TRCL Price: What’s Behind the Coin’s Value and Why It Matters

When you search for TRCL price, a cryptocurrency token with no clear utility, team, or trading volume. Also known as TRCL coin, it appears in a handful of obscure listings but lacks any real market presence or exchange support. Most people asking about TRCL price are either confused by a fake listing or stumbled onto a scam project disguised as a new altcoin. Unlike legitimate tokens backed by working tech or active communities, TRCL has no whitepaper, no GitHub activity, and no verified development team. It doesn’t enable staking, governance, or DeFi interactions. It’s just a ticker symbol floating in the void.

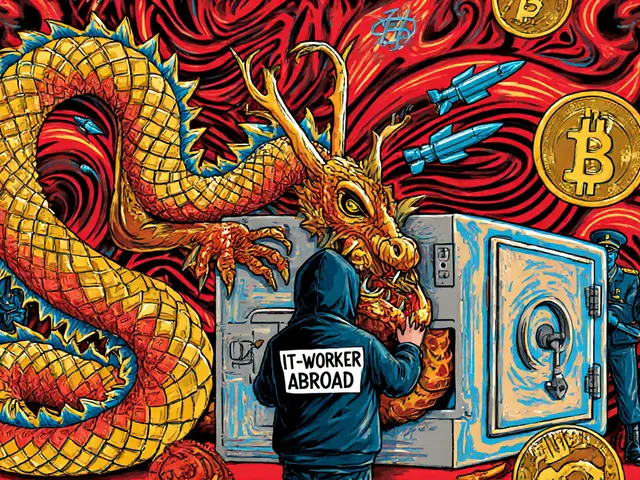

This isn’t an isolated case. Projects like TRCL show up regularly in fake airdrop scams, pump-and-dump groups, and bot-driven price charts on low-traffic exchanges. They rely on people mistaking a rising graph for real value. The same patterns show up in other dead tokens like CRUZE, a crypto project for content creators that vanished within weeks with a 97% price crash, or CHY, a token tied to a "fight poverty" narrative but worth $0 with zero trading activity. These aren’t failed startups—they’re designed to disappear after collecting funds. TRCL fits right in. Its price movements aren’t driven by demand, but by bots creating fake volume to lure in the curious.

So why does TRCL price even show up on some sites? Because crypto data aggregators pull from unverified sources. A single bot can inflate a token’s price on a fake exchange, and that data gets copied everywhere. It’s like a rumor spreading through a broken telephone line—no one checks the source, and everyone assumes it’s real. Meanwhile, real projects like SEAM, a Base blockchain lending token with clear utility and active users, or FLUX, a protocol with a verified CoinMarketCap airdrop and real community engagement, don’t need to hide behind fake charts. They build, they report, they grow. TRCL does none of that.

If you’re looking at TRCL price, you’re not studying a market opportunity—you’re staring at a warning sign. The real question isn’t whether it will go up. It’s whether you’re being targeted by a scammer who wants you to buy into nothing. The posts below show you how to spot these traps, what to look for before touching any obscure token, and which projects actually have legs. You’ll see how fake airdrops, inflated metrics, and ghost tokens like TRCL operate—and how to walk away before you lose anything.