Proof of Work Blockchain: How It Powers Crypto, Why It Matters, and What’s Changing

When you hear about proof of work blockchain, a consensus mechanism where miners solve complex math puzzles to validate transactions and secure the network. Also known as PoW, it’s the backbone of Bitcoin and was the first way blockchains agreed on truth without a central authority. It’s not magic — it’s electricity, hardware, and competition. Miners race to solve cryptographic puzzles, and the first one to crack it gets rewarded in crypto. That’s how new coins enter circulation and how transactions get locked into an unchangeable chain.

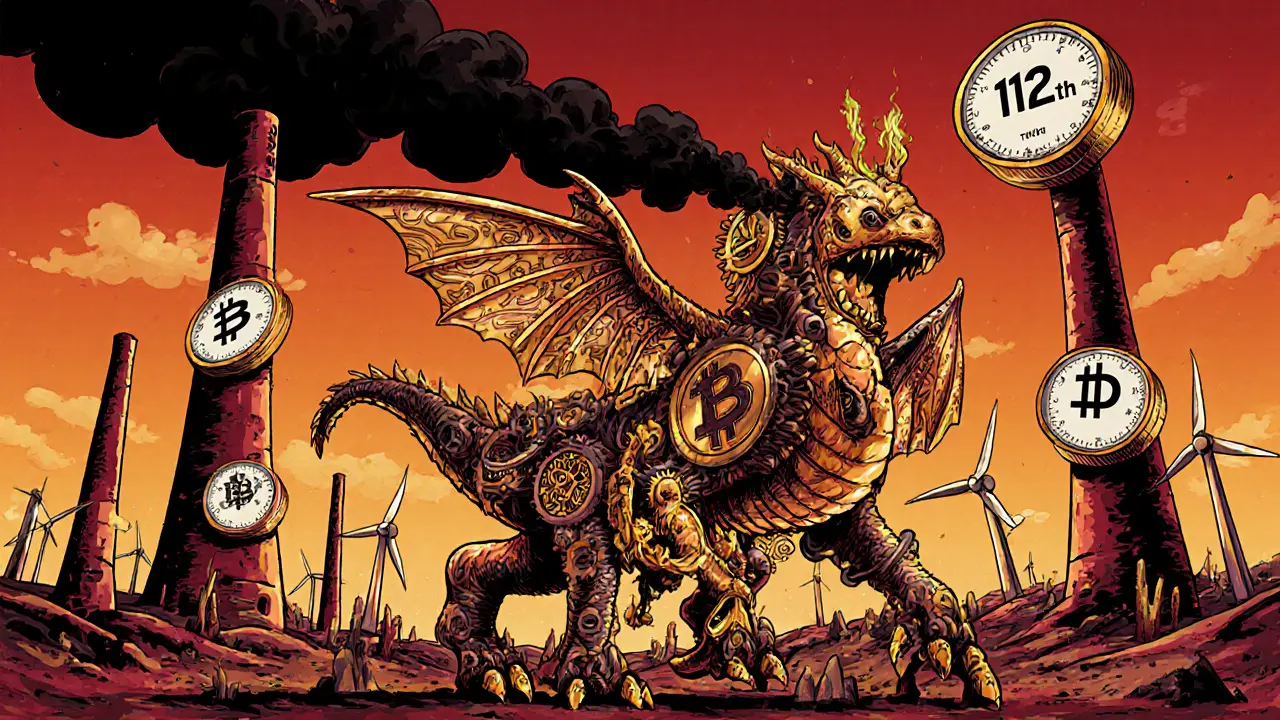

But proof of work isn’t just about security — it’s also about cost. Every Bitcoin block requires massive computing power, and that means huge energy use. Critics point to this as unsustainable, and rightly so. In 2023, Bitcoin mining used more electricity than most countries. That’s why regulators in Europe and parts of the U.S. are pushing for cleaner alternatives. Meanwhile, miners in Russia and Kazakhstan keep going, thanks to cheap power and lax rules. The truth? Proof of work blockchain still works — but it’s under siege.

What’s replacing it? proof of stake, a system where validators are chosen based on how much crypto they lock up, not how much power they use. Also known as PoS, it’s the model Ethereum switched to in 2022 — cutting its energy use by 99.95%. Other chains like Solana and Cardano use variations of this. But here’s the catch: proof of work isn’t dead. Bitcoin still holds 50% of the crypto market cap, and miners aren’t quitting. They’re just moving to places where electricity is dirt cheap and no one’s asking questions.

And then there’s the human side. People still mine crypto with old GPUs in their garages. Some do it for fun. Others rely on it for income. But the era of easy profits is over. Hardware costs more. Electricity prices fluctuate. And now, with regulations tightening in the EU and Australia, even the most dedicated miners need licenses, tax records, and compliance plans. This isn’t the wild west anymore.

What you’ll find below isn’t a list of theory. It’s real-world cases: how North Korea steals crypto using the same infrastructure that powers proof of work, why Russia allows mining only with strict rules, and how a dead exchange like Wannaswap once rode the wave of this system. You’ll see how mining laws in 2025 are changing, why some tokens like FLY and BSL failed despite being built on PoW chains, and how security tools like hardware wallets protect the assets miners earn. This is the messy, real, unfiltered truth about what keeps the oldest blockchain alive — and what’s pushing it toward change.