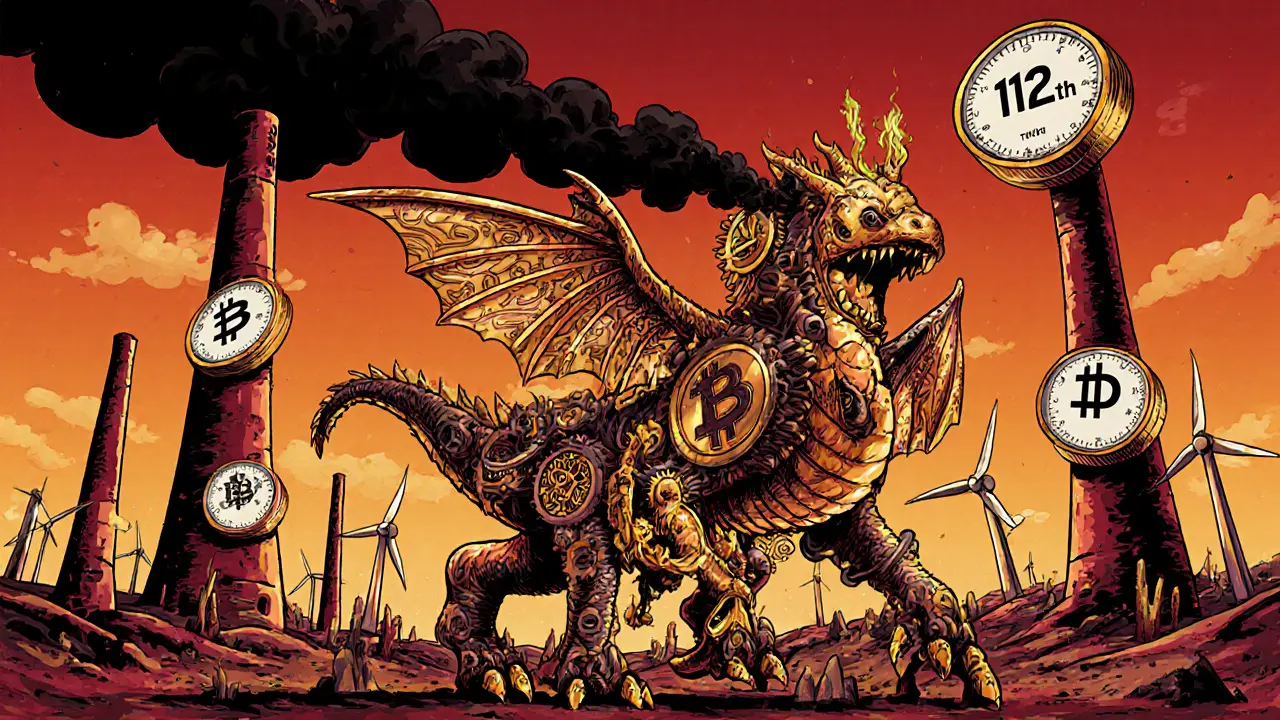

PoW Environmental Impact: How Bitcoin Mining Affects the Planet

When you hear Proof of Work, a consensus mechanism used by Bitcoin and other blockchains that requires miners to solve complex math problems to validate transactions. Also known as mining, it’s the engine behind Bitcoin’s security—but it runs on a staggering amount of electricity. Every time a new Bitcoin block is added, thousands of computers around the world compete to solve puzzles, using power equivalent to entire small countries. This isn’t theoretical—it’s real, measurable, and growing.

The Bitcoin network, the largest blockchain by market cap, relying entirely on Proof of Work to secure its ledger uses more energy annually than Argentina or the Netherlands. Some estimates put it above 150 terawatt-hours per year. That’s more than the entire electricity consumption of Sweden. And while critics point to renewable energy use, the reality is messy: miners chase the cheapest power, which often means coal in China, hydro in Kazakhstan, or gas flaring in Texas. The cryptocurrency energy use, the total electricity consumed by all Proof of Work blockchains combined isn’t just a side effect—it’s the core cost of decentralization.

It’s not just about carbon. Mining hardware generates heat, noise, and electronic waste. Old ASIC miners get dumped in landfills every few years as newer, faster models arrive. And while some argue that mining can help absorb excess renewable energy, that doesn’t fix the fact that most mining operations still rely on fossil fuels during peak demand. The blockchain sustainability, the effort to reduce the environmental footprint of blockchain networks through better design or energy sources movement is real—but it’s mostly happening on other chains. Ethereum switched to Proof of Stake in 2022 and cut its energy use by 99.95%. Bitcoin? Still digging.

What you’ll find here aren’t opinions. These are real breakdowns of mining costs, regional regulations, and the hidden environmental trade-offs behind every transaction. You’ll read about how North Korea funds weapons with stolen crypto, how Russia’s mining laws force operators to live with winter power cuts, and why some exchanges are quietly avoiding PoW coins altogether. This isn’t about banning Bitcoin. It’s about understanding what you’re really supporting when you hold or trade it.