Liquid Restaking: What It Is, How It Works, and Why It Matters

When you stake your crypto, you lock it up to help secure a blockchain and earn rewards. But what if you could use that same staked asset to earn more — without giving up your liquidity? That’s where liquid restaking, a system that lets you reuse staked assets across multiple protocols while keeping them spendable. Also known as re-staking with liquidity, it’s changing how people earn in DeFi. Instead of choosing between earning rewards and using your crypto for loans, trades, or other apps, liquid restaking lets you do both.

This isn’t just a tweak to staking. It’s a new layer of financial leverage built on top of existing blockchains. Projects like EigenLayer, a protocol that allows Ethereum stakers to re-stake their ETH to secure other services made this possible. With EigenLayer, your staked ETH doesn’t just help protect Ethereum — it can also help secure new decentralized services like oracles, bridges, or rollups. In return, you earn extra rewards from those services. But it’s not magic. You’re taking on more risk. If one of those services gets hacked, your original staked assets could be slashed. That’s why liquid restaking isn’t for beginners. It’s for people who understand DeFi risks and want to push their returns further.

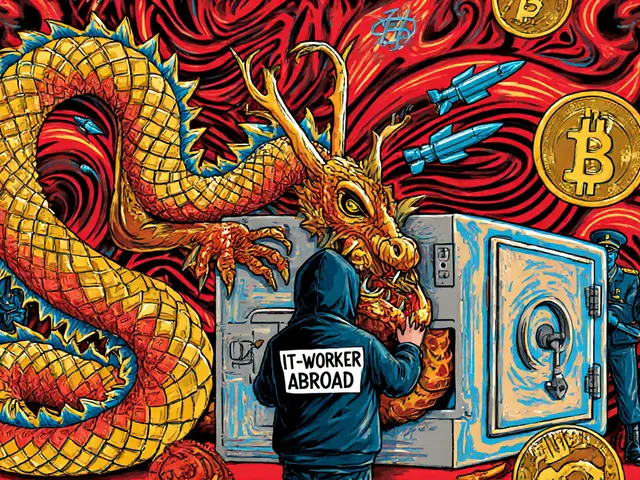

Related concepts like liquid staking, the process of receiving a tokenized version of your staked assets, like stETH or rETH, that you can trade or use in other protocols laid the groundwork. Liquid restaking builds on that by letting you take those tokenized staked assets and stake them again — this time for extra security roles. It’s stacking rewards on top of rewards. But the market is still young. Most of the TVL here is tied to a few big players. And as you’ll see in the posts below, not every project claiming to offer restaking is real. Some are scams hiding behind buzzwords. Others are legitimate but too risky for most. You’ll find real examples here — like how some users are using restaking to earn on top of their ETH, and how others lost money because they didn’t understand the slashing risks.

What you’ll find in this collection isn’t hype. It’s the truth behind the noise. You’ll see how restaking connects to real DeFi risks, how some airdrops are just bait for restaking platforms, and why some crypto projects vanish after promising big returns. Whether you’re curious about EigenLayer, wondering if liquid restaking is worth the risk, or just trying to spot a scam, this page gives you the facts — not the fluff.