Regulated Crypto Exchange: What It Means and Why It Matters

When you hear regulated crypto exchange, a digital trading platform that operates under official financial oversight, often requiring licenses and audits to protect users. Also known as licensed crypto platform, it’s the difference between trusting your money to a anonymous app and knowing it’s held under rules designed to prevent fraud, theft, and abuse. In a world full of fake airdrops, ghost tokens, and exchanges that vanish overnight, a regulated crypto exchange isn’t just safer—it’s the only way to trade with real confidence.

What makes a crypto exchange regulated? It’s not just a logo or a claim. It’s about crypto custody, the secure, legally binding handling of digital assets on behalf of users, often with insurance and cold storage requirements. Think of it like a bank vault, but for Bitcoin and Ethereum. Platforms like Sygnum and Bitcoin Suisse in Switzerland aren’t just offering trading—they’re acting as licensed financial institutions under strict rules. That’s why MiCA regulations, the European Union’s comprehensive framework for crypto asset markets, requiring transparency, consumer protection, and licensing for all major service providers are changing the game. If an exchange is compliant with MiCA, it has to prove where your funds are, who runs it, and how it handles your data. No more hidden teams or silent shutdowns.

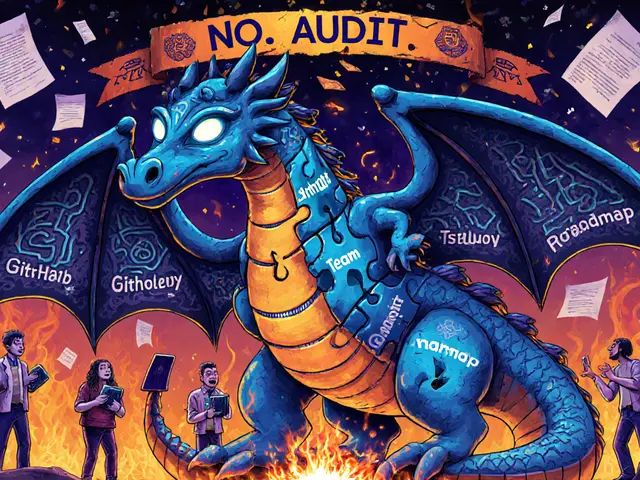

But regulation isn’t just about safety—it’s about trust. You won’t find a regulated exchange offering mystery tokens with zero trading volume or promising automatic ETH rewards that never pay out. They don’t promote meme coins with no team and no utility. Instead, they focus on clear trading pairs, real liquidity, and verified projects. That’s why you’ll see posts here about Swiss crypto custody, EU compliance in Cyprus, and why some exchanges like GroveX fail the test—no licensing, no transparency, no future. A regulated crypto exchange doesn’t need hype. It just needs to follow the rules.

What you’ll find below isn’t a list of every exchange out there. It’s a curated view of what actually works when rules matter. From platforms that meet strict standards to the ones that don’t—and why you should avoid them—you’ll see the real differences between trading safely and gambling with your assets. These aren’t theoretical debates. These are real stories of lost funds, banned accounts, and the few platforms that still stand when the dust settles.