Ethereum Merge: What It Changed and Why It Still Matters

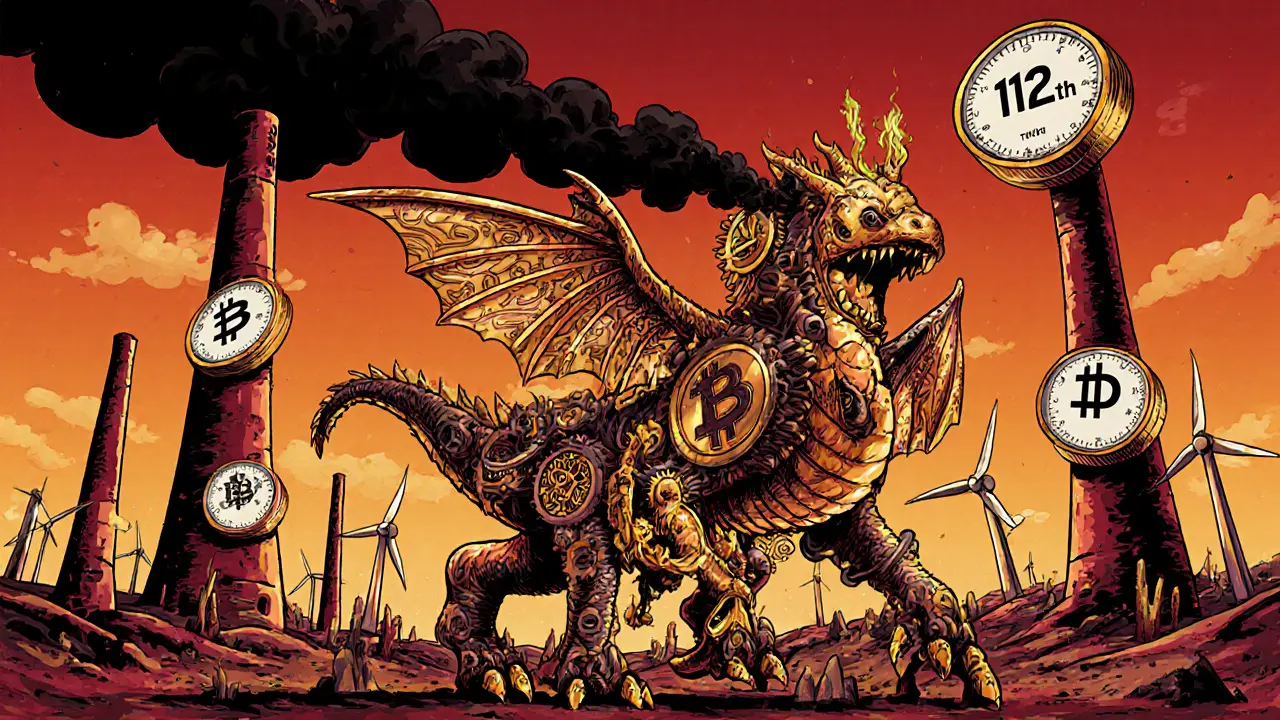

When the Ethereum Merge, the historic upgrade that switched Ethereum from proof-of-work to proof-of-stake. Also known as Ethereum 2.0, it wasn’t just a technical tweak—it was the biggest change to a major blockchain since its launch. Before the Merge, Ethereum relied on miners using powerful GPUs to solve complex puzzles and secure the network. That process, called proof-of-work, used more electricity than most countries. After the Merge in September 2022, that changed overnight. No more miners. No more massive power bills. Instead, validators lock up 32 ETH to help verify transactions and earn rewards. The result? Ethereum slashed its energy use by 99.95%.

The Merge didn’t just make Ethereum greener—it reshaped how people interact with the network. Miners disappeared. Exchanges like Coinbase and Kraken stopped offering mining services. New services popped up to help everyday users run validators with as little as 0.1 ETH through staking pools. Suddenly, holding ETH wasn’t just about speculation—it became a way to earn passive income, like a digital savings account with risk. And while the Merge didn’t lower gas fees or speed up transactions (those came later), it laid the foundation for everything after: shard chains, rollups, and better scalability. Without the Merge, Ethereum couldn’t have scaled to handle millions of daily users on Layer 2 networks like Arbitrum and Optimism.

Related concepts like Proof of Stake, a consensus method where validators are chosen based on how much crypto they stake and blockchain consensus, the system that ensures all nodes agree on the state of the ledger became household terms in crypto circles. The Merge proved that large, real-world blockchains could evolve without breaking. It also showed that environmental concerns weren’t just noise—they were a dealbreaker for institutions and regulators. Countries like the U.S. and EU started looking at crypto with new eyes, not just as a speculative asset, but as a system that could align with climate goals.

What you’ll find in the posts below isn’t just history. It’s the aftermath. You’ll see how the Merge affected everything from tokenomics to exchange listings. Some projects died because they were built for mining. Others thrived because they could now run on a leaner, cheaper chain. You’ll read about real cases—like how POAPs became more popular as events moved online, or how crypto mixers had to adapt to new transparency rules. The Merge didn’t fix everything, but it changed the rules of the game. And now, every update, every new token, every exchange review on this site is built on that new foundation.