Avalanche Meme Coin: What They Are, Why They Rise, and Which Ones Actually Matter

When people talk about Avalanche meme coin, a type of speculative cryptocurrency token built on the Avalanche blockchain that gains value through community hype rather than utility. Also known as AVAX meme tokens, it often starts as a joke, a meme, or a viral tweet—and sometimes turns into a short-lived fortune for early buyers. Unlike Bitcoin or Ethereum, these coins don’t fix problems or power apps. They exist because people believe in them, share them, and rush to buy before the crowd does. And on Avalanche, that crowd moves fast.

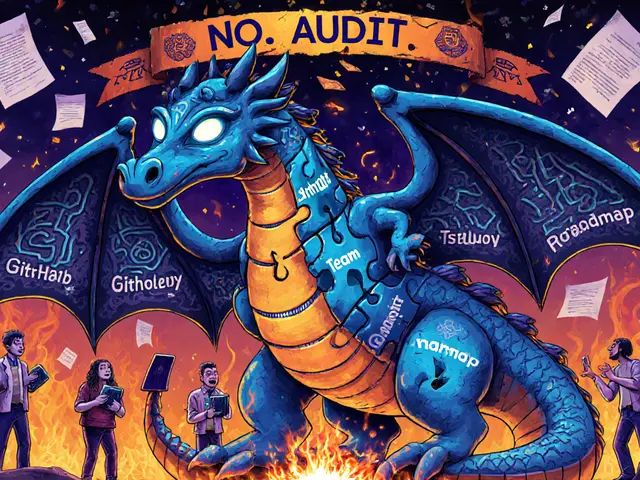

The Avalanche blockchain itself is built for speed and low fees, which makes it a magnet for meme coin traders. Where Ethereum can cost $20 in gas to swap a token, Avalanche lets you do it for pennies. That’s why you see so many new meme coins pop up there—Pump.fun, DEXs like Trader Joe, and wallets like Phantom all make it easy to launch and trade. But speed doesn’t mean safety. Most Avalanche meme coins have no team, no roadmap, and no code audit. They’re built in hours, promoted for days, and abandoned by week’s end. The ones that stick? They either have a funny story, a strong community, or a lucky timing with a big influencer. That’s it.

What you’ll find in the posts below isn’t a list of winners. It’s a list of warnings. You’ll see tokens like OBVIOUS COIN and AmpleSwap (new) that promised big returns but vanished without a trace. You’ll read about LACE and CryptoTycoon airdrops that never happened. You’ll learn how to spot the red flags: zero trading volume, fake social media bots, teams that don’t exist, and tokens with supply numbers that don’t add up. These aren’t just bad investments—they’re traps dressed up as opportunities. The Avalanche network is powerful. But its meme coin ecosystem? It’s a minefield. The only way to survive it is to know what you’re looking at before you click "buy".

Below, you’ll find real breakdowns of tokens that looked promising but failed, exchanges that let you trade them, and airdrop scams that copied real projects. No fluff. No hype. Just what actually happened—and what you should do differently next time.