Wrapped USDR: What It Is, How It Works, and Why It Matters

When you hear Wrapped USDR, a tokenized representation of the USDR stablecoin, optimized for use on Ethereum and other blockchains. Also known as wUSDR, it lets users move value across chains without needing the original USDR token to be natively supported. Wrapped USDR isn’t a new currency—it’s a bridge. It takes the real value of USDR—backed by actual reserves—and locks it up in a smart contract, then issues an equivalent amount of tokens on another network. Think of it like a warehouse receipt: you deposit your goods, get a paper slip, and trade that slip instead. The slip isn’t the goods, but it’s just as good if you trust the warehouse.

Wrapped tokens like Wrapped USDR, a tokenized version of USDR built for interoperability across DeFi ecosystems exist because not every stablecoin runs on every blockchain. If you’re using a DEX on Arbitrum or Polygon and want to trade with USDR, but USDR isn’t available there, Wrapped USDR fills the gap. It’s the same as holding USDR in value, but it’s coded to work with wallets, liquidity pools, and lending protocols on chains where the original doesn’t live. That’s why you see it in DeFi, a financial system built on open blockchains without banks or intermediaries platforms—especially in places where users need stable, low-volatility assets to trade, lend, or earn yield.

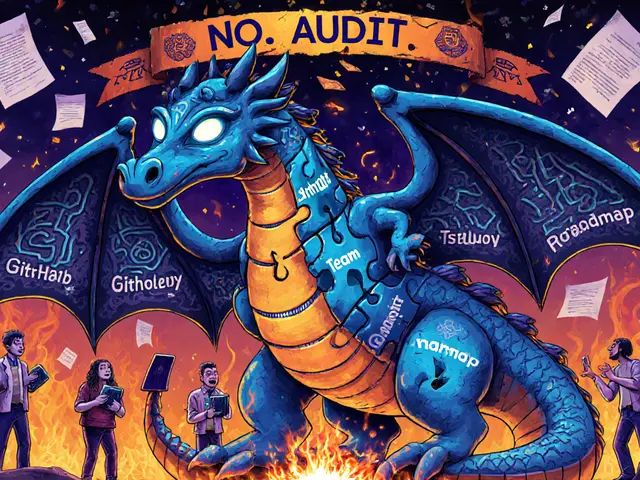

But wrapped tokens aren’t magic. They rely on trust. The issuer must hold enough USDR in reserve to back every Wrapped USDR in circulation. If that reserve is mismanaged, or if the smart contract gets hacked, your wrapped token could lose its peg—or vanish entirely. That’s why users check audits, track reserves, and avoid obscure issuers. You’re not just trading a token—you’re trusting a system. And in crypto, that’s the real risk.

Wrapped USDR shows up in posts about crypto collateral, digital assets used to secure loans or open positions in DeFi protocols, because it’s often used as collateral in lending platforms. It also pops up in discussions about stablecoin, cryptocurrencies designed to maintain a stable value, usually tied to fiat currencies like the US dollar adoption on Layer 2 networks, where gas fees and speed matter more than native token support. You’ll find it mentioned in guides about cross-chain swaps, liquidity mining, and token migration—especially when users are trying to move from one ecosystem to another without cashing out.

There’s no official Wrapped USDR from the original USDR team—most versions are created by third-party bridge protocols or DeFi aggregators. That’s why you see so many posts here warning about fake airdrops, misleading token listings, or unverified contracts. If someone’s offering free Wrapped USDR, check the contract address. If it’s not tied to a known, audited bridge, it’s probably a trap. Wrapped tokens are useful—but only if you know who’s behind them.

What you’ll find below are real stories about Wrapped USDR: how it showed up in a DeFi yield farm that vanished, why it got listed on an exchange that later got hacked, how users got stuck with it after a bridge failed, and why some traders still prefer it over USDT or USDC—even when the risks are higher. These aren’t hype pieces. They’re post-mortems, breakdowns, and practical warnings from people who’ve been there. If you’re holding Wrapped USDR—or thinking about it—this is what you need to know before you move forward.