Crypto Project Warning Signs: How to Spot Fake, Dead, or Scam Tokens

When a crypto project looks too good to be true, it usually is. A crypto project warning signs, visible red flags that indicate a token is likely a scam, abandoned, or worthless. Also known as crypto red flags, these are the telltale clues that separate real projects from zombie tokens and outright frauds. You don’t need to be an expert to spot them—just know what to look for.

One of the biggest warning signs is a token with near-zero trading volume, a lack of real buyers or sellers on exchanges, making it impossible to cash out. This isn’t rare—it’s common in projects like Franklin (FLY), BSClaunch (BSL), and Wannaswap, all of which launched with hype but now trade with almost no activity. If you can’t find recent trades or liquidity pools with real money, the project is dead. Another red flag? A vanished team, founders who disappear after launch, delete social media, or refuse to answer questions. No names, no LinkedIn profiles, no public updates—just silence. That’s not a startup, that’s a shell.

Then there’s the fake airdrop trap. Projects like veDAO (WEVE) don’t even exist. No blockchain record, no website, no whitepaper—just social media posts promising free tokens. If you’re being told to send crypto to claim a reward, you’re being scammed. Real airdrops like ATA or SAKE require you to use a service or trade, not send funds. And don’t trust hype around meme coins like Big Dog (BIGDOG) or Diyarbekirspor Token (DIYAR). Zero utility, zero team, zero liquidity. These aren’t investments—they’re gambling chips with no table.

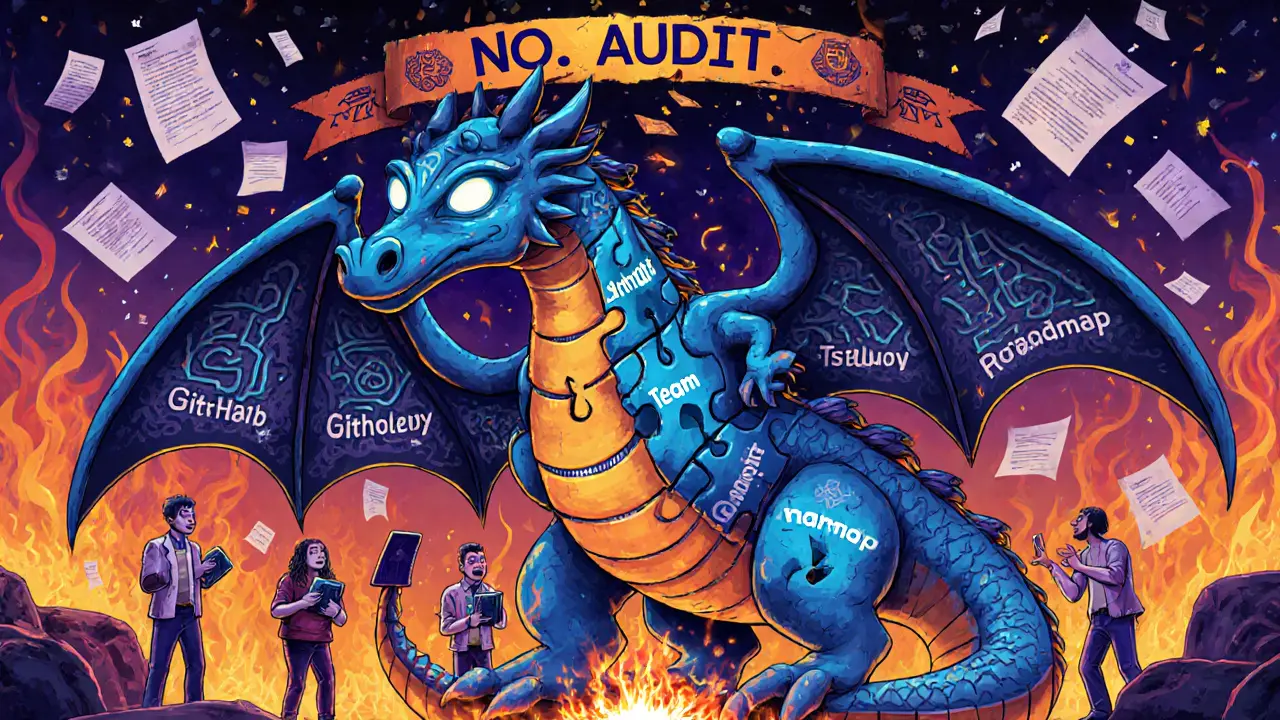

Look at the code. Is it open source? Is it audited? Many fake projects skip this entirely. Real ones publish their contracts on Etherscan or BscScan and let anyone check them. If you can’t find the contract address, or if it’s locked and unverifiable, walk away. Also, watch for projects that claim to be "the next Bitcoin" but have no roadmap, no users, and no real-world use. Blockchain voting, POAPs, and security tokens have clear purposes. Most of the tokens you see promoted on TikTok or Telegram? They don’t.

The market is full of dead projects hiding in plain sight. They don’t always scream "scam." Sometimes they just… stop. No updates. No replies. No trading. That’s the quietest warning sign of all. You don’t need to predict the future to avoid losing money—you just need to recognize when something has already died.

Below, you’ll find real-world breakdowns of failed tokens, fake airdrops, and dead exchanges—each one a lesson in what not to do. These aren’t hypotheticals. These are the projects people lost money on last year. Learn from them before you invest.