Tokenized Assets: What They Are, How They Work, and Real Examples

When you hear tokenized assets, real-world property like real estate, art, or even company shares converted into digital tokens on a blockchain. Also known as asset-backed tokens, they let you own a piece of something valuable without buying the whole thing. This isn’t science fiction—it’s happening right now. A small apartment in Berlin, a share of a vintage car, or even a slice of a music royalty stream can all be split into digital tokens and traded like crypto.

These tokens aren’t just about ownership. They’re about access. Someone in Brazil can buy a fraction of a vineyard in France without flying there or dealing with foreign lawyers. A startup in Nigeria can raise money by selling tokens tied to its future revenue, skipping traditional venture capital. blockchain assets, digital representations of value secured on decentralized ledgers make this possible by removing middlemen and adding transparency. You can see who owns what, when it was traded, and how much it’s worth—all without trusting a bank or broker.

But tokenization isn’t just for big investors. It’s also changing how communities interact. digital assets, items with verifiable ownership on a blockchain, like NFTs or utility tokens are already being used to prove attendance at events, reward participation in online communities, or even represent voting rights in decentralized organizations. That’s why you’ll see posts here about POAPs, fan tokens like DIYAR, and even tokenized voting systems. These aren’t just gimmicks—they’re early signs of how ownership and participation are shifting online.

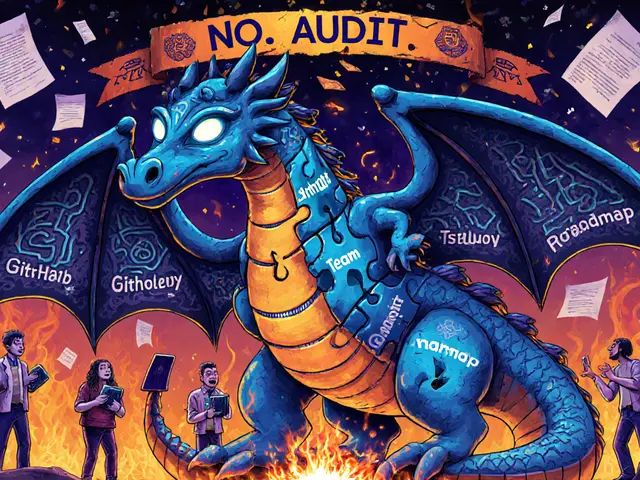

Not all tokenized assets are successful, though. Some, like Franklin (FLY) or BSClaunch (BSL), launched with big promises but faded into obscurity. Others, like the PERA token or RACA airdrops, are tied to active ecosystems with real usage. The difference? Utility. If a token doesn’t do anything useful beyond speculation, it’s just digital noise. The real value comes when the token connects directly to something tangible—a service, a product, a right.

That’s why this collection covers more than just theory. You’ll find reviews of exchanges where tokenized assets are traded, deep dives into failed projects so you know what to avoid, and breakdowns of regulations like MiCA in Cyprus or AUSTRAC in Australia that are shaping how these assets can legally exist. You’ll see how AI is improving how tokens are managed, how crypto theft affects trust in tokenized systems, and why some countries ban them while others build entire frameworks around them.

Whether you’re curious about owning a piece of real estate through a token, wondering if fan tokens are worth anything, or trying to understand why MiCA regulations matter for token issuers—this is the place to find clear, no-fluff answers. No hype. No guessing. Just what’s real, what’s working, and what’s dead.