HUSKY crypto: What it is, why it’s risky, and what to watch out for

When you hear HUSKY crypto, a meme-based token often promoted with flashy graphics and promises of quick returns. Also known as HUSKY token, it’s one of hundreds of coins that pop up on decentralized exchanges with no team, no roadmap, and no real use case. These tokens don’t solve problems—they ride trends. And when the trend fades, so does the price. HUSKY crypto isn’t unique. It’s part of a pattern you’ve seen before: a coin with a cute name, a dog mascot, and a social media blitz that disappears faster than a flash sale.

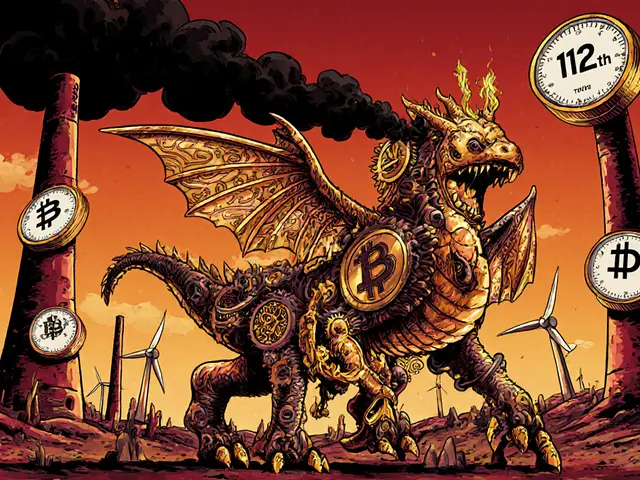

What makes HUSKY crypto dangerous isn’t the name or the logo—it’s the illusion of legitimacy. Many users think if a token is listed on a DEX like PancakeSwap or Uniswap, it must be real. But listing doesn’t mean validation. In fact, most tokens like HUSKY are created in minutes using open-source templates. They have no audits, no liquidity locks, and no team to hold accountable. The meme coin, a type of cryptocurrency built around internet culture rather than technology. Also known as dog coin, it often relies on FOMO and influencer hype to spike trading volume. Then, the creators drain the liquidity and vanish. You’re left holding a token worth pennies—or nothing at all.

Then there’s the tokenomics, the economic structure behind a cryptocurrency, including supply, distribution, and incentives. Also known as token design, it of HUSKY crypto. Is the supply capped? Is 90% of the tokens held by one wallet? Are there buy or sell taxes that make trading expensive? These questions rarely get answered. Real projects publish whitepapers. HUSKY crypto posts memes. And while some people make money early, most don’t. The data shows over 90% of low-cap meme tokens lose 95% of their value within six months. This isn’t investing. It’s gambling with your crypto.

So why do people still buy it? Because they’re told it’s the next Dogecoin. But Dogecoin had a community, media attention, and real use cases—like tipping content creators. HUSKY crypto has none of that. It’s a digital ghost. And if you’re looking at HUSKY crypto right now, you’re probably seeing a pump. That’s not a signal to buy. It’s a warning to look away.

Below, you’ll find real reviews and deep dives into tokens just like HUSKY crypto—ones that promised big returns and delivered nothing. You’ll see how projects like OBVIOUS COIN, EVERETH, and AMPLE vanished overnight. You’ll learn how to spot the same red flags before you lose money. And you’ll find out what actually works in crypto—not the hype, but the habits, tools, and strategies that help you stay in control.