FTX Exchange: What Happened, Why It Matters, and What You Can Learn From It

When you think of FTX exchange, a now-defunct cryptocurrency trading platform that once handled billions in user funds and was backed by major sports sponsorships. Also known as FTX.com, it was marketed as a fast, reliable, and innovative exchange—until it vanished overnight in November 2022. This wasn’t just another crypto failure. FTX was the face of crypto’s rise: celebrity endorsements, flashy ads, and promises of easy profits. But behind the scenes, customer money was being used to fund risky bets, political donations, and luxury spending by its founder, Sam Bankman-Fried. The collapse wasn’t caused by a hack—it was caused by bad accounting, hidden debts, and a complete lack of separation between customer funds and company assets.

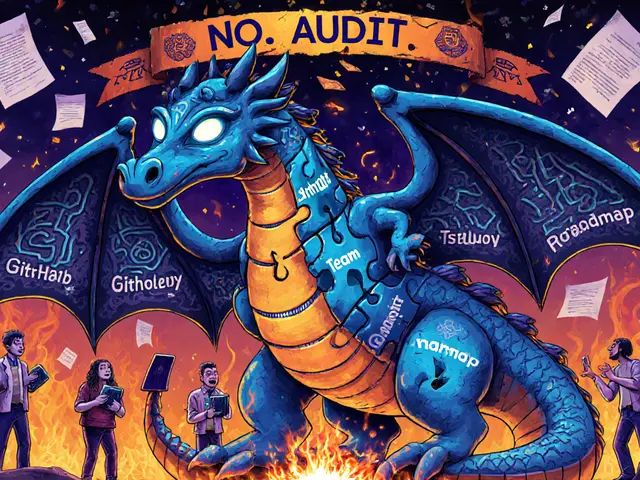

The fallout exposed how fragile trust is in crypto. Sam Bankman-Fried, the former CEO of FTX who was convicted of fraud, money laundering, and conspiracy. Also known as SBF, he once claimed to believe in "effective altruism"—but his actions showed a different priority: personal gain over user safety. His trial revealed that FTX didn’t just mismanage funds—it lied about them. Meanwhile, crypto regulation, the growing set of legal rules meant to protect users and ensure transparency in digital asset markets. Also known as digital asset oversight, it went from being a vague idea to an urgent necessity after FTX. Countries rushed to tighten rules on exchanges, demanding proof of reserves, clearer audits, and better segregation of client money. The lesson? Never assume an exchange is safe just because it looks big or sounds cool.

What’s left after FTX? A wake-up call. If you trade crypto, you need to know how your exchange handles your money. Does it show proof of reserves? Is it regulated by a real authority? Does it separate customer funds from its own? These aren’t optional questions—they’re survival checks. The posts below dig into real cases of failed exchanges, hidden risks, and how to spot danger before it’s too late. You’ll find reviews of platforms that are still operating, warnings about ghost projects, and breakdowns of what actually makes an exchange trustworthy. This isn’t about fear—it’s about knowing what to look for so you don’t end up where FTX users did.