Australia Crypto Exchange Rules: What You Need to Know in 2025

When you trade crypto in Australia, you’re not just dealing with markets—you’re navigating Australia crypto exchange rules, a legal framework enforced by AUSTRAC to prevent money laundering and protect consumers. Also known as Australian crypto compliance laws, these rules require every exchange operating in the country to register, verify users, and report transactions. This isn’t optional. If you’re using Binance, Kraken, or any local platform like CoinSpot, they’re all bound by these rules—or they’re not allowed to operate here.

Under these rules, AUSTRAC, Australia’s financial intelligence unit that oversees anti-money laundering and counter-terrorism financing. Also known as Australian Transaction Reports and Analysis Centre, it acts as the gatekeeper for all digital asset businesses demands full KYC. That means your ID, address, and proof of funds aren’t just suggestions—they’re mandatory. Even if you’re using a non-custodial wallet, if you’re buying crypto on an Australian exchange, you’re tracked. And if you’re running a business that handles crypto, you need a license. No exceptions. The penalties? Fines up to $21 million or jail time for serious breaches.

Then there’s crypto taxes Australia, the ATO’s clear stance that every trade, swap, or sale of crypto is a taxable event. Also known as digital asset capital gains, this means if you bought Bitcoin for $30k and sold it for $50k, you owe tax on the $20k profit—no matter if you turned it into ETH, USDT, or NFTs. The ATO cross-references data from exchanges, so pretending you didn’t make a trade won’t work. They’ve been auditing thousands of wallets since 2020. Keep records. Always.

These rules aren’t just about control—they’re about safety. Australia’s approach has pushed out shady platforms and forced honest ones to build real compliance into their systems. That’s why you see fewer sketchy airdrops and scams here compared to other countries. But it also means less anonymity. If you want to trade crypto legally in Australia, you trade with your identity on the table. There’s no workaround. No loophole. Just clear rules and real consequences.

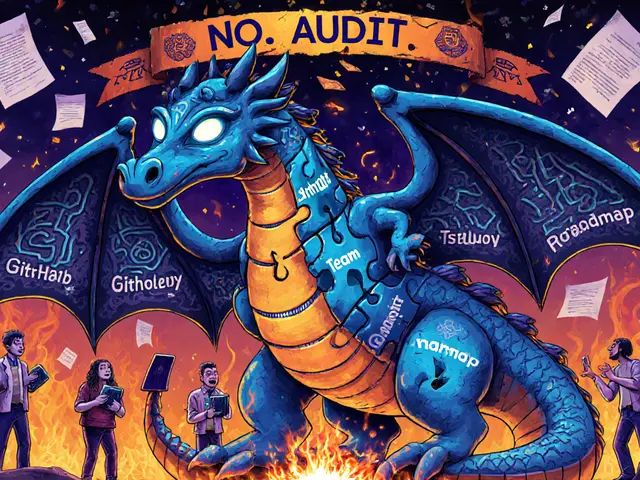

Below, you’ll find real reviews and breakdowns of exchanges that work under these rules—some that let you trade with zero KYC (and why that’s risky), others that explain how to handle taxes without panic, and a few that show what happens when you ignore AUSTRAC’s requirements. No fluff. No hype. Just what actually matters when you’re trying to stay legal, safe, and in control of your crypto in Australia.