Account Closure Crypto: Why Exchanges Shut Down Accounts and How to Protect Your Funds

When an exchange closes your account, it’s not just an inconvenience—it’s a direct threat to your financial control. Account closure crypto, the sudden termination of access to your funds on a centralized platform due to regulatory, compliance, or operational reasons. Also known as crypto account freeze, it happens more often than most users realize, especially in regions with unclear or shifting crypto laws. This isn’t about losing a password. It’s about losing access to your money because someone else controls it.

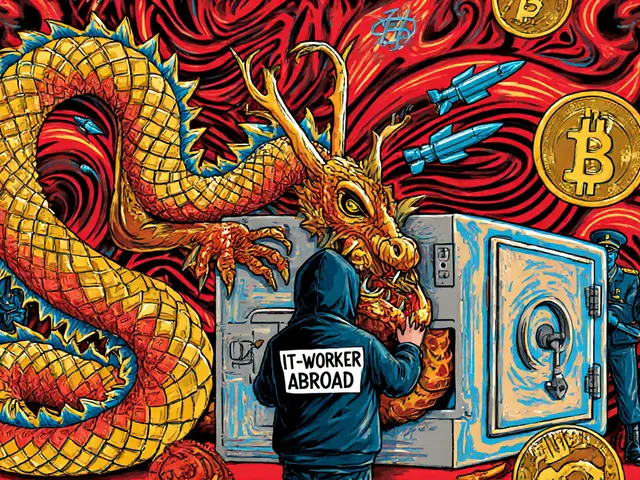

Crypto exchange shutdown, when a platform stops operations entirely, often due to regulatory pressure or insolvency. Also known as exchange collapse, it’s a risk you can’t ignore if you’re storing crypto on platforms like Currency.com, GroveX, or even smaller DeFi gateways. These aren’t banks. They don’t have FDIC insurance. And when regulators step in—like under MiCA in Cyprus or Russia’s strict mining rules—they don’t ask nicely. They demand compliance, and if you’re not on their list, your account gets cut. That’s why users in restricted countries rely on non-custodial wallet, a wallet where you hold your own private keys, with no middleman who can lock you out. Also known as self-custody crypto, it’s the only real defense against account closure. If you don’t control the keys, you don’t control the money. And no amount of KYC, verification, or customer service will bring it back once an exchange shuts down.

Most account closures happen because exchanges are caught between regulators and users. Take Paradex or ProtonSwap—both offer privacy and low fees, but that same anonymity makes them targets. Even legitimate platforms like Swiss banks (Sygnum, Bitcoin Suisse) must follow strict rules. If your activity looks suspicious—even if it’s just buying a meme coin like HUSKY or OBVIOUS COIN—you might get flagged. And once flagged, your account can vanish without warning. That’s why the most common pattern among the posts here is clear: account closure crypto is rarely about fraud. It’s about control. The platforms that promise ease often demand surrender. The ones that give you freedom—like hardware wallets from Ledger or Trezor—ask you to take responsibility.

You’ll find posts here that show exactly how this plays out: projects like LACE and CryptoTycoon that promised airdrops but vanished, tokens like EVERETH and FLY that died with no one left to care, and exchanges like GroveX that avoid KYC but offer zero protection. These aren’t just stories—they’re warnings. The people who lost money didn’t get hacked. They got locked out. And the only way to prevent that is to stop trusting strangers with your crypto. This collection gives you real examples of what happens when exchanges fail, when regulators move in, and when users are left with nothing. What you’ll learn isn’t theory. It’s survival.