Wrapped Assets vs Native Assets: What You Need to Know in 2025

Wrapped assets let you use Bitcoin on Ethereum and other chains, but they come with trade-offs in security and control. Learn how they compare to native assets in 2025.

When you hear WBTC, Wrapped Bitcoin is a tokenized version of Bitcoin that runs on the Ethereum blockchain as an ERC-20 token, allowing Bitcoin holders to participate in DeFi without selling their BTC. Also known as Wrapped BTC, it bridges the liquidity of Bitcoin with the smart contract power of Ethereum. Think of it like a voucher: you lock your real Bitcoin with a trusted custodian, and in return, you get WBTC that works everywhere Ethereum does—lending platforms, decentralized exchanges, yield farms. It’s not Bitcoin itself, but it acts like it on Ethereum.

WBTC isn’t just a technical trick. It’s a solution to a real problem: Bitcoin’s network doesn’t support smart contracts, so you can’t lend it, stake it, or use it as collateral in DeFi. WBTC fixes that. But it comes with trade-offs. Unlike Bitcoin, WBTC relies on centralized custodians like BitGo to hold the real BTC. That means if the custodian gets hacked or goes offline, your WBTC could be at risk. It’s also not trustless—you have to believe the system won’t cheat you. That’s why WBTC is only as good as its guardians. Still, it’s the most widely used way to bring Bitcoin into Ethereum’s DeFi world, and over $4 billion in BTC has been wrapped into WBTC so far.

Related to WBTC are other wrapped tokens like wETH, wrapped Ether, which is simply Ether repackaged as an ERC-20 token for easier use in DeFi protocols, and renBTC, another Bitcoin wrapper that uses a decentralized network of nodes instead of centralized custodians. These all serve the same goal: make Bitcoin usable outside its own chain. But WBTC leads because of its transparency, auditability, and adoption by major platforms like Uniswap, Aave, and Compound.

What you’ll find below isn’t a list of hype or fluff. It’s a collection of real, grounded posts about crypto projects that either use WBTC, relate to bridging assets across chains, or expose the risks of wrapped tokens. You’ll read about fake tokens pretending to be WBTC, exchanges that support it, and how DeFi platforms treat it differently than native Bitcoin. Some posts warn you about scams pretending to offer WBTC airdrops. Others explain why WBTC’s price sometimes drifts from Bitcoin’s. This isn’t theory—it’s what people are actually doing, losing, or earning with WBTC right now. If you’re holding it, trading it, or just wondering why it exists, what’s below will help you decide what to do next.

Wrapped assets let you use Bitcoin on Ethereum and other chains, but they come with trade-offs in security and control. Learn how they compare to native assets in 2025.

The Battle Hero II chest NFT airdrop promised $50,000 in rewards but vanished without trace. Learn what really happened, why it failed, and how to spot fake crypto airdrops before you lose your wallet.

Superp Crypto Exchange offers up to 10,000x leverage with no liquidations, targeting meme traders and DeFi veterans. Powered by $SUP token, it combines dynamic risk management with exclusive perps for viral assets. A bold innovation in decentralized trading.

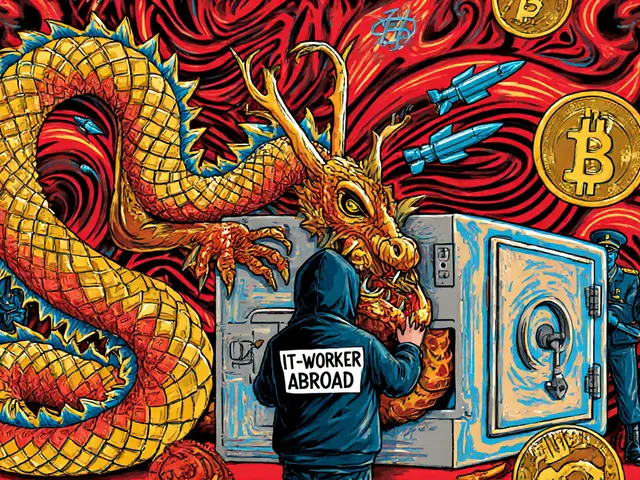

North Korea bans crypto for its citizens but runs the world’s most aggressive state-sponsored hacking operation, stealing over $2.17 billion in 2025 to fund its nuclear program. This is how they do it - and why it matters to everyone.

Argentine citizens are turning to crypto-especially stablecoins and Bitcoin-as a lifeline against hyperinflation and strict currency controls. With the peso losing value daily, crypto has become essential infrastructure for savings, payments, and survival.

China banned Bitcoin trading and mining in 2021. Owning crypto isn't illegal, but using it is risky. Here's what Bitcoin holders really face - and why the ban isn't going away.