Best Crypto Exchange for Beginners and Traders in 2025

Find the best crypto exchange for your needs in 2025. Compare Kraken, Coinbase, Binance US, and Uphold on fees, security, staking, and ease of use to make the right choice.

When you think about buying cryptocurrency, Coinbase, a regulated U.S.-based platform that lets users buy, sell, and store digital assets with fiat currency. Also known as Coinbase Global, it was one of the first exchanges to make crypto feel safe for everyday people. But it’s not just a trading app—it’s a gateway that connects traditional money to blockchain networks. If you’ve ever used a bank transfer to buy Bitcoin, chances are you used Coinbase. It’s not the cheapest or the most powerful tool out there, but it’s the most familiar.

What makes Coinbase stand out is how it handles fiat onramp, the process of converting real-world money like USD or EUR into cryptocurrency. Also known as crypto on-ramp, it’s the reason millions of first-time buyers got into the space. Unlike decentralized exchanges that require you to already own crypto, Coinbase lets you start with a credit card or bank account. But that convenience comes at a cost—fees are higher than most alternatives, and you don’t own your keys unless you move your coins to a hardware wallet like Ledger, a physical device that stores crypto offline, keeping it safe from hackers. Also known as cold wallet, it’s the standard for serious holders. Many users leave their Bitcoin on Coinbase thinking it’s secure, but exchanges are targets. If Coinbase gets hacked, you’re at the mercy of their insurance policy—not the blockchain.

It’s also not a one-size-fits-all platform. If you’re into DeFi, NFTs, or trading lesser-known tokens, Coinbase feels limited. You won’t find obscure tokens like FLY or BSL here. Its focus is on the big names: Bitcoin, Ethereum, Solana, and a few others. That’s good if you want simplicity, bad if you want depth. And while it offers staking and earning features, the returns are low compared to what you could get on a decentralized protocol. The platform is designed for safety, not yield.

Still, for most people, Coinbase does one thing better than anyone else: it removes the fear. No complex wallets. No private keys to lose. No confusing DEX interfaces. It’s the crypto equivalent of a bank teller who explains things slowly and doesn’t judge you for asking too many questions. That’s why it’s still the default starting point—even if you eventually move on.

Below, you’ll find real reviews and deep dives into crypto platforms that compete with Coinbase, expose its flaws, or show you what to do after you’ve outgrown it. From exchanges with zero fees to cold storage guides and scam warnings, this collection cuts through the hype. You’ll see why some users ditch Coinbase entirely—and what they replace it with.

Find the best crypto exchange for your needs in 2025. Compare Kraken, Coinbase, Binance US, and Uphold on fees, security, staking, and ease of use to make the right choice.

HKD.com crypto exchange claims to offer low fees and high security, but user reports reveal frozen withdrawals, app crashes, and zero regulation. Avoid this unregulated platform with dangerously low traffic and trust issues.

OBVIOUS COIN is a Solana-based meme token with no team, utility, or future. Learn why it's a high-risk gamble, how it works, and why 92% of similar tokens vanish within months.

Non-custodial crypto wallets let you control your money without banks or exchanges-critical in countries where crypto is banned. Learn how they work, their risks, and how to use them safely when financial freedom is on the line.

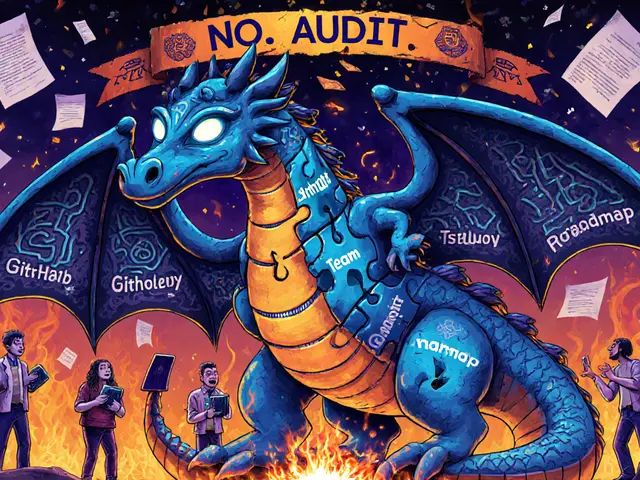

Unaudited blockchain projects carry hidden risks. Learn the 7 critical red flags-ghost ownership, watermelon reports, financial anomalies, missed milestones, selective silence, unchecked scope creep, and fake approvals-that signal failure or fraud before you invest.

Saudi Arabia bans banks from handling crypto transactions, yet its crypto market is growing fast. Learn how individuals and businesses navigate this strict ban, the risks involved, and what the future might hold.