China isn’t trying to improve Bitcoin. It’s trying to erase it. Since 2021, owning, trading, or mining Bitcoin in China has been illegal. Not just discouraged-banned. At the same time, the government rolled out the e-CNY, or digital yuan, a state-controlled digital currency that tracks every transaction, blocks anonymous transfers, and can be turned off for anyone flagged by authorities. This isn’t a new payment app. It’s a financial overhaul designed to replace decentralized crypto with total state control.

What Exactly Is the E-CNY?

The e-CNY is not a cryptocurrency. It’s the digital version of the Chinese yuan, issued and managed entirely by the People’s Bank of China. Think of it like cash, but instead of paper bills, you hold digital tokens in an app. You don’t need a bank account. You don’t need to link a credit card. You just download the official e-CNY wallet and load it with digital money. Transactions happen instantly between phones via QR codes or NFC-no internet needed, even in offline mode. By mid-2024, over 261 million people in China had used the e-CNY, and it had processed more than 7.3 trillion yuan ($1 trillion) in payments. It’s used to pay for subway rides, groceries, salaries, government benefits, and even rent in pilot cities like Beijing, Shanghai, and Shenzhen. McDonald’s, Starbucks, and state-owned enterprises all accept it. Civil servants in some regions are now paid in e-CNY to drive adoption. Unlike Bitcoin, the e-CNY has no fixed supply. The central bank can create as much as it wants. And unlike Bitcoin’s public ledger, every e-CNY transaction is visible to the government. The system is built to monitor, not to protect privacy.Why China Banned Bitcoin

China’s crackdown on Bitcoin didn’t start with the e-CNY-it accelerated because of it. In 2021, the government shut down all crypto mining operations, citing energy waste. Thousands of mining farms, mostly in Sichuan and Xinjiang, were shut down overnight. Then came the trading ban: exchanges like Binance and OKX were forced to stop serving Chinese users. Wallets were blocked. VPNs used to access foreign crypto sites were targeted. The reasoning was simple: Bitcoin threatened China’s monetary sovereignty. If people could move money outside the system, bypass capital controls, or hide wealth from tax authorities, the government lost control. Crypto also enabled cross-border payments without going through the SWIFT system-which China wants to replace with its own infrastructure. To enforce this, China uses advanced tracking tools. Law enforcement monitors blockchain activity to trace wallet addresses linked to illegal activity. They analyze IP logs, detect VPN usage, and flag wallets that behave like mixers or tumblers. All e-CNY wallets must be registered with real-name ID, and any crypto wallet attempting to interact with e-CNY systems gets flagged automatically.E-CNY vs Bitcoin: A Side-by-Side Breakdown

| Feature | E-CNY (Digital Yuan) | Bitcoin |

|---|---|---|

| Issuer | People’s Bank of China | No central authority |

| Supply | Unlimited, controlled by the state | Fixed at 21 million coins |

| Privacy | Full traceability; government sees all transactions | Pseudonymous; public ledger but no personal IDs |

| Legality in China | Legal, promoted, and mandatory for public services | Illegal to trade, mine, or hold |

| Technology | Hybrid blockchain with centralized control | Decentralized, permissionless blockchain |

| Energy Use | Minimal-runs on existing digital payment networks | High-proof-of-work mining consumes massive electricity |

| Global Use | Primarily domestic; cross-border trials underway | Used worldwide; accepted by institutions and individuals |

One key difference? Bitcoin is designed to be censorship-resistant. The e-CNY is designed to enable censorship. If you’re flagged for political dissent, unpaid debts, or even excessive spending on luxury goods, your e-CNY wallet could be frozen. There’s no appeal process. No blockchain arbitration. Just a government system that can cut you off.

How China Is Exporting Its Digital Currency Model

China isn’t just building this system for its own people. It’s pushing the e-CNY globally through the Belt and Road Initiative. Countries in Southeast Asia, Africa, and Central Asia are being offered e-CNY-based payment systems for trade settlements. Pakistan, Saudi Arabia, and the UAE are testing cross-border e-CNY transactions for oil, infrastructure, and logistics. The goal? To bypass the U.S. dollar in global trade. Right now, most international transactions go through the SWIFT network, controlled by Western banks. China wants its own system-mBridge, a multi-CBDC platform developed with the Bank for International Settlements-to let countries settle payments directly in digital yuan, digital ruble, or digital euro, skipping the dollar entirely. Hong Kong, under China’s jurisdiction, recently passed strict rules for stablecoins: any token pegged to the Hong Kong dollar must be backed 1:1 with reserves and approved by regulators. It’s a preview of what the rest of the world might see if China’s model spreads.Is the E-CNY Really Better Than Crypto?

For the average Chinese citizen, the e-CNY is convenient. No fees. No waiting. Works without internet. Instant transfers. Even elderly users who never used smartphones before adapted quickly because it works like Alipay or WeChat Pay. But convenience comes at a cost. There’s no financial privacy. No freedom to transact without oversight. And if the government decides your behavior is “unstable”-say, you donate to a banned NGO or buy too much foreign goods-you lose access to your own money. Bitcoin, despite its volatility and complexity, offers something the e-CNY can’t: autonomy. You own your keys. No one can freeze your wallet. No central bank can print more of your coins. It’s not perfect-but it’s designed to resist control. China knows this. That’s why it spends over $54 billion a year on blockchain tech and AI surveillance to make sure crypto stays out. It’s not about efficiency. It’s about power.

What Happens When the World Chooses Between Them?

By 2025, there are over 580 million crypto users worldwide. That’s more than the population of the European Union. And despite China’s ban, 26% of ETF investors in Greater China still plan to invest in crypto ETFs next year. People want access to decentralized money. Meanwhile, the e-CNY is growing fast-but only inside China’s firewall. Outside, few countries want to adopt a currency that can be turned off at the push of a button. Even Russia, which has its own digital ruble, hasn’t fully embraced China’s surveillance model. The real battle isn’t between two technologies. It’s between two philosophies: control vs. freedom. Centralization vs. decentralization. State power vs. individual sovereignty. China picked control. The rest of the world is still deciding.What This Means for You

If you live in China: you don’t have a choice. The e-CNY is your only legal digital currency. Use it. But know that every payment you make is recorded. Your spending habits, your travel, your donations-all visible to the state. If you live outside China: pay attention. This isn’t just about money. It’s about the future of financial freedom. As more countries consider their own CBDCs, they’ll look to China’s model. Will they copy its surveillance features? Or will they demand privacy protections? The e-CNY isn’t the future of money. It’s the future of state power dressed up as innovation. Bitcoin may be volatile, but it’s the last standing symbol of money that belongs to the people-not the government.Is Bitcoin illegal in China?

Yes. Since 2021, Bitcoin trading, mining, and holding for speculative purposes have been fully banned in China. Financial institutions are prohibited from offering crypto services, and exchanges must shut down operations targeting Chinese users. Enforcement includes blocking websites, tracking wallets, and shutting down VPNs used to access foreign crypto platforms.

Can I use Bitcoin and e-CNY together?

No. The e-CNY system is designed to prevent any interaction with private cryptocurrencies. Wallets are isolated. Any attempt to transfer funds between Bitcoin and e-CNY will trigger system alerts. Financial institutions and payment platforms are required to block such transactions, and users attempting them risk account freezes or legal penalties.

Why does China care so much about controlling digital money?

China wants to eliminate financial anonymity to strengthen capital controls, prevent tax evasion, and monitor dissent. By replacing cash and crypto with a traceable digital currency, the government gains full visibility into economic activity. This helps enforce social credit policies, stop illicit flows, and reduce reliance on the U.S. dollar in global trade.

Does the e-CNY use blockchain?

It uses a hybrid system that includes blockchain-like technology for settlement, but the network is centrally controlled by the People’s Bank of China. Unlike Bitcoin’s open, permissionless blockchain, the e-CNY’s ledger is private, and only the central bank can validate or reverse transactions. It’s blockchain for efficiency-not decentralization.

Will other countries adopt the e-CNY model?

Some are exploring CBDCs, but few are copying China’s surveillance-heavy approach. The European Union and U.S. are focusing on privacy-preserving designs. However, developing nations with weak financial systems may adopt China’s model for its ease of implementation and funding support through Belt and Road projects, even if it means sacrificing financial privacy.

Can the e-CNY replace the U.S. dollar globally?

Not yet. The dollar still dominates global trade, reserves, and finance. But the e-CNY is being used in pilot cross-border deals with countries like Saudi Arabia and the UAE to settle oil and infrastructure payments in yuan instead of dollars. If enough nations adopt this, it could chip away at dollar dominance over time-especially in regions aligned with China’s geopolitical interests.

How is the e-CNY different from PayPal or Apple Pay?

PayPal and Apple Pay are payment apps that move existing bank money. The e-CNY is actual digital currency issued by the central bank-it’s not tied to a bank account. It’s like holding digital cash, not a digital card. Also, unlike private apps, the government can freeze, monitor, or restrict e-CNY usage without court orders or user consent.

What happens if my e-CNY wallet gets frozen?

If your wallet is flagged-due to suspicious spending, political activity, or non-compliance with regulations-it can be frozen without notice. There is no public appeals process. You may need to contact local authorities or your bank to resolve it, but success is not guaranteed. This is a key difference from Bitcoin, where your wallet can’t be shut down by a central authority.

10 Comments

Honestly, I think China's move is less about control and more about efficiency. No more cash handling, no more transaction fees, instant settlements-even my grandma uses it to buy dumplings. It’s not perfect, but it works.

Bitcoin’s cool and all, but if I had to choose between freedom and not waiting 10 minutes for a payment to clear? I’ll take the fast lane.

I get the convenience, but I can’t ignore the trade-off. Privacy isn’t a luxury-it’s a right. When your every coffee purchase is logged and analyzed, you start to feel like you’re being watched even when you’re not doing anything wrong.

Oh please. You people act like China invented surveillance capitalism. The NSA was tracking your search history before you were born. At least the e-CNY doesn’t pretend to be ‘free’-it’s honest about who’s in charge. Stop acting like Bitcoin is some moral victory when half the users are just gambling on memes.

The fundamental divergence here lies not in technological architecture, but in ontological assumptions about the nature of value and the role of the state in human affairs. Bitcoin, as a protocol, embodies the Enlightenment ideal of individual sovereignty over economic agency. The e-CNY, by contrast, is a technocratic instrument of social ordering, wherein monetary autonomy is subordinated to administrative efficiency and political stability.

This is not merely a currency war-it is a civilizational choice between the liberal tradition of non-interference and the authoritarian logic of total visibility. One system empowers the individual; the other, the institution. History will judge which path leads to resilience-and which to fragility.

China’s got balls. While we’re all debating crypto taxes and NFTs, they’re building the future. If you can’t handle your money being tracked, maybe you shouldn’t be spending it. America’s too busy arguing about pronouns to run a real economy. Let the Chinese build the infrastructure we’re too lazy to make.

I used to think Bitcoin was the answer. Then I saw how hard it is to use. You need a wallet, a private key, a backup, a seed phrase, and you still get scammed if you blink wrong. The e-CNY? Just scan a QR code. No drama. No panic when the price drops 20%.

Freedom’s nice, but not when it’s complicated. Most people don’t want to be crypto anarchists. They just want to pay for lunch without a headache.

Oh wow. So now we’re supposed to admire a system that can freeze your money because you bought too many iPhones? Congrats, China. You turned money into a loyalty card.

It’s funny how we treat this like a new phenomenon. The U.S. has been tracking financial activity for decades through AML, KYC, and bank reporting. The difference? China’s doing it at scale, with tech, and without the PR spin. We just don’t like it because it’s not ours.

Maybe instead of demonizing the e-CNY, we should ask why our own CBDC proposals are stuck in bureaucracy while China’s already paying civil servants in digital yuan.

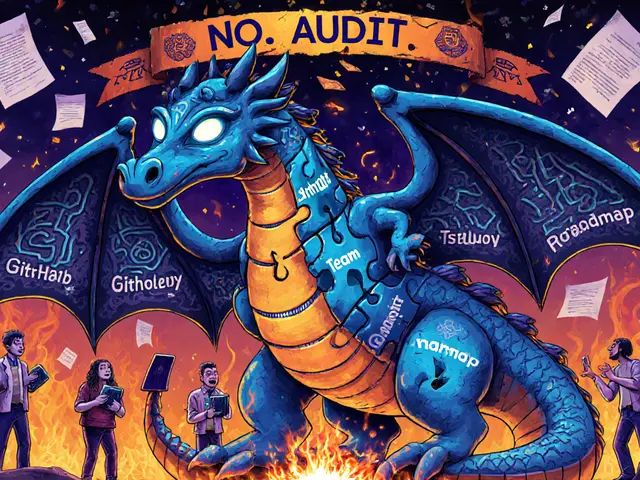

This is step one. The e-CNY is the gateway drug to a fully digitized social credit economy. Soon, your wallet won’t just track your spending-it’ll adjust your interest rates, your travel permissions, your access to education, even your job eligibility based on ‘economic behavior scores’. The government doesn’t just want to monitor you-they want to *engineer* you.

And yes, the blockchain is real. But it’s not decentralized. It’s a honeypot. Every transaction is a data point feeding AI models that predict dissent before it happens. This isn’t innovation. It’s algorithmic authoritarianism.

The e-CNY’s architecture leverages a permissioned distributed ledger for settlement finality while maintaining centralized monetary policy control. Unlike Bitcoin’s Nakamoto consensus, the e-CNY employs a Byzantine Fault Tolerant (BFT) consensus mechanism under PBOC oversight, enabling sub-second transaction finality with minimal energy expenditure. Crucially, the dual-anonymity layer-wherein microtransactions are pseudonymous at the user level but fully traceable at the central bank tier-represents a novel monetary design paradigm unattainable in permissionless systems.