work done. Some networks, like Bitcoin, use proof of work, a consensus method that requires miners to solve complex math problems using massive amounts of electricity. Others, like Ethereum since 2022, switched to proof of stake, a system where validators are chosen based on how much crypto they lock up, not how much power they burn. That one change cut Ethereum’s energy use by over 99%. The difference isn’t subtle—it’s planet-changing.

Why does this matter? Because if you’re holding crypto, you’re indirectly tied to its energy source. A single Bitcoin transaction can use as much power as an average U.S. household does in a week. Meanwhile, a transaction on Solana or Cardano uses less than a smartphone charger uses in five minutes. It’s not about whether crypto is good or bad—it’s about which version you’re supporting. The crypto environmental impact, the broader ecological consequences of blockchain operations, including hardware waste and grid strain isn’t just about emissions. It’s about who controls the power, where it comes from, and whether the system is designed to last—or just to hype.

Some projects claim to be green but still rely on outdated tech. Others hide behind vague "carbon offset" claims while their nodes run on coal-powered grids. Real change comes from transparency: knowing which chains are optimized for efficiency, which ones have active teams reducing their footprint, and which ones are just relics of an energy-hungry past. You don’t need to be an engineer to make smarter choices—you just need to know what to look for.

Below, you’ll find real breakdowns of projects that got it right, those that didn’t, and the hidden energy costs behind tokens you might be holding. No fluff. No marketing. Just what’s actually happening on the chain.