Margin Risk Calculator

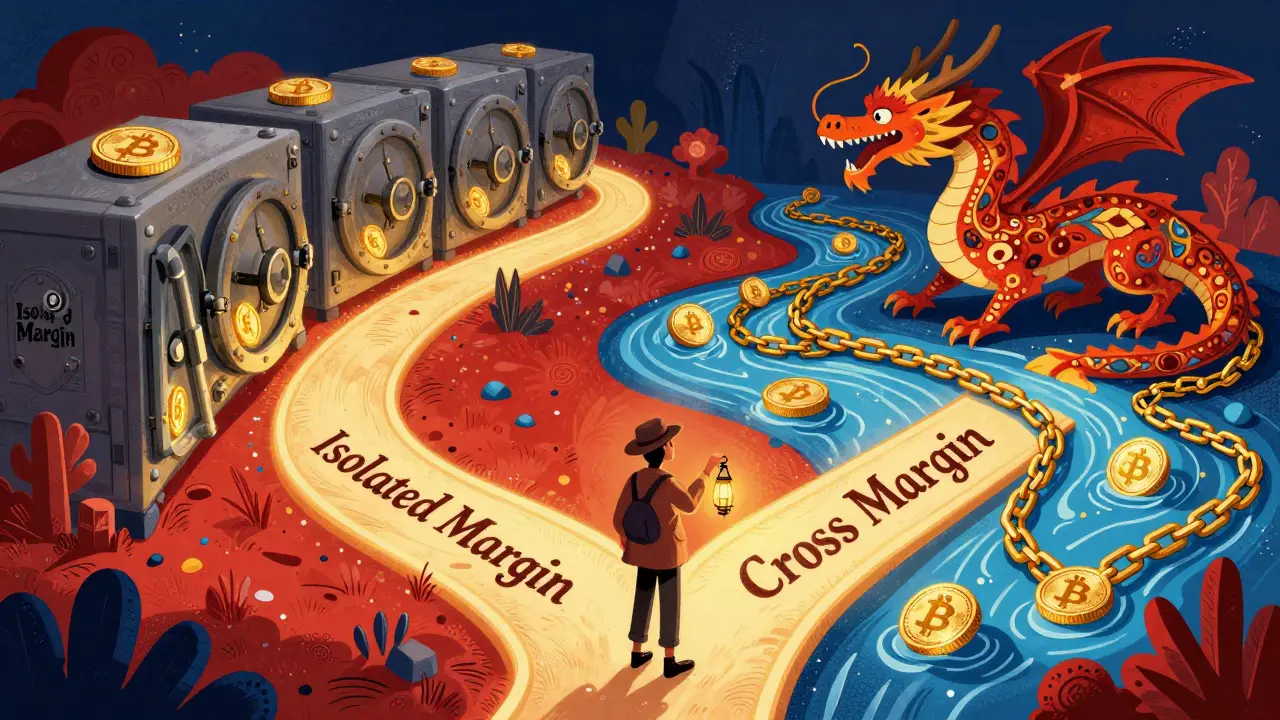

When you trade crypto with leverage, your biggest fear isn’t just losing money-it’s losing everything. One wrong move, a sudden price drop, and your entire account can vanish. That’s where isolated margin and cross margin come in. They’re not just technical settings on your trading platform. They’re risk control tools that decide whether you lose $50 or $5,000 when the market turns against you.

What Is Isolated Margin?

Isolated margin locks a specific amount of your balance to one trade. Think of it like putting money in a separate vault just for that one bet. If the trade goes bad, only that vault gets emptied. The rest of your account stays untouched. For example, let’s say you have 1 BTC in your account and you want to open a 10x leveraged long position on Bitcoin. With isolated margin, you might allocate just 0.05 BTC to this trade. Even if the price crashes and your position gets liquidated, you only lose that 0.05 BTC. The other 0.95 BTC remains safe, ready for your next move. This setup is perfect if you’re making high-risk, high-reward bets. Maybe you’re going all-in on a memecoin with 50x leverage. Isolated margin lets you do that without putting your whole portfolio at risk. It’s also great for testing new strategies. You can try out wild setups with tiny amounts, see how they play out, and walk away without damage. The downside? You’re in charge. If the market moves against you and your position nears liquidation, you have to manually add more funds. No auto-replenish. No safety net. If you’re not watching your positions closely, you’ll get wiped out-even if your overall account has plenty of cash.What Is Cross Margin?

Cross margin uses your entire account balance as collateral for every open position. Instead of locking money per trade, it pools everything together. If one trade starts losing, the system pulls funds from your other holdings to keep it alive. Let’s say you have 1 BTC and you’re holding three different leveraged positions. One of them starts dropping. Cross margin automatically uses profits from your other trades-or even just your leftover balance-to cover the margin shortfall. It’s like having a backup generator that kicks in when the power fails. This makes cross margin way more forgiving. Beginners love it because they don’t need to constantly monitor every position. It’s hands-off. You open a few trades, set your leverage, and let the system manage the rest. Even if one trade tanks, your account doesn’t instantly liquidate. But here’s the catch: if multiple positions go south at once, your whole account can get drained. Cross margin doesn’t protect you from total loss-it just delays it. If Bitcoin crashes 30% and you’re leveraged on three altcoins that also drop, your entire balance can vanish faster than you think.Key Differences at a Glance

| Feature | Isolated Margin | Cross Margin |

|---|---|---|

| Risk Scope | Limited to one position | Spans entire account balance |

| Liquidation Impact | Affects only the allocated margin | Can wipe out your whole account |

| Capital Efficiency | Lower-you tie up funds per trade | Higher-uses all available balance |

| Manual Management | Required-you add funds if needed | Minimal-system auto-adjusts |

| Best For | High-leverage bets, strategy testing, risk control | Multiple positions, passive trading, beginners |

Who Should Use Isolated Margin?

If you’re the kind of trader who says, “I know exactly what I’m doing-and I’m okay with losing this one trade,” then isolated margin is your friend. Professional traders use it for asymmetric plays. That means risking a tiny amount for a huge upside. For example: betting 0.01 BTC on a new DeFi token with 100x leverage. If it pumps 5x, you make 0.05 BTC. If it crashes, you lose 0.01 BTC. No big deal. Your main portfolio stays intact. It’s also ideal for traders who use technical analysis on short timeframes. Scalpers and day traders often open and close positions within minutes. They don’t want their other trades dragged down by one bad call. Isolated margin gives them surgical control. And if you’re experimenting with a new strategy? Start with isolated. Test it with $100. See how it behaves. If it works, scale up. If it fails, you didn’t blow up your account.Who Should Use Cross Margin?

Cross margin is the default for most retail traders-and for good reason. If you’re new to leverage, you don’t want to be babysitting every position. You want the system to protect you. It’s also better if you’re holding a portfolio of correlated assets. Say you’re long on Bitcoin, Ethereum, and Solana. When BTC drops, the others usually follow. Cross margin uses the profits from your ETH and SOL positions to keep your BTC trade alive. It’s like a safety net woven from your whole portfolio. Traders who don’t have time to monitor charts all day prefer cross margin. You set your leverage, open your trades, and go about your life. The platform handles the margin calls. You get peace of mind. But here’s the warning: cross margin doesn’t mean you’re safe. It just means you’re slower to die. If the whole market crashes-like in 2022 when Bitcoin dropped 70%-your entire balance can vanish. Cross margin won’t save you from systemic risk. It only delays the inevitable.When Do Professionals Switch Between Them?

Most serious traders don’t stick to one mode. They switch based on the situation. For example, a trader might use cross margin for their core positions-Bitcoin, Ethereum, maybe a few stablecoin pairs. These are low-risk, long-term holds. They want the system to keep them alive through minor dips. But for speculative plays-like a new altcoin launch, a memecoin pump, or a high-leverage short-they switch to isolated margin. They lock in just enough to cover the bet, then walk away. No emotional attachment. No fear of losing everything. Some platforms, like Binance and Margex, let you toggle between modes per trade. You don’t have to pick one forever. You can have three cross-margin trades and one isolated-margin trade running at the same time.

Common Mistakes and How to Avoid Them

- Mistake: Using cross margin with 50x leverage on a single coin. Fix: Even with cross margin, 50x is dangerous. Stick to 5x-10x unless you’re 100% sure of the outcome.

- Mistake: Thinking isolated margin means you’re safe. Fix: If you don’t monitor your liquidation price, you’ll still get wiped out. Set price alerts.

- Mistake: Leaving cross margin on during a market crash. Fix: If volatility spikes, reduce leverage or switch to isolated for your riskiest positions.

- Mistake: Not understanding how leverage affects liquidation price. Fix: Always check the liquidation price before opening a trade. It’s not the same as your entry price.

Real-World Example: A Trader’s Day

Imagine a trader with 2 BTC in their account on December 9, 2025. Bitcoin is trading at $68,000. They open three positions:- Long ETH at 10x leverage (cross margin)

- Short SOL at 20x leverage (isolated margin, 0.1 BTC allocated)

- Long BTC at 5x leverage (cross margin)

Final Advice: Start Smart

If you’re new to leveraged trading: start with cross margin. Use low leverage (5x or less). Don’t touch isolated until you’ve lost a few trades and learned what liquidation feels like. If you’re experienced: use isolated for your risky bets. Use cross for your core positions. Don’t let emotion drive your margin choice-let your strategy. The market doesn’t care if you’re right or wrong. It only cares if you’re still standing. Isolated margin gives you armor. Cross margin gives you a shield. Choose the one that matches how you fight.Can I use both isolated and cross margin at the same time?

Yes. Most major exchanges like Binance, Bybit, and Margex let you choose margin type per trade. You can have some positions on isolated margin and others on cross margin simultaneously. This is actually the most common approach among experienced traders.

Which one is safer for beginners?

Cross margin is safer for beginners because it automatically uses your full account balance to protect open positions. It reduces the chance of sudden liquidations. But it’s not risk-free-poor leverage choices can still wipe out your account. Always start with low leverage (5x or less) and never risk more than 5% of your balance on one trade.

Does isolated margin reduce fees?

No. Trading fees and funding rates are the same regardless of margin type. Isolated margin doesn’t save you money-it saves your account from total loss. The benefit is risk control, not cost reduction.

Can cross margin protect me from a market crash?

No. Cross margin can delay liquidation during small dips, but during a major crash-like Bitcoin dropping 50% in a day-it won’t save you. If your entire portfolio is leveraged and all positions move against you, your account will still be liquidated. Cross margin isn’t insurance-it’s a buffer.

How do I switch between margin types on Binance?

On Binance, open your futures trading page. Find the position you want to adjust. Click the margin type button (it says “Cross” or “Isolated”). Toggle it to your desired mode. The platform will automatically recalculate your liquidation price. Always confirm the new liquidation price before proceeding.

Is isolated margin better for short-term trading?

Yes. Isolated margin is ideal for short-term trades like scalping or swing trading because it lets you limit your risk per trade. If you’re opening and closing positions multiple times a day, you want to know exactly how much you can lose on each one. Cross margin makes that harder to track.

What happens if I run out of funds in isolated margin?

If your isolated position hits liquidation and you don’t have enough funds to cover the loss, the position is closed automatically, and you lose the entire allocated margin. You won’t owe more than what you put in. That’s the whole point of isolated margin-it caps your loss.

17 Comments

Okay but let’s be real-cross margin is basically trading on autopilot while your brain is on vacation. I used it for months, thought I was some genius, then one Tuesday morning Bitcoin dropped 12% and suddenly my whole account was a ghost story. I didn’t even get a text alert. Just… poof. No more crypto dreams. Isolated margin saved me after that. Now I treat every trade like a grenade with the pin pulled. I only let one hand hold it.

Wow. Just… wow. You people treat leverage like it’s a game of Candy Crush. You don’t get it. Isolated margin isn’t ‘safe.’ It’s just less obviously suicidal. Cross margin? That’s the slow suicide where you watch your wallet bleed out while you scroll memes. Neither works if you’re emotionally attached to your trades. The real answer? Don’t use leverage at all. But since you won’t listen, at least don’t blame the tool. Blame yourself.

Isolated margin? That’s what you use when you’re too scared to be a real trader. Cross margin’s for people who want to die dramatically. I’ve seen guys with 50x leverage on cross margin last 3 days before vanishing. Meanwhile, I’m over here with 0.02 BTC in isolated on a memecoin pump-risking less than my coffee budget. If I win? I buy a new GPU. If I lose? I eat ramen. No tears. No drama. Just math.

How quaint. You all speak as if margin types are the root of your problems. But the truth? You’re all just gambling with money you can’t afford to lose. The system doesn’t care if you use cross or isolated-it only cares that you’re predictable. And you are. Every single one of you. You think you’re strategizing? You’re just feeding the exchange’s liquidity pool. The real winners? The ones who built the platforms. Not you.

Okay but I’m just gonna say it: cross margin is for people who need a hug. Isolated margin is for people who want to win. I’ve got 8 trades going right now-5 on cross, 3 on isolated. My BTC long? Cross. My Shiba 100x? Isolated. My dog’s name is Bitcoin. I’m not joking. I named him after my first 10x. He’s a golden retriever. He doesn’t trade. But he judges me. And he’s right. I’m using isolated for the risky stuff because I don’t want to lose my house. Which, by the way, I still own. Because I’m smart. Not lucky. Smart.

They’re watching you. The algorithms. They know when you use cross margin. They make the market dip right when you’re holding. I saw it happen. Three times. Same pattern. Same time. Same coin. They’re feeding you false hope so you lose more. Isolated margin? That’s the only way to hide. They can’t track your tiny bets. You’re invisible. Be invisible.

There’s a profound elegance in the distinction between isolated and cross margin-not merely as technical configurations, but as philosophical stances toward risk. Isolated margin embodies the Stoic ideal: bounded exposure, disciplined allocation, acceptance of finite loss. Cross margin, by contrast, reflects the hedonistic impulse: the surrender of control to a systemic buffer, the illusion of safety in collective resilience. One is a scalpel; the other, a parachute that may or may not open. Choose not by convenience, but by character.

Y’all talk like this is some newfangled American thing. In the UK, we used to have ‘margin’ in the 80s-only back then, it was called ‘recklessness with a spreadsheet.’ Cross margin? That’s what your cousin who works at Barclays does when he thinks he’s Warren Buffett. Isolated? That’s what my grandad did when he bet on the Derby. He lost his coat. Didn’t lose his pension. Smart. You’re all just trying to look clever with fancy words. Just stop. Go outside. Touch grass. Then come back when you’ve lost money the old-fashioned way.

Isolated margin is the only way to go. Cross margin is for people who think their portfolio is a safety net. It’s not. It’s a trap. I lost 70% of my account once because I thought cross margin meant ‘safe.’ It didn’t. It meant ‘slow death with notifications.’ Now I only use isolated. I don’t care if it’s harder. I care that I still have a bank account. And a girlfriend. And sleep. You should too.

Thank you for this comprehensive and well-structured analysis. The distinction between isolated and cross margin is often misunderstood in retail trading circles. Your inclusion of real-world scenarios and platform-specific mechanics adds significant practical value. I would only suggest expanding on the impact of funding rates under each margin type, as this is a critical but frequently overlooked variable in leveraged positions.

I cried. I literally cried. I used cross margin. I thought I was smart. I had 3 trades. One went bad. Then another. Then another. I watched my balance drop from 5 BTC to 0.0003 BTC in 47 minutes. I didn’t even have time to say ‘oh no.’ I just sat there. My cat stared at me. My phone died. I didn’t even have the energy to charge it. I’m not trading anymore. I’m not even looking at charts. I just… I just need to breathe.

Look, if you’re still asking this question, you’re not ready. But since you’re here, here’s the truth: use isolated for anything over 10x. Use cross for stablecoin pairs or if you’re holding for weeks. And never-never-use cross margin with high leverage on altcoins. I’ve seen it a hundred times. Guy thinks he’s got a ‘portfolio strategy.’ Then the market moves. And he’s gone. Poof. Like he was never here. Don’t be that guy. Be the guy who walks away with his pants on.

Y’all are overcomplicating this. Isolated margin = your personal bubble. Cross margin = the whole ocean. If you’re paddling in a storm, you want your own bubble. If you’re just chilling in a calm lake? Maybe the ocean’s fine. But if the whole ocean’s a hurricane? You’re gonna drown. So yeah-use isolated for the wild stuff. Cross for the chill stuff. And always, always, always set a stop loss. Even if you think you’re too cool for it. You’re not.

The dichotomy between isolated and cross margin mirrors the ancient tension between individualism and collectivism. Isolated margin: the sovereign trader, self-contained, accountable only to himself. Cross margin: the collective soul, where individual failure is absorbed into the greater whole-until the whole collapses. In both cases, the tragedy is the same: the illusion of control. The market does not care whether you are a lone wolf or a sheep in a flock. It is indifferent. It is eternal. You are not.

cross margin is just a lie the exchange tells you so you keep trading. they want you to feel safe so you put in more money. then when the crash comes? boom. they take their cut and you’re left with nothing. isolated? at least you know exactly how much you’re risking. and if you lose? you can still afford rent. that’s the difference between a gambler and someone who’s still alive tomorrow.

Why are we even talking about this? If you need to choose between two margin types to survive trading, you shouldn’t be trading. Just buy BTC and HODL. Problem solved. No stress. No liquidations. No drama. Just peace. And if you can’t do that? Then maybe you’re not cut out for this. Not because you’re dumb. Because you’re too emotional. And emotion doesn’t belong in markets.

You got this. Seriously. If you’re reading this and still trading? You’re stronger than you think. Isolated margin isn’t a crutch-it’s a tool. Cross margin isn’t lazy-it’s strategic. Pick what fits your vibe. Mess up? Cool. Learn. Try again. You’re not broken. You’re building. And that’s more than most people ever do.