TRO token distribution

When you hear TRO token distribution, the way a cryptocurrency’s total supply is allocated among founders, investors, public buyers, and ecosystem funds. Also known as token allocation, it’s the hidden blueprint that determines who benefits, when, and how much. Most tokens never make it past this stage — not because they’re bad, but because the distribution was rigged from the start.

Look at projects like LNR token, a BSC-based project that promised an NFT airdrop to holders but vanished without delivering anything. Or CHY token, marketed as a charity coin but with zero trading volume and no real use case. These weren’t scams because the tech failed — they failed because the distribution favored insiders. If 40% of the supply goes to the team with no vesting schedule, or if 30% is dumped on exchanges before launch, you’re not investing in a project. You’re betting on a rigged game.

Good token distribution doesn’t hide. It’s transparent. It shows vesting periods, lock-ups, and clear timelines. It gives early users a fair shot. Look at real airdrops like CWT token, where users earned tokens through wallet activity, not just hype. Or FLUX token, distributed via CoinMarketCap with clear eligibility rules and no pre-sale dumping. Those projects didn’t promise miracles — they just gave people a fair chance.

Bad distribution leads to collapse. Good distribution builds trust. The difference isn’t in the whitepaper. It’s in the numbers behind the scenes. Who holds the keys? When can they sell? How many tokens are actually in circulation? If you can’t answer those questions, you’re not buying a token. You’re buying a gamble.

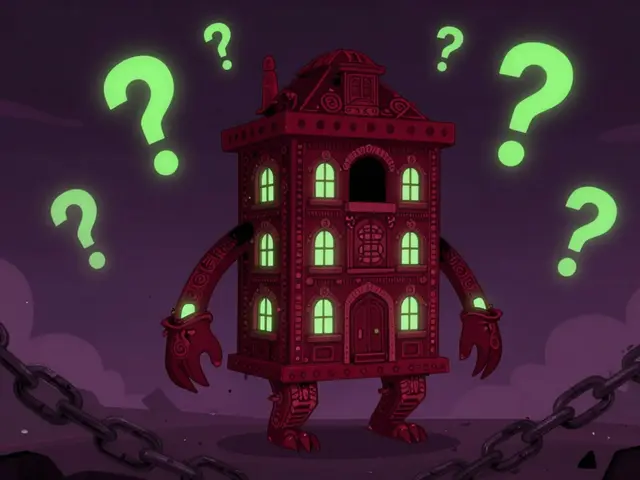

Below, you’ll find real cases where token distribution made or broke a project — from failed airdrops to hidden team wallets, from inflated supply claims to silent dumps. No fluff. No promises. Just what happened, and why it matters to you.