DEX Explained: What Decentralized Exchanges Are and How They Work

When you trade crypto on a DEX, a decentralized exchange that lets users swap tokens directly from their wallets without relying on a central company. Also known as decentralized crypto exchange, it removes banks, brokers, and account freezes—putting control back in your hands. Unlike centralized platforms like Binance or Coinbase, a DEX doesn’t hold your money. You keep your keys. You sign the trades. If something goes wrong, there’s no customer support line to call—just code and blockchain records.

This is why DeFi, a system of financial apps built on open blockchains that operate without traditional intermediaries grew so fast. DEXs like Paradex, ProtonSwap, and KyberSwap Classic (Avalanche) let you trade tokens with zero fees, low slippage, or even zk-privacy—but they also come with risks. You’re trading directly with smart contracts. A bad contract? A rug pull? A forgotten password? That’s your problem now. That’s also why non-custodial wallets like MetaMask are the only way to use them safely. You can’t use a DEX without one.

Most of the posts here aren’t about big names like Uniswap. They’re about the quiet, obscure, and sometimes broken DEXs that pop up every week—AmpleSwap with zero volume, KiloEx for high-leverage futures, or ProtonSwap with no public data. These aren’t failures because they’re new. They’re failures because they promised something they never delivered. That’s why you need to check real trading volume, not marketing claims. A DEX with $200 in daily trades isn’t a platform—it’s a ghost town.

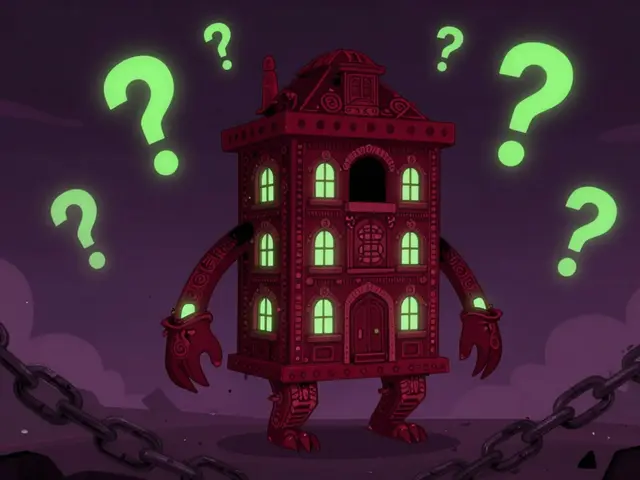

Some DEXs are built for institutions, like Paradex on Starknet. Others are meme token dumping grounds, like AmpleSwap on BSC. And then there are the ones that vanished—LNR’s NFT airdrop, LACE’s abandoned metaverse, or EverETH’s $0 ETH rewards. These aren’t just bad projects. They’re warnings. A DEX isn’t safe just because it’s decentralized. It’s safe only if the code is audited, the team is real, and the liquidity isn’t fake.

What you’ll find below isn’t a list of top DEXs. It’s a collection of real stories—some successful, most cautionary—about what happens when people trade without a safety net. You’ll see how a zero-fee exchange can still be risky. How a meme coin on Avalanche can be listed on a DEX with no users. How a token called AMPLE claims to be a top DEX but has no trades at all. These aren’t theoretical debates. They’re real cases. And if you’re using a DEX today, you’re walking the same path.