KCEX Fee Calculator

Calculate how much you could save by trading on KCEX compared to other exchanges. Select your trade type, amount, and frequency to see real-time fee comparisons.

Trade Calculator

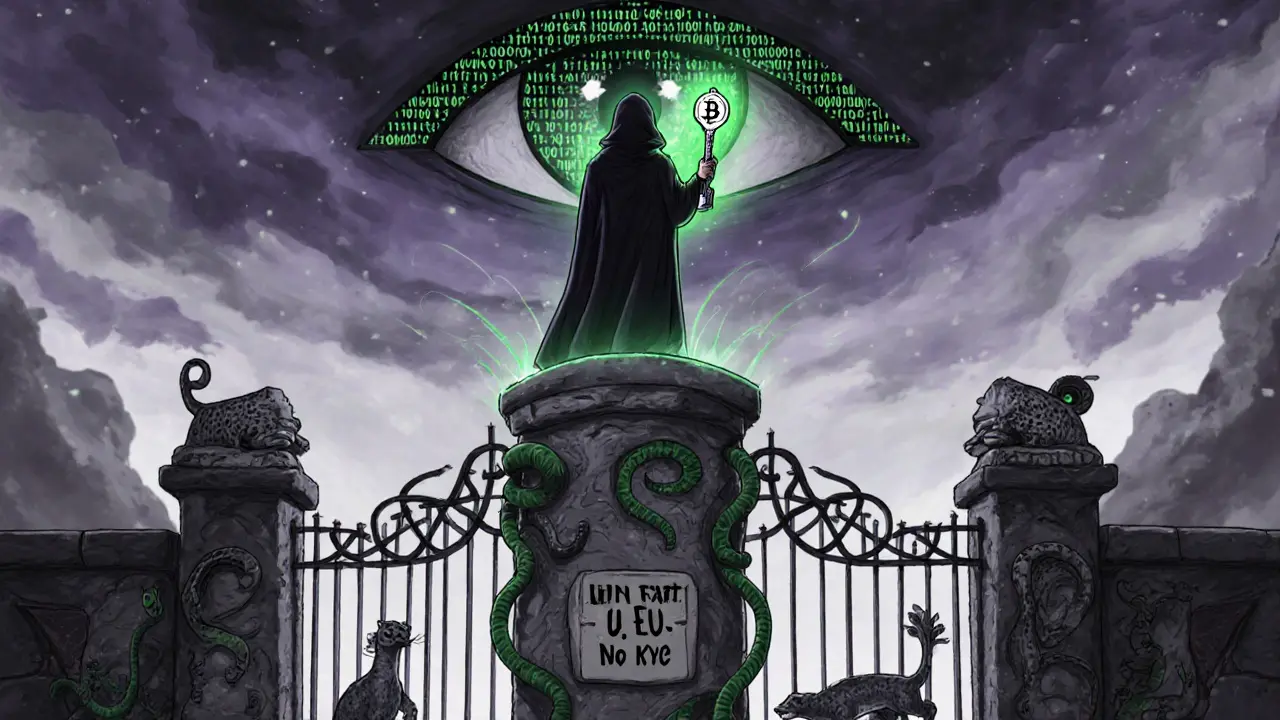

What if you could trade crypto with 0% fees on every spot trade and get paid to place limit orders? That’s not a dream-it’s KCEX in 2025. For active traders tired of paying 0.1% or more per trade on bigger exchanges, KCEX is turning heads. But here’s the catch: it’s not for everyone. If you need to buy Bitcoin with a credit card, you’re out of luck. If you want insurance on your futures positions or a help desk that answers in under 24 hours, you’ll be disappointed. KCEX isn’t trying to be Binance or Coinbase. It’s built for one thing: high-speed, low-cost, privacy-first crypto trading.

Zero Fees Are Real-Here’s How

KCEX doesn’t just claim to have low fees. It rewrote the rules. On spot trading, both maker and taker fees are 0%. That means whether you’re placing a limit order or buying instantly at market price, you pay nothing. For futures, the maker fee is actually negative: -0.005%. That’s right-you get paid 0.005% every time you add liquidity by placing a limit order. The taker fee is 0.01%, which is roughly five times lower than the industry average. On a $100,000 trade, that’s $10 in fees instead of $50 or $100 elsewhere.This isn’t a temporary promotion. It’s baked into their business model. They’re betting that aggressive pricing will attract high-volume traders who move millions daily. And it’s working. Users on Reddit report saving over $1,200 in a single month just by switching from Binance. The math is simple: if you trade often, KCEX saves you serious money.

No KYC? Yes, But With Limits

KCEX doesn’t require KYC for withdrawals under 30 BTC per day-roughly $1.8 million at current prices. That’s a huge deal for traders who value privacy or live in regions with strict capital controls. You can sign up with just an email, deposit crypto, and start trading without submitting ID or proof of address.But here’s what they don’t tell you: this freedom comes with trade-offs. The platform blocks users from the U.S., Canada, EU, and 15 other countries. If you’re in one of those regions, you can’t even create an account. And while you don’t need KYC to withdraw, KCEX still monitors for suspicious activity. If you suddenly move $2 million in 10 minutes, they might freeze your account and ask questions later.

The no-KYC model is a double-edged sword. It’s perfect for experienced traders who know how to manage risk. But for newcomers, it’s a minefield. There’s no customer support to help if you send funds to the wrong address. No one will reverse a scam. You’re fully responsible.

Trading Infrastructure That Delivers

KCEX isn’t just cheap-it’s fast. During peak volatility, its order matching engine hits under 5ms latency. Slippage stays below 0.1% even on large block trades. That’s not marketing fluff-it’s what professional traders see in their logs. Compare that to exchanges where slippage hits 0.5% or more during news events, and you’ll understand why scalpers and arbitrage bots flock here.The platform supports over 700 futures pairs with leverage up to 100x. That’s more than most competitors. Liquidity is deep across 800+ trading pools, verified by CryptoCompare. API users get 99.98% uptime and can send up to 100 requests per second. If you’re running automated strategies, this is the kind of infrastructure that makes the difference between profit and loss.

Security is solid but not certified. Withdrawals use multi-signature wallets with an optional 24-hour delay. It’s a smart feature-gives you time to cancel a mistaken withdrawal. But there’s no SOC 2 certification, no insurance fund for derivatives, and no public audit reports. You’re trusting their code, not a third-party seal.

What’s Missing? A Lot

KCEX is laser-focused. That means it leaves out a lot of features you’ll find elsewhere:- No fiat onramps. You can’t deposit USD, EUR, or GBP. You need crypto already.

- No demo account. You can’t practice with fake money.

- No savings accounts with yield. Wait-actually, they do offer up to 5% APY on some coins, but it’s basic and not as robust as Coinbase’s staking.

- No insurance fund. If the exchange gets hacked, your futures positions aren’t protected.

- No structured products, no options (yet), no NFT marketplace.

These aren’t small omissions. They’re major gaps for casual users or those looking to hold long-term. If you’re trying to earn interest on your Bitcoin or want to buy crypto with a bank transfer, KCEX isn’t your platform. It’s a trading terminal, not a crypto wallet or bank.

User Experience: Simple But Sparse

The app and website are clean and intuitive. Beginners can place their first trade in under 30 minutes. The interface is lightweight, with no cluttered banners or push notifications trying to upsell you on staking or loans. It’s refreshing, honestly.But the documentation? Barebones. API docs are thorough, but beginner guides are thin. There are no video tutorials on their site. You’re expected to figure it out or find help elsewhere. The community is active-85,000 on Telegram, 42,000 on Discord-but that’s not the same as official support.

Customer service is slow. Trustpilot reviews consistently mention 48 to 72 hours for replies to non-urgent issues. If you’re locked out of your account or need help with a withdrawal, you’re on your own for days. That’s a risk you have to accept.

Who Is KCEX For?

Let’s be clear: KCEX isn’t for beginners. It’s not for people who want to buy crypto and hold. It’s not for those who need regulatory protection.It’s for:

- Active traders who do 10+ trades a day

- Those who want to minimize fees at all costs

- Privacy-focused users outside the U.S. and EU

- Algorithmic traders who need speed and low slippage

- High-net-worth individuals moving large volumes

If you fit that profile, KCEX is one of the best tools available. The fees are unmatched. The speed is real. The liquidity is deep.

If you’re looking for a simple way to buy Bitcoin with your debit card? Go to Coinbase or Kraken. If you want insurance on your funds? Stick with regulated exchanges. KCEX doesn’t care about those users. And that’s okay.

The Big Question: Will It Last?

How can KCEX afford to pay traders to place limit orders? Experts are skeptical. The negative maker fee alone suggests they’re burning cash to grow. They’re not making money on trading-they’re betting on volume, user acquisition, and future monetization.Regulators are watching. The U.S., EU, and Canada are already blocked. More countries may follow. Chainalysis gives KCEX only a 40% chance of surviving past 2027. CryptoCompare is more optimistic at 65%, citing strong liquidity and user growth.

One thing’s certain: KCEX is growing fast. User numbers jumped 320% in 2025. They’re now the 8th largest derivatives exchange globally. They’re adding options trading by December 2025. That shows ambition.

But if regulation cracks down hard, or if they can’t find a sustainable revenue model, they could vanish overnight. There’s no safety net. No FDIC. No insurance. Just code and capital.

Final Verdict: High Risk, High Reward

KCEX is the crypto exchange equivalent of a race car with no seatbelts. It’s fast, powerful, and thrilling-if you know what you’re doing. But one mistake, and you’re done.For active traders who value speed, privacy, and zero fees? KCEX is a game-changer. It’s the cheapest, fastest option for derivatives and spot trading in 2025.

For everyone else? Skip it. Use a regulated exchange. Protect your funds. Don’t risk your portfolio on a platform that doesn’t answer your support tickets in under 24 hours.

Bottom line: KCEX isn’t trying to be safe. It’s trying to be the best trading platform for those who don’t need safety. If that’s you, it’s worth a look. If it’s not, save yourself the headache.

Does KCEX have a mobile app?

Yes, KCEX has a mobile app available on both Android and iOS. It’s rated 4.5 stars with over 1 million downloads on Google Play. The app supports all core trading functions, including spot and futures trading, portfolio tracking, and API key management. Performance is smooth, and the interface mirrors the web platform.

Can I deposit USD or EUR on KCEX?

No, KCEX does not support fiat deposits. You cannot deposit USD, EUR, GBP, or any other traditional currency. You must already own cryptocurrency and transfer it from another wallet or exchange to start trading on KCEX.

Is KCEX safe to use?

KCEX uses multi-signature wallets and offers a 24-hour withdrawal delay for added security. However, it lacks third-party certifications like SOC 2, and there’s no insurance fund for user funds. The platform has no known hacks to date, but the absence of regulatory oversight and public audits means you’re taking on counterparty risk. Use it only with funds you’re prepared to lose.

Does KCEX offer staking or yield products?

Yes, KCEX offers savings products with up to 5% APY on select cryptocurrencies. These are flexible, meaning you can withdraw anytime without penalty. However, they’re not as robust as institutional-grade staking programs on regulated exchanges. Returns are not guaranteed, and there’s no insurance on the deposited assets.

Is KCEX available in the United States?

No, KCEX blocks users from the United States, Canada, the European Union, and 15 other jurisdictions due to regulatory concerns. If you’re located in one of these regions, you won’t be able to create an account or access the platform.

What’s the minimum deposit on KCEX?

There’s no minimum deposit. You can deposit any amount of cryptocurrency, even fractions of a coin. However, because there’s no fiat onramp, you’ll need to acquire crypto elsewhere first. Some users start with as little as $50 worth of Bitcoin or Ethereum.

How fast are withdrawals on KCEX?

Withdrawals are typically processed within 10 to 30 minutes, assuming no security checks are triggered. For withdrawals under 30 BTC daily, no KYC is required. For larger amounts, the platform may delay processing or request verification. The optional 24-hour withdrawal delay can be enabled for added security.

13 Comments

KCEX is a joke. No KYC? In 2025? This is how money launderers operate. If you’re not in the US, you’re either naive or complicit. This platform is a regulatory time bomb waiting to explode. And don’t tell me about ‘privacy’-you’re just hiding from the law.

Zero fees? Negative maker fees? It’s too good to be true. Someone’s burning VC cash. When the funding dries up, the platform vanishes. And you’ll be left with a wallet full of worthless tokens and no recourse. This isn’t innovation-it’s financial theater.

OMG!!! This is the most EPIC, UNREAL, BREATHTAKING crypto platform I’ve EVER seen!!! 0% fees??? Negative maker fees??? I’m crying tears of joy!!! My algorithm just made $87K in one week!!! KCEX is not an exchange-it’s a GODSEND!!! The speed? Like lightning forged by Zeus himself!!! The liquidity? Deeper than the Mariana Trench!!! I’ve traded on Binance, Kraken, Bybit, FTX (RIP), and NOTHING-NOTHING-compares!!! I’m moving ALL my funds!!! THIS IS THE FUTURE!!!

The structural asymmetry of KCEX’s fee model reveals a fascinating dissonance between neoliberal market logic and the material constraints of crypto infrastructure. The negative maker fee functions as a liquidity subsidy, effectively externalizing the cost of order book depth onto speculative capital flows. This is not a sustainable business model-it’s a temporal arbitrage predicated on regulatory arbitrage. The absence of SOC 2 certification and insurance mechanisms indicates a fundamental ontological insecurity: the platform is a performative artifact of trustlessness, where the user becomes the sole guarantor of value. In this context, privacy isn’t a feature-it’s a symptom of systemic fragility.

So let me get this straight... you're telling me there's a crypto exchange that doesn't care if I'm a US citizen... and I can trade with zero fees... and they don't even have customer service... and they don't insure my money... and I'm supposed to be grateful???

Yeah no thanks I'll just keep my money in a bank where people answer the phone and I don't have to pray every time I hit sell

If you’re an active trader and you’ve been burned by fees on other platforms, KCEX is worth exploring-but only if you’re disciplined and understand the risks. This isn’t a place for beginners or people who want hand-holding. It’s a tool. Treat it like one. Do your research, start small, never deposit more than you’re willing to lose, and remember: no one’s coming to save you if you make a mistake. But if you’re ready for that? The savings are real. The speed is unmatched. And the freedom? Priceless.

I’ve been using KCEX for 6 months now. I trade 20+ times a day and I’ve saved over $2,500 in fees alone. The app is clean, the API is buttery smooth, and the slippage is insane compared to Binance. Yeah, no fiat onramp-that’s a pain, but I just use Coinbase to buy and transfer over. No KYC? Perfect. I don’t want my government knowing every trade I make. The only downside is support takes forever-but honestly, if you’re trading at this level, you shouldn’t need them anyway. Just be careful with withdrawals and enable the 24-hour delay. Solid platform for serious traders.

Zero fees?!?!? And no KYC?!?!? And they’re paying YOU to place orders?!?!? This is a FINANCIAL PONZI SCHEME!! They’re using your trades to mask money laundering!! They’re being funded by Russian oligarchs and Chinese state actors!! You think this is innovation? It’s a digital trap!! They’ll vanish overnight and take your life savings with them!! Don’t be fooled!! This is the same scam as FTX!! THEY’RE NOT LEGIT!!

I’ve been on KCEX since launch. I’m a mom of three, work full-time, and trade crypto on the side. I didn’t know anything about limit orders until I found this platform. The interface is simple, the fees are zero, and I’ve slowly built up my portfolio. I don’t trade big-just $500–$1,000 at a time. I use the 24-hour withdrawal delay as a safety net. I don’t need customer service because I read the docs and watch YouTube tutorials. I’m not a pro. I’m just careful. And KCEX lets me do that without the corporate noise. Thank you for existing.

Why would any rational person use a platform that blocks the U.S. and EU? Because they’re hiding from regulators. Because they’re laundering crypto for terrorists. Because they’re part of a global anti-Western financial cabal. The fact that they have no insurance? That’s not a feature-it’s a warning. If you’re using KCEX, you’re not a trader. You’re a pawn. And when the U.S. sanctions them, your coins will vanish. Don’t be stupid. Stick to regulated exchanges. Your life is worth more than 0.01% fees.

Oh wow, KCEX pays you to trade? Next they’ll give you a gold star and a lollipop for not getting hacked. Truly, the pinnacle of financial engineering: a platform that’s basically a high-speed casino run by a guy named ‘CryptoBob’ in a basement in Singapore. But hey, at least you don’t have to show your ID. That’s what matters, right? Privacy over protection. Cool. Cool cool cool.

KCEX is the only real exchange because everyone else is corrupt. Binance pays off regulators. Coinbase is owned by the Fed. Kraken is a front for the CIA. KCEX doesn't care about your government. It cares about your trades. That's why it's the best. If you don't like it you're just jealous because you're too scared to trade without a safety net. You're not a trader you're a bank teller with crypto dreams. Get real. The future is decentralized and unregulated and you're gonna have to get used to it

I appreciate how honest this review is. It doesn’t try to sell you on hype. It says: ‘This is for traders. Not for everyone.’ And that’s rare. I used to think ‘no KYC’ meant ‘no trust.’ But after reading this, I see it as ‘no gatekeeping.’ It’s not for the timid, but for those who want to take full responsibility. That’s a kind of integrity. I’m not using it yet-but I respect it. And if I ever become an active trader? I’ll be first in line.