1% TDS on Crypto Transactions in India: What You Need to Know in 2025

India's 1% TDS on crypto transactions deducts tax at the time of trade, not on profits. Understand thresholds, crypto-to-crypto rules, GST叠加, and how to stay compliant in 2025.

When you buy or sell cryptocurrency in India, a 1% TDS, a tax deducted at source on crypto transactions as mandated by India’s Income Tax Department. Also known as Tax Deducted at Source on digital assets, it’s not a new income tax—it’s a withholding mechanism that platforms take right out of your trade before you even see the cash. This rule kicked in on July 1, 2022, and it applies to every trade, no matter how small. If you buy ₹10,000 worth of Bitcoin, ₹100 gets pulled out before the transaction finishes. Same if you sell. No exceptions. No loopholes. Not even for swaps between tokens.

This isn’t just about the government collecting money—it’s about visibility. Before TDS, most crypto trades happened off the radar. Now, every exchange registered in India has to report your trades to the tax department. That means the Income Tax Department, India’s federal agency responsible for enforcing tax laws and collecting direct taxes has a real-time view of your crypto activity. It also means KoinBX, a crypto exchange registered with India’s Financial Intelligence Unit and compliant with local tax rules and others like it now act as tax collectors. You don’t file the TDS yourself—it’s done for you. But you still need to track it, because it’s a credit against your final tax bill.

Here’s the catch: TDS is not the end of your tax obligation. It’s just the first step. If you made a profit on your crypto trades, you still owe capital gains tax—either 30% for short-term or 20% with indexation for long-term holdings. The 1% TDS you paid? You can claim it back when you file your return. But if you don’t file, that money disappears. Many traders don’t realize this. They think TDS = done. It’s not. You still need to keep records: when you bought, when you sold, what price, and how much TDS was deducted. Without that, you can’t prove your gains or losses to the tax office.

And it’s not just about exchanges. If you trade on a foreign platform like Binance or Kraken and transfer crypto to an Indian wallet, TDS doesn’t apply at the time of trade. But when you convert that crypto to INR later—say, through a peer-to-peer trade or a local exchange—the buyer’s platform will deduct 1% TDS. So even if you avoid Indian exchanges, you’re still caught in the system. The rules follow the money, not the platform.

There’s no way around it: if you trade crypto in India, you’re in the system. The question isn’t whether TDS affects you—it’s whether you’re ready for what comes next. The posts below break down real cases: how Indian traders are handling TDS, what happens when you ignore it, which exchanges handle it smoothly, and how to avoid getting hit with unexpected tax bills. You’ll see how people are using tools like KoinBX to stay compliant, how some try to dodge the system—and why it almost always backfires. This isn’t theory. It’s what’s happening right now, on the ground, in India’s crypto market.

India's 1% TDS on crypto transactions deducts tax at the time of trade, not on profits. Understand thresholds, crypto-to-crypto rules, GST叠加, and how to stay compliant in 2025.

After Algeria's 2025 total crypto ban, underground trading persists through P2P deals, stablecoins, and VPNs. Despite prison sentences and heavy fines, citizens use crypto to protect savings from inflation and bypass broken banking systems.

Dogelon Mars (ELON) has no official CoinMarketCap airdrop, but its real legacy is charity-driven token giveaways to scam victims. Learn the truth about ELON, how to get it safely, and why this meme coin still matters.

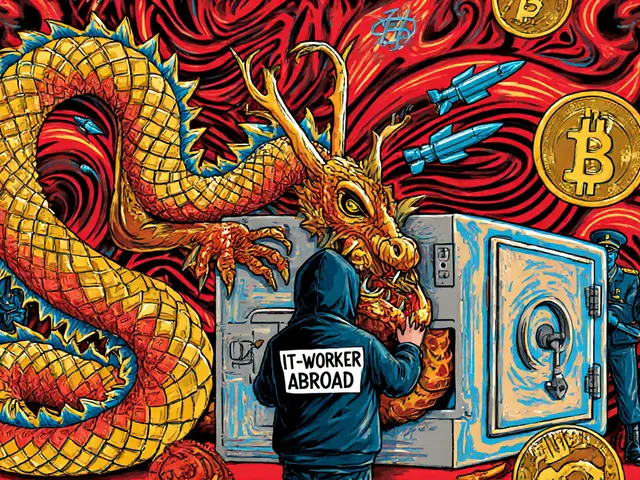

North Korea bans crypto for its citizens but runs the world’s most aggressive state-sponsored hacking operation, stealing over $2.17 billion in 2025 to fund its nuclear program. This is how they do it - and why it matters to everyone.

Turkey banned crypto payments in 2021 to stop financial risks - but allowed trading. Today, 19% of Turks use crypto, yet can't pay with it. Learn how the rules changed, why businesses struggle, and what the 2025 court case could mean.

Ultron Swap is a low-volume decentralized exchange built on the Ultron blockchain. With minimal liquidity, no user reviews, and little community engagement, it's not a reliable trading platform - but it may hold potential for early adopters willing to take big risks.