SEAM Yield Calculator

Calculate Your Potential Earnings

How This Works

Based on Seamless Protocol's current strategy:

- 5-8% Annual yield from vault strategies

- +1.5% Additional SEAM token rewards

- Total Up to 8% APY (including SEAM rewards)

- Overcollateralized Vaults are protected with safety buffers

Estimated Earnings

Seamless (SEAM) isn't just another crypto coin. It's the fuel behind a DeFi platform built to make lending and borrowing on the Base blockchain as simple as clicking a button. If you've ever felt overwhelmed by complex yield farming, manual liquidity management, or juggling multiple DeFi apps, Seamless is designed to fix that. It doesn't ask you to be a crypto expert. It just gives you a clean way to earn passive income without the headache.

What exactly is the Seamless Protocol?

Seamless Protocol is a non-custodial lending and borrowing platform that runs entirely on Base - Coinbase’s Layer 2 blockchain. Unlike Aave or Compound, which work across multiple chains, Seamless is built from the ground up for Base. That means lower fees, faster transactions, and tighter integration with the growing ecosystem of users already on Coinbase’s network.

The real innovation? It wraps complicated DeFi strategies into simple, ready-to-use tokens called Leverage Tokens (LTs). Instead of manually depositing ETH into one protocol, borrowing USDC from another, and staking it in a third, you just pick a vault. The platform handles the rest. These vaults are curated by Gauntlet, a professional risk management firm, so you’re not guessing which strategy is safe. You’re choosing from ones that have been tested and monitored.

What is the SEAM token used for?

SEAM is the native token of the Seamless Protocol. It’s not just a speculative asset - it has real, functional roles inside the system. Here’s what it actually does:

- Governance: Holders vote on protocol changes - like adding new vaults, adjusting fees, or updating risk rules. Your vote is weighted by how much SEAM you hold.

- Fee discounts: Using Seamless? Paying fees in SEAM gives you a discount. The more you use the platform, the more you save.

- Staking rewards: You can lock up SEAM to earn more SEAM. This isn’t just for passive holders - it rewards active participation.

- Insurance fund: A portion of fees goes into a safety pool that helps cover losses if a vault underperforms. SEAM holders help protect the whole system.

There’s also esSEAM - an escrowed version of SEAM. You can’t buy or trade esSEAM. You only get it by actively using the platform, like supplying liquidity to a vault. esSEAM gives you full voting power but can’t be moved. That’s intentional. It keeps users engaged and aligned with the protocol’s long-term health.

How does Seamless make DeFi easier?

Traditional DeFi is like assembling IKEA furniture without the instructions. You need to understand collateral ratios, liquidation thresholds, and cross-protocol dependencies. Seamless removes all that.

Here’s how it works in practice:

- You go to the Seamless app and pick a vault - say, one that lends ETH and borrows USDC to earn yield.

- You deposit your ETH. That’s it.

- The platform automatically uses Morpho’s lending markets to optimize your yield, layers on SEAM and MORPHO rewards, and manages risk through Gauntlet’s models.

- You get a token representing your share of the vault. You can hold it, trade it, or even use it as collateral elsewhere.

No need to track interest rates. No need to rebalance. No need to monitor liquidation risks. You just deposit and earn. It’s DeFi, but designed for people who don’t want to spend 10 hours a week managing it.

How is Seamless different from Aave or Compound?

Most DeFi platforms are like open markets - you pick your assets, set your terms, and manage everything yourself. Seamless is more like a pre-built investment fund.

| Feature | Seamless | Aave / Compound |

|---|---|---|

| Blockchain | Base only | Multi-chain (Ethereum, Polygon, etc.) |

| User control | Automated strategies, minimal input | Full manual control required |

| Risk management | Handled by Gauntlet | User responsibility |

| Token utility | Governance, fees, staking, insurance | Mainly governance |

| Learning curve | Low - simple vault selection | High - requires deep DeFi knowledge |

Seamless doesn’t try to be everything to everyone. It focuses on one thing: making yield generation safe and simple for Base users. That focus gives it an edge in user experience.

What’s the SEAM token’s market status?

As of November 2025, SEAM has a fixed total supply of 100 million tokens. Around 39 million are in circulation. The price hovers between $0.33 and $0.40, with recent 24-hour volume hitting over $1.5 million. That’s modest compared to top 100 coins, but it’s growing steadily with Base’s adoption.

Price movements are typical for a mid-tier DeFi token: +18% in 24 hours, -5% over the past month. That volatility isn’t unusual. What’s more important is the token’s utility. Unlike tokens that exist only to pump and dump, SEAM’s value is tied to real usage. If more people use Seamless, more SEAM is staked, voted with, and used for fees - creating a feedback loop that supports long-term demand.

Some analysts predict SEAM could reach $0.41 by end of 2025 and possibly $2.70 by 2030. Those are speculative. But what’s clear is that if Base becomes a top-tier DeFi hub, Seamless - as its native lending protocol - will be one of the biggest beneficiaries.

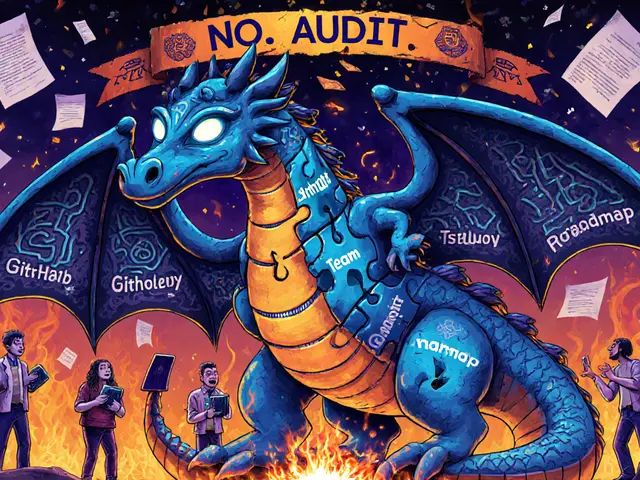

Is Seamless safe?

No DeFi protocol is risk-free. But Seamless takes safety seriously.

- All vaults are overcollateralized - you can’t borrow more than your deposit is worth.

- Liquidations are tiered and gradual, not sudden, to protect users from flash crashes.

- Smart contracts have been audited by reputable firms.

- Risk is managed by Gauntlet, not left to users or algorithms alone.

- Decentralization is progressive - governance is gradually shifting from core teams to the community.

The protocol’s design philosophy is "stacking yield, not risk." That means they prioritize stable, proven strategies over high-risk, high-reward gambles. If you’re tired of DeFi projects that promise 1000% APY and then vanish, Seamless feels like a breath of fresh air.

Who is Seamless for?

Seamless isn’t for crypto traders looking to day trade tokens. It’s for people who want to earn passive income from their crypto holdings - without becoming DeFi engineers.

If you own ETH, USDC, or other major assets on Base and want to make them work harder, Seamless is worth trying. You don’t need to understand yield curves or impermanent loss. You just need to understand that depositing your ETH into a vault might earn you 5-8% annually - plus SEAM rewards - with minimal effort.

It’s also for those who care about governance. If you believe crypto should be run by users, not venture capitalists, then holding SEAM gives you a voice in shaping the future of the protocol.

What’s next for Seamless?

The team is expanding vault offerings, adding support for more assets, and deepening partnerships with Morpho and Gauntlet. They’re also working on mobile access and better educational tools for new users.

The biggest wildcard? Base’s growth. If Coinbase continues driving users to its Layer 2, Seamless will be right there - the go-to platform for earning yield without the complexity. That’s a powerful position.

Right now, Seamless isn’t the biggest name in DeFi. But it’s one of the most thoughtful. It doesn’t chase hype. It builds tools that solve real problems - and rewards people who use them.

Is SEAM a good investment?

SEAM isn’t a traditional investment like a stock. Its value comes from usage. If more people use Seamless Protocol, demand for SEAM increases through staking, voting, and fee payments. It’s not about hoping the price goes up - it’s about participating in a functional system. If you believe in Base’s growth and want to earn rewards for using DeFi, SEAM has real utility. If you’re just chasing price pumps, there are riskier options.

Can I buy SEAM on Coinbase?

As of late 2025, SEAM is not listed directly on Coinbase’s main exchange. But you can buy it on decentralized exchanges like Uniswap or BaseSwap using ETH or USDC. You’ll need a Web3 wallet like MetaMask connected to the Base network. Always check the official Seamless website for the most trusted trading links.

Do I need to know how to use DeFi to use Seamless?

You don’t need to be an expert, but you should understand basic crypto concepts: wallets, gas fees, and blockchain networks. Seamless simplifies the hard parts - like lending and yield strategies - but you still need to connect your wallet, approve transactions, and understand that crypto is volatile. If you’ve ever sent ETH or used a DEX, you already have the skills needed.

What happens if a vault loses money?

Each vault is overcollateralized, and Gauntlet monitors risk levels in real time. If losses occur, the protocol’s insurance fund - funded by SEAM fees - steps in to cover the difference. Users are protected from total loss, though they might see reduced returns. This is a key reason Seamless avoids aggressive, high-risk strategies.

How do I start using Seamless?

Go to the official Seamless Protocol website. Connect your wallet (MetaMask or Coinbase Wallet) set to the Base network. Deposit a supported asset like ETH or USDC into a vault. That’s it. You’ll start earning yield and SEAM rewards automatically. Always verify you’re on the real site - scams mimic DeFi platforms often.

Seamless doesn’t promise to make you rich. It promises to make earning from crypto less stressful. In a space full of noise, that’s a rare and valuable thing.

15 Comments

This is literally the most boring crypto project I've ever seen 😴

Seamless is the real deal - it’s DeFi for people who don’t want to be full-time risk managers. The Gauntlet integration alone makes it leagues ahead of Aave’s chaotic free-for-all. And esSEAM? Genius move. Locking voting power to usage ensures governance isn’t just bought by whales. This isn’t hype - it’s infrastructure. 🚀

OMG YES. I’ve been using Seamless for 3 months now and I literally haven’t touched my vault since I deposited. It just keeps earning. And the SEAM rewards? Like free candy. 🍬 I used to stress over APRs and liquidation thresholds - now I just check my balance once a week. Life-changing. 😊

You know what’s wild? People still think DeFi is about ‘getting rich quick.’ But Seamless? It’s about getting *stable*. It’s not flashy, it’s not a meme, it’s not a pump-and-dump. It’s like… the quiet librarian who actually knows how to fix your computer. No drama. Just results. 🤫

Why are people even talking about this? If you’re not on Ethereum, you’re not serious. Base is just Coinbase’s sandbox for newbies. This whole thing smells like a marketing ploy to get people to use their wallet. Stay away. 🚫

I read the whole thing. I’m still not sure what the point is. Is this a bank? A mutual fund? A DAO? Why does it need a token? Why not just use a savings account? I feel like I’ve been sold a philosophy seminar disguised as a crypto product. 🤔

Let me be clear: the term 'Leverage Tokens' is misleading. They are not tokens in the traditional sense-they are tokenized shares of a vaulted strategy. Also, 'esSEAM' is not 'escrowed'-it's 'earmarked' or 'vested.' The article's terminology is sloppy. Precision matters in DeFi. 📝

There’s something deeply poetic about a protocol that doesn’t scream for attention. In a world where every token has a celebrity ambassador and a Discord full of bots, Seamless quietly builds. It doesn’t need to be the biggest-it just needs to be the most thoughtful. That’s rare. And beautiful. 🌿

okay so i tried seamless last week and honestly?? it just WORKED. no drama, no confusing menus, no 'approve this transaction 3 times' nonsense. i deposited eth, got my vault token, and boom-i’m earning. i didn’t even know what morpho was until i read this. now i’m hooked. thanks for the guide!! 🙌

Base is American tech. Seamless is American innovation. Why are people still clinging to Ethereum like it’s 2017? This is the future-fast, cheap, and built for real people. If you’re still on L1, you’re not early-you’re just behind. 🇺🇸

SEAM is a 100% scam token. 100 million supply? 39 million circulating? That’s a rug pull waiting to happen. And Gauntlet? They’re just a consultancy-they don’t magically make code safe. Don’t fall for the ‘professional risk management’ fairy tale. This is just another Ponzi wrapped in a whitepaper. 💸

Seamless is a quiet revolution. It doesn’t need to be loud to be powerful. The fact that it rewards participation-not speculation-is a radical idea in crypto. I wish more protocols thought this way. This is what decentralization should look like: thoughtful, sustainable, and user-owned. 🌍

I appreciate the clarity of this guide. Most DeFi explanations read like academic papers written by people who’ve never interacted with a real user. Seamless’s design philosophy-stacking yield, not risk-is refreshingly pragmatic. I’ve seen too many protocols prioritize tokenomics over usability. This one doesn’t. Well done.

Oh, another ‘DeFi for dummies’ project. How quaint. I mean, if you can’t handle the complexity of Aave, maybe you shouldn’t be in DeFi at all. This feels like financial babysitting. And esSEAM? Sounds like a corporate loyalty program. I’ll stick with the real stuff. ✨

Seamless is just Coinbase’s way of locking people into their ecosystem. You think you’re earning yield? You’re just becoming a data point for their next ad campaign. And SEAM? It’s a loyalty card. You’re not a participant-you’re a product. Wake up. 💔