MultiSig Treasury Configuration Calculator

Calculate Your Secure MultiSig Setup

Choose your treasury size to get recommended signer thresholds, gas costs, and security assessment

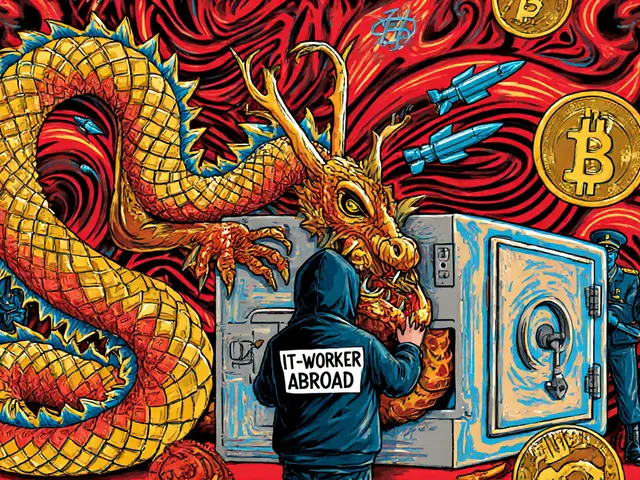

Imagine your DAO’s treasury holding $10 million in ETH and USDC. One person has the only key. What happens if they get hacked, quit, or turn rogue? That’s not speculation-it’s happened. In 2022, a DAO lost $750,000 because a single signer was compromised. The fix? MultiSig. It’s not fancy. It’s not magic. But it’s the reason most DAOs with serious funds are still standing.

What MultiSig Actually Does for Your DAO Treasury

A MultiSig wallet isn’t just another wallet. It’s a vault that needs multiple people to open it. Think of it like a bank safe that requires two out of three keys to unlock. No single person can move money alone. In DAOs, those keys are held by different members-developers, treasurers, community reps. Each holds their own private key, usually stored on a hardware wallet like Ledger or Trezor. When someone wants to pay a developer or buy a new tool, they propose a transaction. Then, at least X out of Y members must sign off. Only then does the money move. This isn’t theoretical. In 2024, 72.4% of top DeFi protocols used MultiSig for their treasuries. MakerDAO, with over $500 million locked, uses a 6-of-11 setup. Index Coop stopped a $4.2 million exploit because five of nine signers refused to approve the transaction. That’s not luck. That’s design.Why Single Signatures Fail-And MultiSig Stops Them

Single-key wallets are like leaving your house key under the mat. Easy to find. Easy to steal. In 2023, DAOs using single-signature wallets saw 2.3 hacks per $100 million in assets. MultiSig DAOs? Just 0.3. That’s an 87% drop in successful attacks. The biggest threat isn’t always outsiders. It’s insiders. A team member with access might get pressured. They might make a mistake. Or worse-they might decide to steal. In August 2022, a DAO member tried to siphon $750,000 into a fake wallet. Their MultiSig setup, built on Gnosis Safe, required two other signatures. Both refused. The transaction never went through. Chainalysis tracked this case. It’s now a textbook example of how MultiSig prevents internal fraud. Single keys also die. People lose phones. Forget passwords. Move away. If your DAO’s only signer disappears, your funds are frozen forever. MultiSig fixes that. You can set up recovery rules. If one signer goes silent, others can still act-without needing to reset everything.How MultiSig Builds Trust Without Centralization

DAOs are supposed to be decentralized. But if one person controls the treasury, you’re just a corporation with a fancy name. MultiSig enforces real decentralization. It forces collaboration. No more “trust the founder” culture. The setup is simple: pick a threshold. For a $500K treasury, 3-of-5 is standard. For $5M+, go with 4-of-7 or 5-of-9. Each signer should be someone with skin in the game-a contributor, not just a token holder. They should be active, accountable, and ideally use hardware wallets. Gnosis Safe is the most popular tool for this. It’s open-source, audited by OpenZeppelin, and works across Ethereum, Polygon, Arbitrum, and more. It even lets you preview transactions before signing. That’s huge. One DAO saved $250,000 when a member spotted a scam address in a proposed payment. They flagged it. Others reviewed. The transaction was canceled. This isn’t just security. It’s transparency. Every transaction is on-chain. Every signature is recorded. Anyone can audit it. That builds community trust. No whispers. No backroom deals. Just public votes.

What MultiSig Doesn’t Fix-And How to Fill the Gaps

MultiSig isn’t a silver bullet. It won’t stop a hacker who tricks a signer into approving a transaction. That’s social engineering. In 2023, BadgerDAO lost funds because a hacker convinced a signer to hand over their hardware wallet PIN. The MultiSig was intact. The human wasn’t. So what’s the fix? Two things: education and process. First, train your signers. Every person with a key needs to understand phishing, fake websites, and how to verify addresses. No exceptions. Second, add a timelock. This means any change to the MultiSig setup-like adding or removing a signer-must wait 24 hours before taking effect. That gives time for others to notice something wrong. Gnosis Safe and most secure setups include this by default. Also, rotate keys. Every 30 to 90 days, have signers generate new keys and redistribute them. This reduces the risk if someone’s device gets compromised over time.Costs, Delays, and the Real Trade-Offs

Yes, MultiSig is slower. You can’t instantly pay a freelancer at 2 a.m. if no one’s online. That’s the price of safety. Some DAOs, like Yearn Finance, moved away from MultiSig for high-frequency trading because speed mattered more than security. But for a treasury? Not worth it. Gas fees are higher too. A standard ETH transfer costs 21,000 gas. A MultiSig transaction? 25,000 to 100,000 gas. But compared to losing millions, that’s pennies. The real cost is time. Setting up a MultiSig treasury takes 16-24 hours for experienced teams. Onboarding new signers? Another 3-5 weeks. But here’s the kicker: DAOs with MultiSig are 63% more likely to survive past two years, according to Harvard Business Review. That’s not just security. That’s sustainability.

What the Experts Say-and What the Data Proves

Chainalysis’s Chief Security Officer says MultiSig is the minimum standard for any DAO treasury over $100,000. Vitalik Buterin recommends 4-of-7 as the baseline for protocol-owned liquidity. A survey of 150 blockchain security pros in March 2024 found 92.7% agree: if your DAO has over $500,000, you’re negligent without MultiSig. The SEC even noticed. In February 2024, they said MultiSig setups with 7+ signers and majority approval count as evidence of decentralization-meaning your tokens might not be classified as securities. That’s huge for legal compliance. And the market agrees. DAO treasuries protected by MultiSig grew from $3.2 billion in early 2022 to $54.3 billion by mid-2024. That’s a 1,600% increase. Not because people got lucky. Because they got smart.How to Set Up a Secure MultiSig Treasury

If you’re starting a DAO or upgrading your treasury, here’s exactly how to do it right:- Pick your signers: At least 3-5 people. No CEOs. No anonymous devs. Choose active contributors with a track record.

- Use hardware wallets: Ledger or Trezor. Never software wallets for signers. Hardware wallets reduce theft risk by 99.8%.

- Choose your threshold: $100K-$1M? 3-of-5. $1M-$10M? 4-of-7. Over $10M? 5-of-9.

- Use Gnosis Safe: It’s the most tested, audited, and widely adopted. Avoid custom builds unless you have a security team.

- Enable timelock: All config changes must wait 24 hours. No exceptions.

- Set key rotation: Every 30-90 days, generate new keys and re-distribute them securely.

- Document everything: Where are keys stored? Who has backups? What’s the recovery plan? Write it down. Share it.

What Happens If You Skip MultiSig?

You’re gambling. Not with your money. With your DAO’s future. In 2023, a community DAO lost $2 million because their founder’s phone was stolen. He had the only key. The funds were gone. No recovery. No recourse. The DAO collapsed. Another DAO tried to use a centralized custodian like Coinbase Custody. They paid 0.15% annually plus a $1,000 setup fee. But they gave up control. No transparency. No audits. Just trust a company that could freeze funds anytime. MultiSig gives you control. Without trust. Without middlemen. Without single points of failure. It’s not perfect. It’s not fast. But it’s the only system that lets a decentralized group protect its collective wealth. And in crypto, where hacks are routine and trust is rare, that’s everything.Do I need MultiSig if my DAO treasury is under $100,000?

Yes-even small treasuries are targets. Hackers don’t care if your wallet has $50,000 or $5 million. They scan for weak points. A 2-of-3 MultiSig setup costs less than $100 in gas to set up and prevents 99% of common attacks. It’s the cheapest insurance you’ll ever buy for your DAO.

Can I use MultiSig on any blockchain?

Yes. Gnosis Safe works on Ethereum, Polygon, Arbitrum, Optimism, Base, and 13+ other chains. The setup process is nearly identical across them. Choose the chain your DAO uses most. Avoid chains with weak security or low adoption unless you have a specific reason.

What if a signer loses their hardware wallet?

If you set up your MultiSig correctly, you don’t need that one key. For example, in a 3-of-5 setup, losing one key means you still have four others. But you should have a recovery plan: backup phrases stored in secure locations (like a safe or encrypted USB), and a process to replace lost signers via a vote. Aave Grants DAO does this every quarter.

Is MultiSig better than a timelock alone?

They’re complementary. A timelock delays actions but doesn’t prevent bad approvals. MultiSig stops bad approvals before they happen. Many DAOs use both: MultiSig for daily spending, timelock for major changes like upgrading contracts or changing the threshold. Together, they’re the strongest combo available.

Can I automate payouts with MultiSig?

Yes-Gnosis Safe’s 2024 Modules let you connect automated payment schedules, like weekly dev stipends or monthly grants, directly to your MultiSig. The wallet still requires approvals, but the proposal is generated automatically. You save time without sacrificing control.