Project Risk in Blockchain: How to Spot Failed Tokens and Avoid Scams

When you hear about a new blockchain project, a digital initiative built on decentralized ledger technology that promises innovation, returns, or community value, it’s easy to get excited. But not every project survives. Many vanish within months—no updates, no team, no trading volume. These are dormant tokens, cryptocurrencies that were launched with hype but now have zero activity or development. They’re not just inactive—they’re risky, and often, they’re scams.

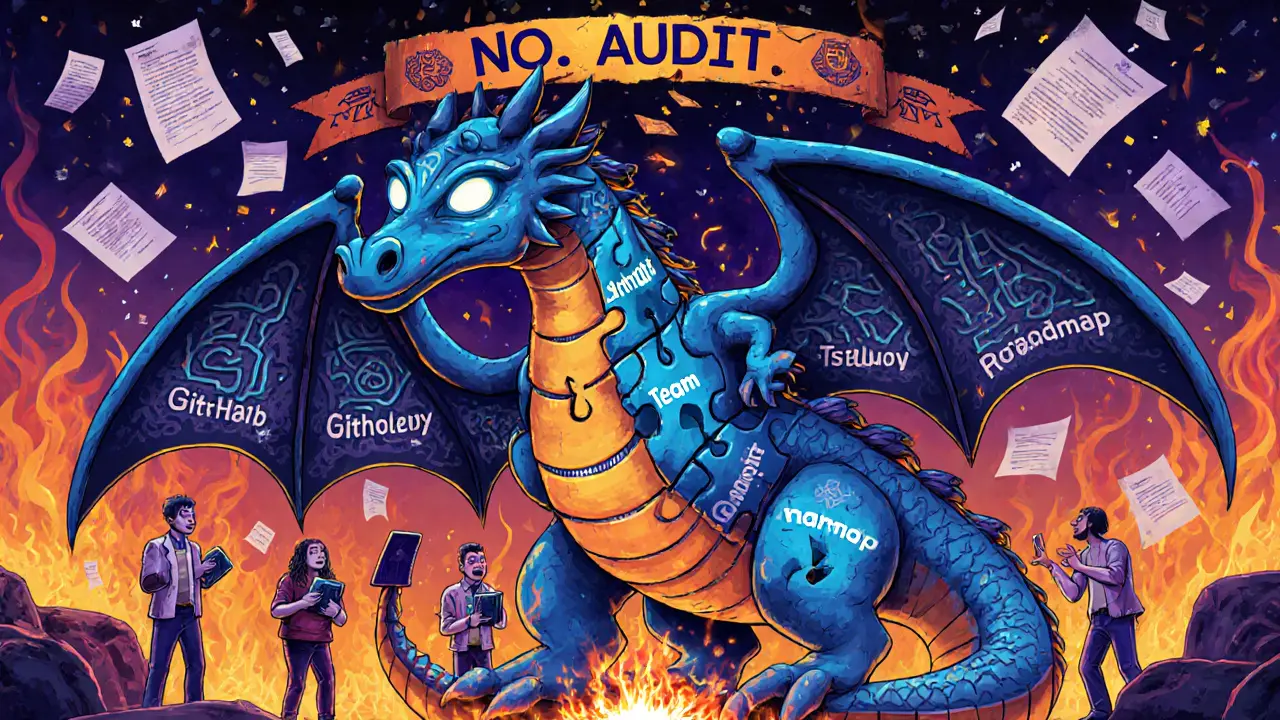

Project risk in blockchain isn’t about market swings. It’s about whether the team ever existed, whether the code was ever used, and whether anyone actually holds the token for anything other than speculation. Look at Franklin (FLY), a token tied to a DeFi ecosystem that stopped functioning years ago. Or BSClaunch (BSL), a Binance Smart Chain token with no updates since 2021 and no team in sight. These aren’t outliers. They’re common. The same goes for veDAO (WEVE), a token that doesn’t exist on any blockchain, yet people still search for it. If you can’t find real data—no GitHub, no exchange listings, no community chatter—it’s probably a ghost.

Some projects don’t fail because they’re bad—they fail because they were never real. Fan tokens like Diyarbekirspor Token (DIYAR), a football club token with zero circulating supply, or meme coins like Big Dog (BIGDOG), a Solana-based coin with no team and no liquidity, look like investments but act like lottery tickets. And then there are the outright scams: fake airdrops, cloned websites, and tokens named after real projects just to trick you into sending crypto. crypto scams, fraudulent schemes designed to steal funds by pretending to offer real value thrive when people skip the basics: check the team, verify the contract, look at trading history.

Blockchain security isn’t just about hardware wallets or private keys. It’s also about knowing which projects to avoid. The same tools that make crypto powerful—transparency, immutability, public ledgers—also make it easy to spot dead projects. If a token hasn’t moved in six months, if the website is a placeholder, if the whitepaper is copied from another project—run. You don’t need to be an expert to see these red flags. You just need to look.

Below, you’ll find real reviews of projects that didn’t make it, exchanges that cut corners, and scams that fooled people. Each one shows you what to watch for. Whether you’re new to crypto or have been trading for years, knowing project risk isn’t optional—it’s the first line of defense.