FTX Bankruptcy: What Happened and How It Changed Crypto Forever

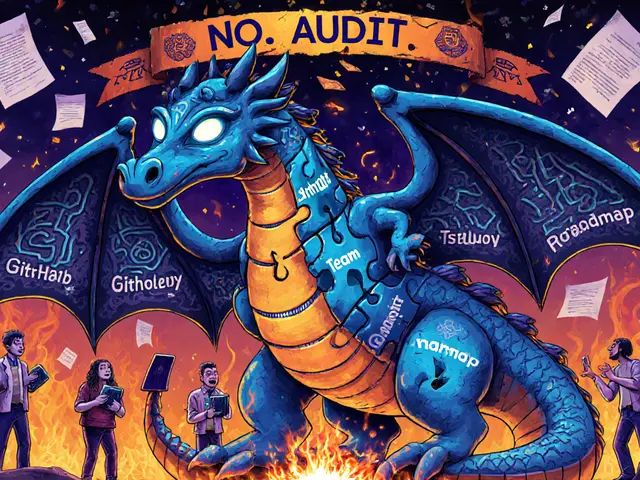

When FTX bankruptcy, the dramatic collapse of a once-billion-dollar cryptocurrency exchange that triggered global market panic and criminal investigations. Also known as the FTX implosion, it wasn’t just another failed startup—it was the moment crypto lost its innocence. FTX wasn’t a fringe player. It was everywhere: sponsorships, TV ads, celebrity endorsements. Then, in November 2022, a single report revealed its books were empty. Customer money had been funneled to Alameda Research, a trading firm owned by the same CEO, Sam Bankman-Fried. Within days, billions vanished.

This wasn’t a hack. It was fraud, the deliberate misuse of funds by insiders with access to customer assets. Also known as embezzlement in crypto, it exposed how little oversight existed in the industry. Sam Bankman-Fried, the former CEO of FTX who was convicted of wire fraud, securities fraud, and money laundering. Also known as SBF, he once claimed to be a philanthropist pushing for smart regulation. But his actions showed the opposite: he treated customer funds like his own personal piggy bank. The fallout wasn’t just financial. It shattered trust. People lost life savings. Companies tied to FTX went under. Even big names like Coinbase and Binance were dragged into the chaos, forced to prove they weren’t next.

After FTX, crypto regulation, government rules designed to enforce transparency, protect users, and hold exchanges accountable. Also known as digital asset oversight, it went from a debate to an emergency. The U.S. SEC, the EU with MiCA, and regulators in Japan and Singapore moved fast. Exchanges had to prove they held customer funds, stop risky lending, and stop hiding behind vague terms like "decentralized" when they weren’t. The days of "move fast and break things" were over. Now, if you run a crypto exchange, you need lawyers, auditors, and compliance teams—or you won’t survive.

What’s left today? A quieter, more cautious market. Fewer flashy ads. More questions before you deposit money. And a growing number of people who now check: Is this exchange actually keeping my coins safe? The FTX bankruptcy didn’t kill crypto. It killed the illusion that it was a wild west with no consequences. Now, the real winners aren’t the hype builders—they’re the ones who built systems that don’t need to be trusted to be safe.

Below, you’ll find real stories, deep dives, and hard truths about what went wrong—and how to avoid becoming the next victim.