Cryptocurrency: What It Is, How It Works, and What You Need to Know

When you hear cryptocurrency, a digital form of money that runs on decentralized networks without banks. Also known as crypto, it lets people send value directly to each other—no middleman, no delays, just code and consensus. It’s not magic. It’s not a bubble. It’s a system built on blockchain, a public, tamper-proof ledger that records every transaction across thousands of computers. Every time someone sends Bitcoin, Ethereum, or even a weird token like FLY or DIYAR, that transaction gets locked into a chain of blocks. No one can delete it. No one can fake it. That’s the core promise.

But here’s the catch: not all crypto is equal. Some projects, like decentralized exchange, a platform where you trade crypto directly from your wallet without giving control to a company, are real tools used daily by thousands. Others, like veDAO or Wannaswap, are ghosts—no team, no code, no liquidity. Then there are the airdrops. crypto airdrop, a free distribution of tokens to users who meet certain criteria, often for using a service or holding a coin—they sound like free money, but most are traps. You don’t just get tokens by signing up. You earn them by participating: trading on SakePerp, staking on Pera Finance, or using Automata Network’s privacy tools. The real value isn’t in the free token. It’s in the activity behind it.

Security is another layer. If you’re holding crypto, you’re holding keys. Lose them, and your money is gone forever. That’s why hardware wallets like Ledger and Trezor aren’t optional—they’re essential. And if you’re trading, you need to know the difference between a regulated exchange like KoinBX and a no-KYC platform like GroveX. One follows rules. The other doesn’t. One protects you. The other leaves you exposed.

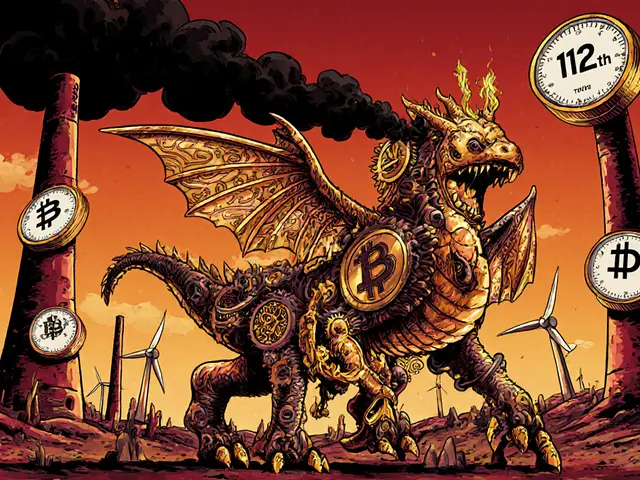

And then there’s the bigger picture. Governments are watching. China replaced crypto with its own digital yuan. The EU now forces crypto firms to get licenses. North Korea steals billions. Mining in Russia is legal—but only if you accept blackouts. Crypto isn’t just tech. It’s politics, law, energy, and human behavior all tangled together.

What you’ll find below isn’t hype. It’s the real stuff: broken tokens, working DEXs, security guides, airdrop traps, and the quiet truth about what’s actually moving in this space. No fluff. No promises. Just what’s happening, who’s behind it, and what you should do next.